Digital Currency includes companies involved in the creation, trade, and services of digital forms of money. It includes businesses that operate in blockchain technology, cryptocurrency mining, exchanges, digital wallets, and payment solutions.

- 1473.713

- -7.222-0.49%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Mawson Infrastructure November 2024 Monthly Digital Colocation Revenue Up 111% Y/Y To About $4.18M

U.S. stocks closed: The Dow Jones fell for four consecutive days, Chinese concept stocks plummeted over 4%, as the market focused on the CPI report.

① The Nasdaq China Golden Dragon Index fell 4.34%, as China Concept Stocks collectively declined; ② Apple is reportedly planning to equip its smartwatches with satellite communication capabilities; ③ Google A rose 5.62%, as the company launched its latest quantum chip "Willow," achieving significant technological breakthroughs; ④ Microsoft shareholders voted against the Bitcoin investment proposal.

Market Whales and Their Recent Bets on CLSK Options

Microsoft Shareholders Reject Proposal To Explore Bitcoin Investment

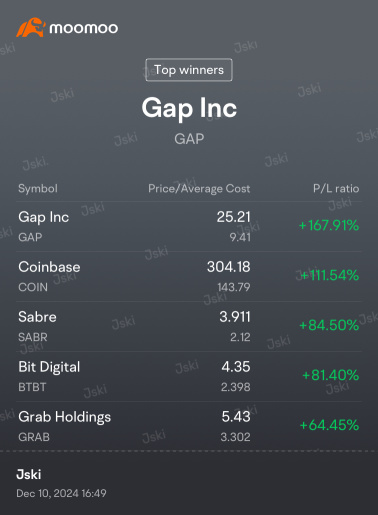

Can US Keep Up With Other Markets On Digital Asset Regulation? 'Headwinds Are Turning Into Tailwinds,' Coinbase Exec Says

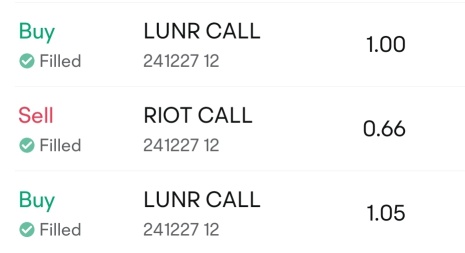

Riot Platforms's Options: A Look at What the Big Money Is Thinking

Comments

$MARA Holdings (MARA.US)$

![[rumour] $mstr will be added to Nasdaq 100 on Friday](https://sgsnsimg.moomoo.com/sns_client_feed/152382205/20241211/1733872046777-random4104-152382205-android-compress.png/thumb?area=102&is_public=true)

102514703 : Then bring SMCI down, he should be very happy.