Nancy Pelosi is a US Congresswoman who has served as the Speaker of the House of Representatives from 2007 to 2011 and from 2019 to 2023. In 2023, Pelosi and her family's investment portfolio showed significant performance gains. According to statistics from Unusual Whales, the Pelosi portfolio returned 65% in 2023, substantially outperforming the S&P 500 index during the same period. This has made her one of the most closely watched investors in the capital markets.

- 1958.717

- -0.0750.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Amazon.com Analyst Ratings

Rivian, Tesla Will Drive Autonomous Vehicle Progress In 2025: Goldman Sachs

9 Consumer Discretionary Stocks With Whale Alerts In Today's Session

10 Information Technology Stocks Whale Activity In Today's Session

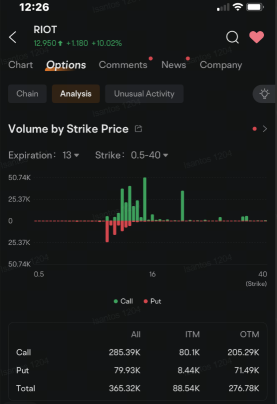

Riot Options Volume Jumps as Stock Rallies 10% After Starboard Reportedly Takes Stake

Chevron Tops Most Shorted Large-cap Stock for Second Straight Month in November, Hazeltree Says

Comments

Shares jumped as much as 12.8% to $13.28 Thursday morning, likely helping fuel demand for call options. The most active of them are call options th...