High Dividend

- 1464.500

- -14.033-0.95%

20min DelayMarket Closed Jan 6 15:30 JST

1479.828High1461.373Low

1479.828Open1478.534Pre Close97.59MVolume4Rise13.74P/E (Static)72.34BTurnover--Flatline0.33%Turnover Ratio22.53TMarket Cap6Fall13.68TFloat Cap

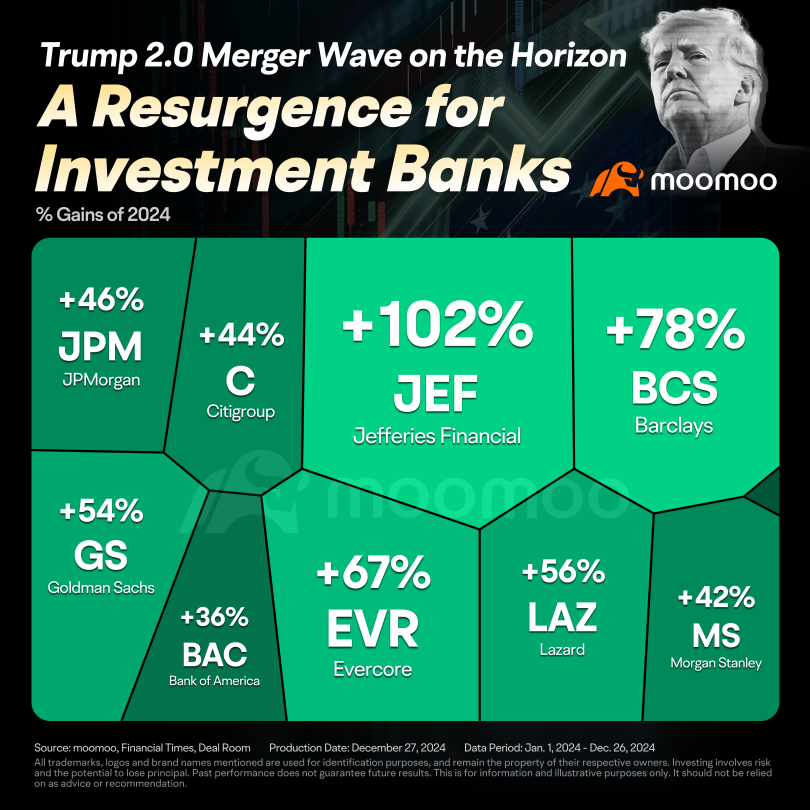

Deregulation was a hallmark of Trump's policy framework, and his previous term saw M&A-friendly regulatory reforms. With Trump poised for a White House comeback and an M&A market primed to rebound, many market observers foresee a surge in deals over the coming years.

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

60

5

28

Stocks to Watch

Kimberly-Clark Corporation (KMB US) $Kimberly-Clark (KMB.US)$

Daily Chart -[BULLISH ↗ **]KMB is holding above mid-term ascending trendline support and hasbeen making a series of higher highs and higher lows. As long as price is holding above 142 support, a further push higher towards 155.70 resistance is expected. Technical indicators are advocating for a bullish scenario.

Alternatively: A daily candlestick closingbelow 142 suppor...

Kimberly-Clark Corporation (KMB US) $Kimberly-Clark (KMB.US)$

Daily Chart -[BULLISH ↗ **]KMB is holding above mid-term ascending trendline support and hasbeen making a series of higher highs and higher lows. As long as price is holding above 142 support, a further push higher towards 155.70 resistance is expected. Technical indicators are advocating for a bullish scenario.

Alternatively: A daily candlestick closingbelow 142 suppor...

+3

20

18

No comment yet

LittleSoldier : Yeah I have mixed feelings on the issue, while I suspect it was a good offer I’m not totally on board with handing over the largest steel corp to a foreign entity. I realize they are our allies, things change. With the Government blocking the sale, I suspect there will be some kind of bailout in the works. Trump wants to reignite manufacturing in the USA and there is the auto industry as well not to mention a boarder wall that needs to be finished, not to mention Biden’s dumb ass selling the steel for pennies on the dollar. Bringing Us steel back to its former self would mean hundreds of thousands new jobs not dependent of foreign interest. America has lots of allies that don’t always play in Americas interest!

Stock_Drift OP LittleSoldier : $Cleveland-Cliffs (CLF.US)$ wants to buy $United States Steel (X.US)$ too but for much less.

吸猫西施 : Just waiting for Trump to come to the rescue, back to 40.