Nancy Pelosi is a US Congresswoman who has served as the Speaker of the House of Representatives from 2007 to 2011 and from 2019 to 2023. In 2023, Pelosi and her family's investment portfolio showed significant performance gains. According to statistics from Unusual Whales, the Pelosi portfolio returned 65% in 2023, substantially outperforming the S&P 500 index during the same period. This has made her one of the most closely watched investors in the capital markets.

- 1911.748

- +2.337+0.12%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Justin Sun's Takes A Cheeky Dig At Microsoft For Rejecting Bitcoin Strategy: 'Highly Recommend Buying It When BTC Reaches $1M'

Google Wants FTC To Dismantle Microsoft's Exclusive Cloud Hosting Deal With OpenAI: Report

Options Market Statistics: Tesla's Cheaper 'Model Q' Is on the Way; Options Pop

Gamestop, US Steel, Walgreens, Rigetti Computing, Tesla: Why These 5 Stocks Are On Investors' Radars Today

Google has complained to regulators: Microsoft and OpenAI are suspected of monopolistic practices and must terminate their exclusive Cloud Computing Service.

The exclusive agreement makes Microsoft the only Cloud Computing Service provider for OpenAI technology, which places other competitors, such as Google and Amazon, at a significant disadvantage. These companies hope to host OpenAI's AI models so that their cloud customers can access OpenAI's technology without the need to use Microsoft's Server.

Auto Disruption: Amazon Joins Costco as a Source for Consumers to Buy Cars

Comments

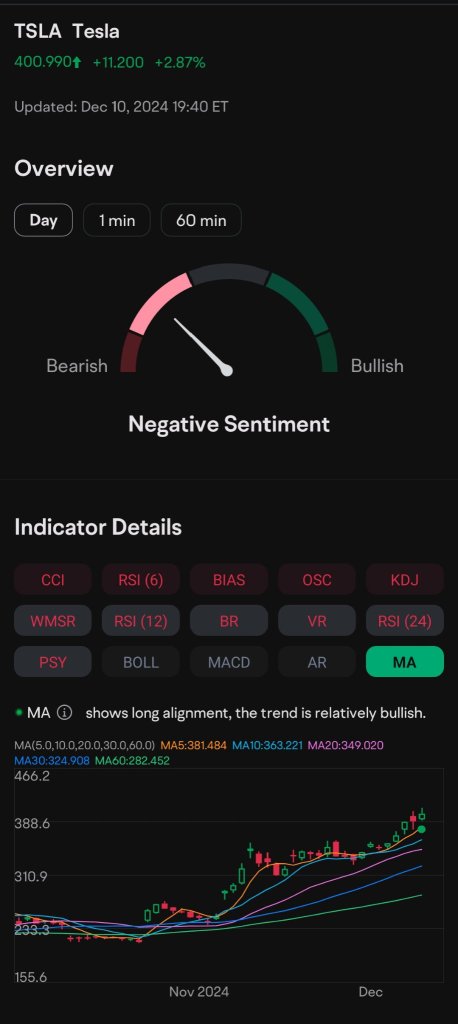

1) Moomoo's Indicators Feature

Moomoo has 15 TA Indicators to view and they are updated daily.

Go Menu>Watchlists and select a stock. After scrolling down, you should see "Indicator Sentiment". You can check the different types ...

The biggest problem is that everyone knows it. Everyone in the world knows it.

The stock market only rewards a few people. Do you understand?