Nancy Pelosi is a US Congresswoman who has served as the Speaker of the House of Representatives from 2007 to 2011 and from 2019 to 2023. In 2023, Pelosi and her family's investment portfolio showed significant performance gains. According to statistics from Unusual Whales, the Pelosi portfolio returned 65% in 2023, substantially outperforming the S&P 500 index during the same period. This has made her one of the most closely watched investors in the capital markets.

- 1637.485

- -81.724-4.75%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

AI dreams, Silicon Valley persists, while Wall Street hesitates.

"Follow the money" on Wall Street believes that AI technology has not yet reached the expected level of practicality, investing too much not only fails to recover costs, but also easily triggers a bubble. However, technology giants in the midst of the AI whirlpool are still frantically investing money, aiming for a future.

CrowdStrike Offers $10 Uber Eats Gift Card As Apology For Its Outage That Took Down 8.5M Windows Computers Globally: Some Users Report Their Vouchers Being Canceled

Google's 'Mojo' Is Back, Says Wedbush Analyst Dan Ives, Sees More Upside For Alphabet Stock

Tesla Bull Cathie Wood's Ark Invest Sells $7.16M Worth Of EV Maker's Shares After Q2 Earnings Reveal Profits Tanked Sharply

Nvidia, Ford, Chipotle, Viking Therapeutics, Tesla: Why These 5 Stocks Are On Investors' Radars Today

Key Nvidia Supplier SK Hynix Stock Drops Nearly 8% Following US Tech Sell-Off Despite Record Quarterly Profit Reveal

Comments

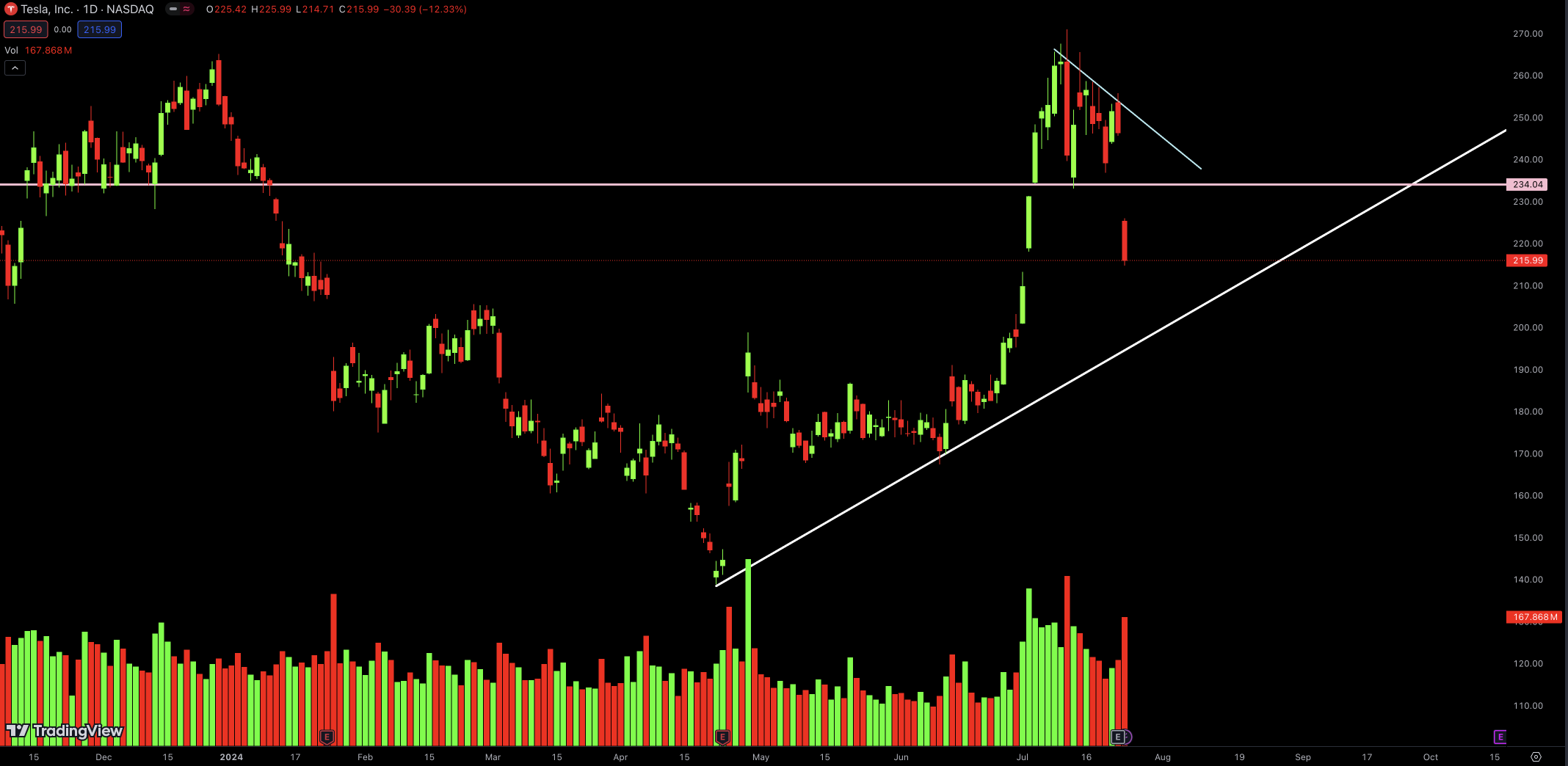

Now, as we're just gettin' into earnings season, this sell-off has got folks wonderin' if it's time to cash out and take profits.

$Tesla(TSLA.US$ $Invesco QQQ Trust(QQQ.US$ $NVIDIA(NVDA.US$ $IBM Corp(IBM.US$

���������...