Nancy Pelosi is a US Congresswoman who has served as the Speaker of the House of Representatives from 2007 to 2011 and from 2019 to 2023. In 2023, Pelosi and her family's investment portfolio showed significant performance gains. According to statistics from Unusual Whales, the Pelosi portfolio returned 65% in 2023, substantially outperforming the S&P 500 index during the same period. This has made her one of the most closely watched investors in the capital markets.

- 1700.893

- +13.548+0.80%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

IQVIA Posts Upbeat Earnings, Joins Terex, Reddit And Other Big Stocks Moving Higher On Monday

U.S. stocks were higher, with the Nasdaq Composite gaining over 100 points on Monday.Shares of IQVIA Holdings Inc. (NYSE:IQV) rose sharply during Monday's session after the company released better-

Serve Robotics Stock Is Soaring 53% after Nvidia Stake

Serve Robotics Inc (NASDAQ:SERV) shares are trading higher Monday. The stock appears to be moving on continued momentum after Nvidia Corp (NASDAQ:NVDA) disclosed a stake in the company last week.

Amazon.com Analyst Ratings

Date Upside/Downside Analyst Firm Price Target Change Rating Change Previous / Current Rating 07/22/2024 25.1% Truist Securities $220 → $230 Maintains Buy 07/17/2024 14.22% Needham $205 → $210

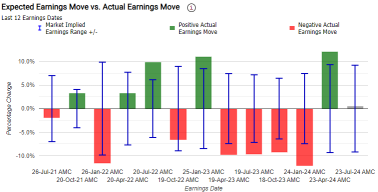

Will Alphabet's Q2 Earnings Defy Bearish Trends?

Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) will be reporting second-quarter earnings on Tuesday. Wall Street expects $1.84 in EPS and $84.1 billion in revenues when the Google parent company reports

Why Are Delta Air Lines Shares Descending On Monday?

Delta Air Lines Inc (NYSE:DAL) shares are trading lower after the legacy carrier canceled more than 600 flights on Monday, as it struggled to recover from a global cyber outage that impacted

Semis Have Opportunities Within Volatility and Attractive Valuations - BofA

Comments

Approximately 14% of $S&P 500 Index(.SPX.US$ companies have released their earnings for the June quarter, and the blended earnings growth rate for ...