Nancy Pelosi is a US Congresswoman who has served as the Speaker of the House of Representatives from 2007 to 2011 and from 2019 to 2023. In 2023, Pelosi and her family's investment portfolio showed significant performance gains. According to statistics from Unusual Whales, the Pelosi portfolio returned 65% in 2023, substantially outperforming the S&P 500 index during the same period. This has made her one of the most closely watched investors in the capital markets.

- 1973.203

- -36.788-1.83%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Apple Halts iPhone 14, iPhone SE Sales In EU: Here's Why

OpenAI Lays Out Its For-Profit Transition Plans, Says It Must Evolve To Advance Its AGI Mission

5 Tips For Your Tesla This Winter

Options Market Statistics: Tesla Stock Falls on Friday; Investors Closely Focus on Tesla's Fourth-Quarter Deliveries, Options Pop

Weekly Buzz: So far, Santa is Letting us Down

LeBron James Vs. NFL: NBA Star Declares Christmas 'Our Day,' But 2024 Ratings Disagree

Comments

$NVIDIA (NVDA.US)$ $Apple (AAPL.US)$ $Oracle (ORCL.US)$ $Tesla (TSLA.US)$ $Advanced Micro Devices (AMD.US)$ $Alphabet-C (GOOG.US)$ $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ $Eli Lilly and Co (LLY.US)$ $Meta Platforms (META.US)$ $Netflix (NFLX.US)$

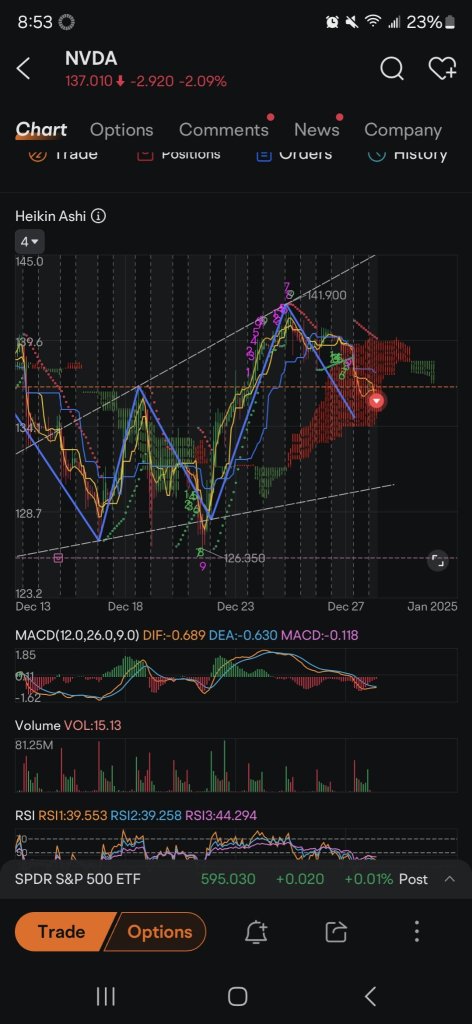

Another week of profit selling Nvidia put options ~$70 + $22 totalling $92.

that's not good. good for me got like 10k coming in on a side account in a week or two lalala