High Dividend

- 1028.730

- -6.153-0.59%

20min DelayNot Open Mar 27 15:30 JST

1033.644High1020.368Low

1026.260Open1034.882Pre Close117.03MVolume16Rise10.64P/E (Static)267.89BTurnover--Flatline0.87%Turnover Ratio38.50TMarket Cap12Fall29.42TFloat Cap

Columns Top 5 Stocks To Watch This Week!

Stocks to Watch

Best Buy Co Inc (BBY US) $Best Buy (BBY.US)$

Daily Chart - [BEARISH ↘ **] BBY US has shaped a bearish breakout of an ascending trendline. As long as price holds below 83.8 resistance, a drop towards support at 67.45 is expected. Technical indicators are advocating for a bearish scenario as well.

Alternatively: A daily candlestick closing above 83.8 resistance will invalidate bearish view and open a push higher towards next resistance at 91.85.

Kimbe...

Best Buy Co Inc (BBY US) $Best Buy (BBY.US)$

Daily Chart - [BEARISH ↘ **] BBY US has shaped a bearish breakout of an ascending trendline. As long as price holds below 83.8 resistance, a drop towards support at 67.45 is expected. Technical indicators are advocating for a bearish scenario as well.

Alternatively: A daily candlestick closing above 83.8 resistance will invalidate bearish view and open a push higher towards next resistance at 91.85.

Kimbe...

+3

16

2

1

Market Re-Cap: What Happened Last Week (For 17th Feb week)

US Market

US markets ended the week lower, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ falling 1.78% and 2.50% respectively. This came after economic data revealed that consumers' long-term inflation expectations had surged to their highest level in nearly three decades. Investor sentiment took another hit as Trump threatened to impose 25%...

US Market

US markets ended the week lower, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ falling 1.78% and 2.50% respectively. This came after economic data revealed that consumers' long-term inflation expectations had surged to their highest level in nearly three decades. Investor sentiment took another hit as Trump threatened to impose 25%...

74

8

16

Stocks to Watch

Lululemon Athletica Inc (LULU US) $Lululemon Athletica (LULU.US)$

Daily Chart - [BEARISH ↘ **] LULU US traded sideways before breaking down lower. With bearish divergence being posted, a further push lower below resistance at 371.88 towards 318.24 support is expected. Price is now below 34 period EMA with MACD showing a build up in bearish divergence.

Alternatively: A daily candlestick closing above 371.88 resistance will invalidate bear...

Lululemon Athletica Inc (LULU US) $Lululemon Athletica (LULU.US)$

Daily Chart - [BEARISH ↘ **] LULU US traded sideways before breaking down lower. With bearish divergence being posted, a further push lower below resistance at 371.88 towards 318.24 support is expected. Price is now below 34 period EMA with MACD showing a build up in bearish divergence.

Alternatively: A daily candlestick closing above 371.88 resistance will invalidate bear...

+3

35

5

2

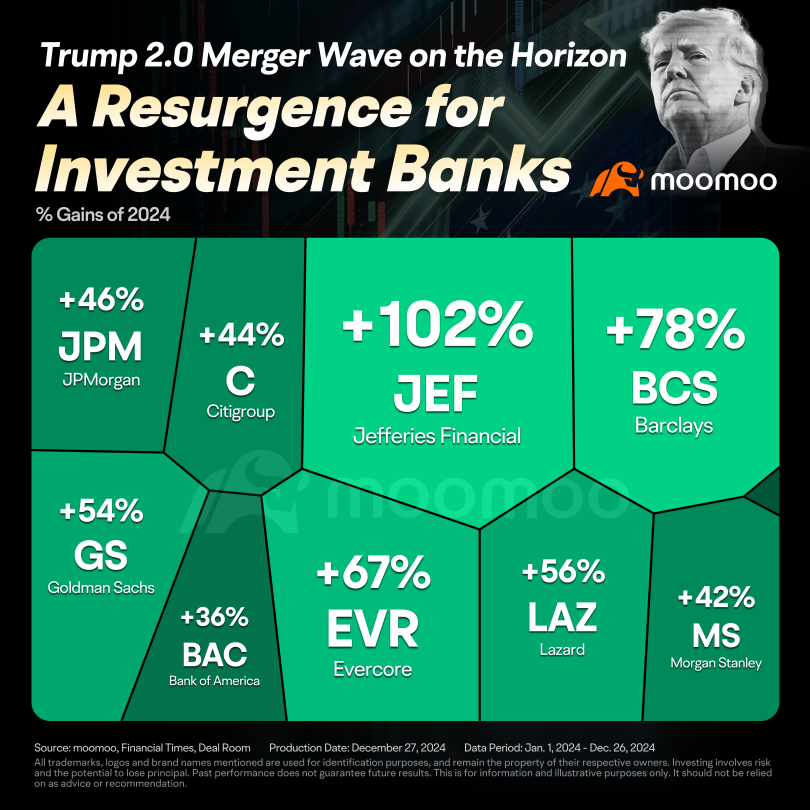

Deregulation was a hallmark of Trump's policy framework, and his previous term saw M&A-friendly regulatory reforms. With Trump poised for a White House comeback and an M&A market primed to rebound, many market observers foresee a surge in deals over the coming years.

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

62

5

29

No comment yet

Cui Nyonya Kueh : See you tomorrow I hope

ValPhang : the graph… misleading?