Nancy Pelosi is a US Congresswoman who has served as the Speaker of the House of Representatives from 2007 to 2011 and from 2019 to 2023. In 2023, Pelosi and her family's investment portfolio showed significant performance gains. According to statistics from Unusual Whales, the Pelosi portfolio returned 65% in 2023, substantially outperforming the S&P 500 index during the same period. This has made her one of the most closely watched investors in the capital markets.

- 1975.365

- +33.852+1.74%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

OpenAI Plans to Launch New ChatGPT Feature That Performs Tasks - Report

Tesla (TSLA) Yield Shares Purpose ETF - ETF Units Declares CAD 0.55 Dividend

NVIDIA (NVDA) Yield Shares Purpose ETF - ETF Units Declares CAD 0.75 Dividend

Databricks Accumulates $15B Through Funding; Meta Joins as Investor

Alphabet (GOOGL) Yield Shares Purpose ETF Declares CAD 0.25 Dividend

Alphabet Analyst Ratings

Comments

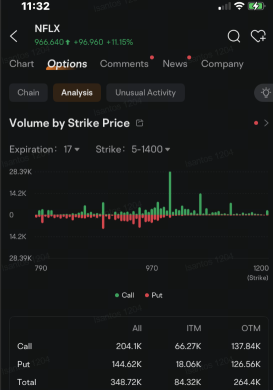

Shares of the streaming giant climbed as much as 15% to an all-time high of $999 after Netflix announced price increases. That came after net subscribers grew more than double the ...