High Dividend

- 1478.534

- -1.019-0.07%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Biden to Decide on US Steel Takeover After Panel Deadlocks

Recovery to 0.04 million yen level due to expectations for the New Year market.

The Nikkei average rose significantly for the third consecutive day. It ended at 40,281.16 yen, up 713.10 yen (with an estimated Volume of 2.1 billion 30 million shares), recovering to the 0.04 million yen level for the first time in about five and a half months since July 19. The yen rate weakened to around 158 yen to the dollar in the previous day's Overseas market, leading to early buying focused on export stocks such as Automobiles, and the Nikkei average started to rise. Just before the midday close, it recovered to the 0.04 million yen level for the first time in about two weeks. Afterwards, Semiconductor-related stocks and other high-value stocks continued to rise.

List of breakout stocks (Part 1) [Ichimoku Kinko Hyo - List of breakout stocks]

○ List of stocks that have broken through the clouds Market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Stock Exchange Main Board <1379> Hokuto 1786 1759.5 1783 <1515> Nippon Steel Mining 448043654355 <1662> Petroleum Resources 112611201117.5 <1720> Tokyu Construction 720692.25708.5 <1721> Comsys HD 32253211.53194.5 <

Canon Inc-Spons Adr, Espec, etc. [List of stocks from the newspaper]

*Canon Inc-Spons Adr <7751> re-enters the ArF lithography equipment market, aiming to gain Share through miniaturization (Nikkei Industrial Daily page 1) -○ *Espec <6859> launches aggressive strategies for Semiconductors, continuously introducing contract measurement services (Nikkei Industrial Daily page 1) -○ *Nippon Steel <5401> believes in 'presidential approval' for the acquisition of United States Steel, statement made for final decision (Nikkei Industrial Daily page 3) -○ *Sumitomo Chemical <4005> sells polarizing film to two Chinese companies, targeting large LCDs, to local companies in spring next year (Nikkei Industrial Daily page 3) -○ *Mitsubishi Corporation <8058> diverse workforce.

List of conversion stocks (Part 3) [List of parabolic signal conversion stocks]

○ List of stocks that have switched to Sell Market Code Stock Name Closing Price SAR Main Board <6905> Kossel 1166 1218 <7095> Macbee P28002824 <7102> Nichisharyo 22282320 <7202> Isuzu 21292134 <7421> Kappa Create 16141644 <7545> Nishimatsuyachain 22992398 <7599> IDOM 11041136 <7679>

List of Conversion Stocks (Part 1) [List of Parabolic Signal Conversion Stocks]

○ List of stocks undergoing buy transition in the market Code Stock Name Closing Price SAR Main Board <1417> Miraitowa 2209 2100 <1433> Bestera 1005978 <167A> Ryosan Ryohyo 22842246 <1719> Ando Hazama 11891153 <1890> Toyo Construction 12981262 <1893> Goyo Construction 643611 <2163> Altner 19641852 <2170> L

Comments

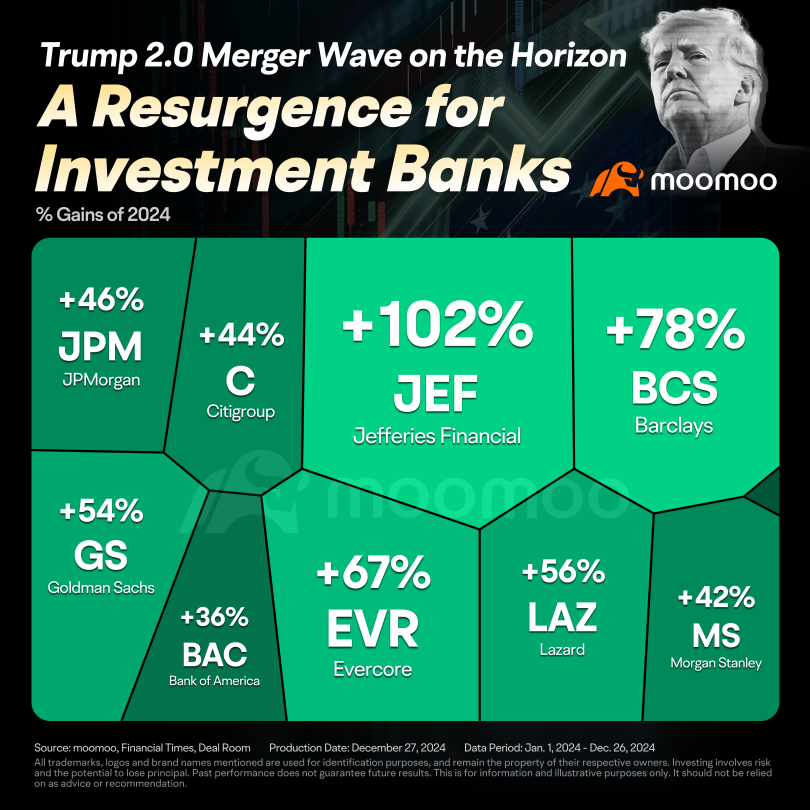

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

LittleSoldier : Yeah I have mixed feelings on the issue, while I suspect it was a good offer I’m not totally on board with handing over the largest steel corp to a foreign entity. I realize they are our allies, things change. With the Government blocking the sale, I suspect there will be some kind of bailout in the works. Trump wants to reignite manufacturing in the USA and there is the auto industry as well not to mention a boarder wall that needs to be finished, not to mention Biden’s dumb ass selling the steel for pennies on the dollar. Bringing Us steel back to its former self would mean hundreds of thousands new jobs not dependent of foreign interest. America has lots of allies that don’t always play in Americas interest!

Stock_Drift OP LittleSoldier : $Cleveland-Cliffs (CLF.US)$ wants to buy $United States Steel (X.US)$ too but for much less.

吸猫西施 : Just waiting for Trump to come to the rescue, back to 40.