The Semiconductor selection includes companies and ETFs in the Philadelphia Semiconductor Index (SOX Index) which is a key indicator for measuring global trends and performance in the semiconductor industry. Changes in the stocks that make up the SOX index reflect the overall trends and opportunities of the semiconductor industry. The SOX index is also used for research and investment in semiconductor ETFs. Refer to the Philadelphia Semiconductor Index (SOX index) for more details.

- 4087.947

- -77.420-1.86%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Emerging Trends in Renewable Energy Drive Surge in Battery Technology Stocks

Silicon Valley's "King of Overwork", Nvidia! Some people work seven days a week and spend money like there's no tomorrow.

In the technology industry, the phenomenon of "lying flat and waiting for stocks to mature" is very common, but it does not exist in Nvidia. There are employees who work seven days a week and work until early morning, but they are unwilling to leave because the compensation is too high. A current employee said that the practice of lying flat and waiting for stocks to mature would make employees out of sync with the company and others, and those who try to do so become the target of internal criticism.

Bitcoin Slips Below $64K As AI Tokens Surge; Anthony Scaramucci Says It's Still 'An Early-Adopting Technology'

What the Options Market Tells Us About Broadcom

Nvidia Could See More Than 9% Upside on Its Reporting Day

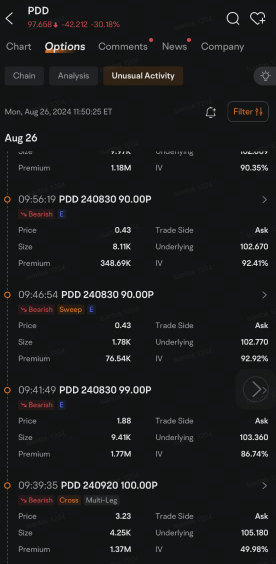

Intel Unusual Options Activity For August 26

Comments

Lol tried hard to pull down the price to invest before financial announcement. Good luck.

May close at 127-129

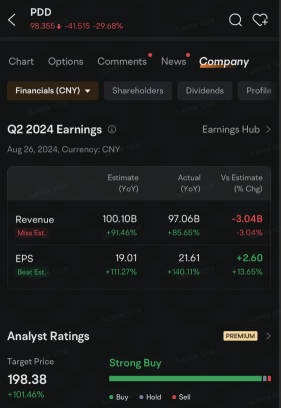

"Revenue growth will inevitably face pressure due to intensified competition and external challenges,” VP of Finance Jun Liu, said in the company's earnings release Monday. “Profitability will also likely be impacted as we con...