Virtual Reality

- 610.759

- -12.239-1.96%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Tencent Launches Hunyuan-T1 Reasoning Model as China AI Race Heats up

The "gap" in the implementation of the DeepSeek large model integrated machine | Depth

① The customer demand for the DeepSeek all-in-one machine has significantly increased, more than doubling compared to the customer density brought by ChatGPT in the previous two years. ② Currently, there is a severe shortage of relevant technical talent in government and enterprises, and there is a considerable gap between large models and their Business implementation.

The training tool for Siasun Robot&Automation is here! The embodied intelligence simulation platform "Ge Wu" is officially released.

① It is reported that "Ge Wu" integrates advanced reinforcement learning frameworks and multimodal motion control technology. ② Professor Ye Linqi, an open-source contributor to the "Ge Wu" platform, believes that future embodied intelligence needs to meet the most basic survival needs. ③ Brokerage firms believe that the second half of 2025 will be a stage for the rapid advancement of humanoid robot commercialization.

The Index may return to adjustment in the short term, with a focus on the Diffusion opportunities in the Marine Economy as the theme rotation accelerates.

Track the entire lifecycle of the main Sector.

Highlights from the brokerage morning meeting: Large models are driving the middle platform into a new phase, and the Technology Hardware Industry Chain is expected to benefit.

In today's Brokerage morning meeting, Soochow believes that the commercialization of non-invasive brain-machine interface products is expected to accelerate; HTSC stated that the growth rate of parcel volume in the express delivery industry this year may exceed expectations; China International Capital Corporation pointed out that large models are driving the middle platform into a new stage, and the Hardware Industry Chain is expected to benefit.

Before the "three witching hour," US stocks had a one-day rebound, quantum computing stocks plummeted, PDD Holdings briefly rose by 10%, and the Bank of England took a hawkish stance, with UK bonds turning to declines during the session.

Accenture fell over 7%; quantum computing stock D-Wave dropped 18%; after the Earnings Reports, FedEx fell over 5% in after-hours trading; Micron Technology once rose over 5% in after-hours trading. NIO declined nearly 9%, but PDD Holdings closed up 4%. After the Bank of England meeting, UK bond yields experienced a V-shaped reversal, and UK stocks halted a six-day rally. The USD reached a two-week high. Brent crude oil rose nearly 2% to create a new three-week high. Gold reached a new intraday historical high for three consecutive days. Copper increased for four straight days, closing at a new historical high.

Comments

LinkLogis 3 big shareholders are TENCENT, GIC PTE LTD AND CITIC.

These institutions have backed LinkLogis since it's early days and remain a shareholder. this suggest confidence in their management and the company future prospects

Netvista91 : Maybe Bear. Look at graph, candle so high. One day, must down for correction. Mark my word

MT888888 : next week back to 58 and above....a very healthy retracement. Just look at the daily chart...

104254860 MT888888 : The key figures from April 2 discuss the matter of influence, and it is currently difficult to see a return to the peak. Perhaps after April 2, it will return to 50.

Moriarty mcG OP 104254860 : April 2nd?

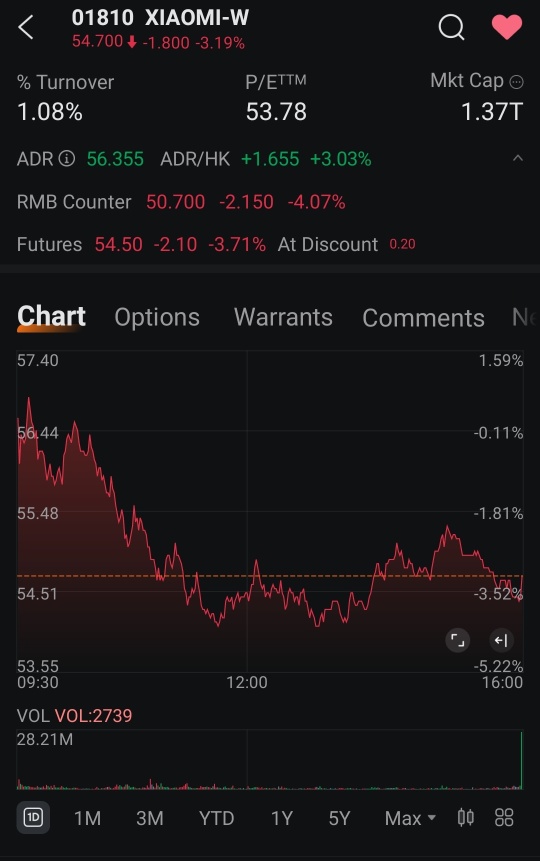

Moriarty mcG OP : options analysis for Xiaomi (01810), with a focus on put options and implied volatility.

Key Observations:

1. Stock Price Decline (-3.19%)

Xiaomi's stock is currently trading at HKD 54.7, down 1.8 HKD for the day. This suggests some short-term selling pressure.

2. Put Option Implied Volatility (IV) Analysis:

IV is highest for near-term expirations (March 28, 2025) and decreases as expiration extends to June 27, 2025, and March 30, 2026.

This means the market expects higher short-term uncertainty but lower long-term volatility.

3. Volatility Smile:

The Call option IV chart shows a strong skew, with deep OTM (Out of the Money) calls having extremely high IV (above 1300%).

This suggests traders may be speculating on major upside movements or that liquidity is low, leading to exaggerated IV.

Interpretation & Strategy:

Short-term traders: The high near-term IV in puts suggests the market is pricing in risk—perhaps due to Xiaomi’s earnings report on March 18. If you believe the stock will rebound, selling high IV puts could be profitable.

Long-term investors: The IV drop in 2026 expiration suggests confidence in Xiaomi’s long-term stability. If you're bullish, longer-dated call options might offer good value.

Stock Movement: The current pullback (-3.19%) might be a buying opportunity if you expect positive earnings. However, the high IV in options suggests some uncertainty.

View more comments...