Semiconductor

- 2063.697

- +30.826+1.52%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

In the future, attention will turn to the Bank of Japan's monetary policy decision-making meetings.

The Nikkei average continued to rise, closing up 125.48 yen at 39,027.98 yen (Volume estimated at 1.5 billion 30 million shares), recovering the 39,000 yen level for the first time since the 10th. Developments were influenced by reports regarding tariffs from U.S. President Trump. Anticipating that Trump would postpone tariff policies during his inauguration, buying activity led to a rise, reaching 39,238.21 yen shortly after the opening. However, after reports emerged about considering tariffs on Mexico and Canada, it turned negative in the middle of the first half.

The Nikkei average continues to rise, with fluctuations driven by excitement and concern over Trump's tariffs.

On the 20th, the USA market was closed due to the holiday commemorating Martin Luther King Jr.'s birthday. In the highly anticipated inauguration of President Trump, statements regarding tariffs were withheld, leading to a Buy-dominant start for the Tokyo market. There were moments when the Nikkei average rose to 39,238.21 yen, but around 10 o'clock, the report of "imposing a 25% tariff on Mexico and Canada starting February 1" changed the optimistic mood drastically. The Nikkei average experienced fluctuations and declined. After the Sell and Buy transactions settled down, the market was around 39,000 yen.

API, Ryohin Keikaku ETC (Additional) Rating

Upgrades - Bullish Code Stock Name Securities Company Previous After ---------------------------------------------------------------- <4568> Daiichi Sankyo Mizuho "Hold" "Buy" <6768> Tamura Manufacturing Morgan Stanley "Equal Weight" "Overweight" Downgrades - Bearish Code Stock Name Securities Company Previous After --------------------------------------------

Bronco B (21st) [Financial Results Schedule]

The above Calendar is merely a plan and is subject to change due to company circumstances.--------------------------------------- January 21 (Tue) <3091> Bronco B--------------------------------------- January 22 (Wed) <8617> Mitsuyoshi Securities--------------------------------------- January 23 (Thu)

The Nikkei average rebounded significantly, temporarily recovering to 39,000 yen, but caution regarding Trump 2.0 weighed heavily.

On the 17th, the US stock market rebounded. The Dow Inc rose by 334.70 points to 43,487.83, while the Nasdaq closed 291.91 points higher at 19,630.20. In addition to the International Monetary Fund's (IMF) upward revision of global and domestic economic growth forecasts for 2025, optimistic views on the economy were spreading due to the better-than-expected number of housing starts and industrial production in December, leading to a rise after the opening. With the presidential inauguration set for the 20th, there are expectations for regulatory easing by the next administration and support measures for businesses and the economy.

Toyota Industries, Asahi Kasei, etc. [List of stocks and materials from the newspaper]

* Nidec Corporation Sponsored ADR <6594> Maki No TOB, concerns in the Chinese mold industry, impact on supply balance (Nikkan Kogyo, page 1) - ○ * Toyota Industries <6201> aims for 7 times solar power, plans for Tahahama factory by 2035, also considering perovskite (Nikkan Kogyo, page 1) - ○ * Rohm <6963> appoints Mr. Higashi as president, structural reform without shying away from 'pain' (Nikkan Kogyo, page 3) - ○ * Honda <7267> plans to invest 15 billion yen in human resources over 5 years, recruitment of engineers and retraining of overseas talent (Nikkan Kogyo, page 3) - ○ * Mitsubishi Corporation <8058> partnership with JOGMEC and synthesis.

Comments

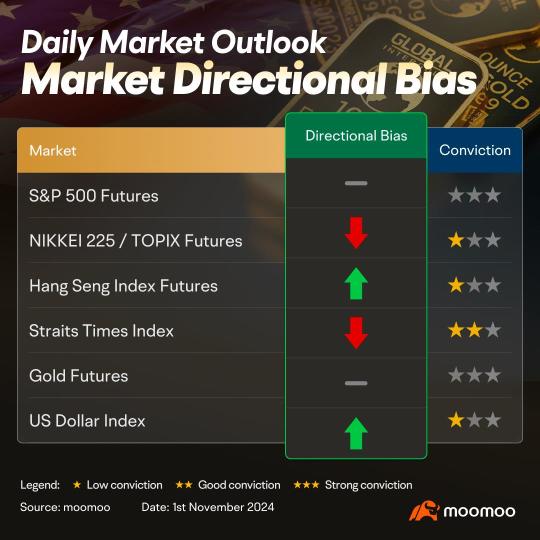

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$(4 Hour Chart) -[BULLISH↗ *]We stay slightly bullish as we expect price to push towards 6000 resistance level. A 4 hour candlestick closing above 6000 resistance level would open a push towards 6035 resistance level. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlesti...

Abbott Laboratories (ABT US) $Abbott Laboratories (ABT.US)$

Daily Chart -[BULLISH ↗ **]ABT US is currently holding above short term ascending trendline support. As long as price is holding above 117.30 support, a further push higher towards 1st resistance at 123.80 then next resistance at 131.20 is expected. Technical indicators are advocating for a bullish scenario as well.

Altern...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We stay bullish as long as price holds above 5815 support level. We expect price to push towards 5930 resistance level. A 4 hour candlestick closing above 5930 resistance level would open next push towards 5990 resistance level. Technical indicators are mixed, with prices holding above 21-EMA period.

Alternatively: A 4 hour candlestick c...