Yen Depreciation Beneficiaries

- 1508.677

- 0.0000.00%

20min DelayMarket to Open Dec 4 15:30 JST

0.000High0.000Low

0.000Open1508.677Pre Close0Volume--Rise18.84P/E (Static)0.00Turnover10Flatline0.00%Turnover Ratio44.69TMarket Cap--Fall38.68TFloat Cap

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

25

1

【The US】

🔸 Powell Says Fed Not in a Hurry, Will Lower Rates “Over Time”. Federal Reserve Chair Jerome Powell said the central bank will lower interest rates “over time,” while again emphasizing that the overall US economy remains on solid footing. Powell also reiterated his confidence that inflation will continue moving toward the Fed’s 2% targ...

🔸 Powell Says Fed Not in a Hurry, Will Lower Rates “Over Time”. Federal Reserve Chair Jerome Powell said the central bank will lower interest rates “over time,” while again emphasizing that the overall US economy remains on solid footing. Powell also reiterated his confidence that inflation will continue moving toward the Fed’s 2% targ...

![Powell Says Fed Not in a Hurry, Will Lower Rates “Over Time”; Oil prices rise on escalating attacks in the Middle East [CSOP Global Market Morning Report]](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20241002/1727850092990-1359bf352d.jpeg/thumb?area=999&is_public=true)

5

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]View remains unchanged. We maintain our bullish directional bias as long as price is holding above 5680 support level. Price is still expected to push higher towards 5945 resistance. Technical indicators are also advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below ...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]View remains unchanged. We maintain our bullish directional bias as long as price is holding above 5680 support level. Price is still expected to push higher towards 5945 resistance. Technical indicators are also advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below ...

26

1

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

9

1

Market News

【United States】

U.S. retail sales in July exceeded expectations to a one-and-a-half-year high, data dispelled recession fears, and U.S. stocks soared.

U.S. retail sales in July increased by 1% month-on-month, the highest growth rate in a year and a half. Data showed that U.S. retail sales growth in July exceeded expectations, indicating that consumers are still resilient even in the face of high prices and borrowing costs, and U.S. recessi...

【United States】

U.S. retail sales in July exceeded expectations to a one-and-a-half-year high, data dispelled recession fears, and U.S. stocks soared.

U.S. retail sales in July increased by 1% month-on-month, the highest growth rate in a year and a half. Data showed that U.S. retail sales growth in July exceeded expectations, indicating that consumers are still resilient even in the face of high prices and borrowing costs, and U.S. recessi...

3

Stocks to Watch

Amazon.com Inc (AMZN US) $Amazon (AMZN.US)$

Daily Chart -[BULLISH ↗ **] AMZN holding above 161.25 support, level above which we expect price to do a bounce towards 181.70 resistance. Stochastics indicator is on support where price bounced strongly in the past.

Alternatively: A daily candlestick closing below 161.25 support will open a further drop towards next support at 151.50.

eBay Inc (EBAY US) $eBay (EBAY.US)$

Daily Chart ...

Amazon.com Inc (AMZN US) $Amazon (AMZN.US)$

Daily Chart -[BULLISH ↗ **] AMZN holding above 161.25 support, level above which we expect price to do a bounce towards 181.70 resistance. Stochastics indicator is on support where price bounced strongly in the past.

Alternatively: A daily candlestick closing below 161.25 support will open a further drop towards next support at 151.50.

eBay Inc (EBAY US) $eBay (EBAY.US)$

Daily Chart ...

+3

29

2

1

$Lion-Nomura Japan Active ETF (Powered by AI) (JJJ.SG)$

Nikkei 225 plunged more than 12% on Mon as investors worried that the U.S. economy may be in worse shape than had been expected dumped a wide range of shares.

The Nikkei index shed 4,451.28 to 31,458.42. It dropped 5.8% on Fri and has now logged its worst two-day decline ever, dropping 18.2% in the last two trading sessions.

At its lowest the Nikkei plunged ...

Nikkei 225 plunged more than 12% on Mon as investors worried that the U.S. economy may be in worse shape than had been expected dumped a wide range of shares.

The Nikkei index shed 4,451.28 to 31,458.42. It dropped 5.8% on Fri and has now logged its worst two-day decline ever, dropping 18.2% in the last two trading sessions.

At its lowest the Nikkei plunged ...

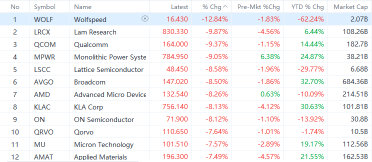

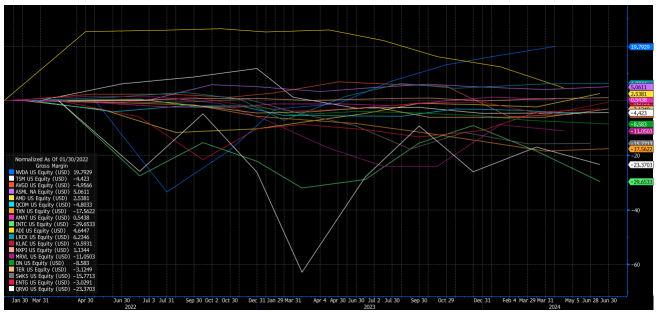

Thursday's release of multiple economic data points all showed poor performance, reigniting fears of a recession due to deteriorating macro demand expectations and weak employment figures. This led the market to experience a significant decline. Simultaneously, leading chip design giant Arm's projected growth rate for patent licensing fees, which benefit from the AI-enabled smartphone trend, fell below previous expe...

+3

57

13

126

•Last week, LCU (-2.74% in USD), SQU (-0.64% in USD), SRT (-1.30% in SGD) and $CSOP DIV ETF S$ (SHD.SG)$ (-1.43% in SGD) fell, while $CSOP STAR&CHINEXT50 SGD (SCY.SG)$ (+3.25% in SGD) rose.

• $CSOP LOW CARBON US$ (LCU.SG)$ fall was driven by IT, consumer discretionary and communication services by sector. By country, the decline was led by China, Taiwan and Japan. By individual firms, the fall was led by $Taiwan Semiconductor (TSM.US)$, $TENCENT (00700.HK)$ ...

• $CSOP LOW CARBON US$ (LCU.SG)$ fall was driven by IT, consumer discretionary and communication services by sector. By country, the decline was led by China, Taiwan and Japan. By individual firms, the fall was led by $Taiwan Semiconductor (TSM.US)$, $TENCENT (00700.HK)$ ...

3

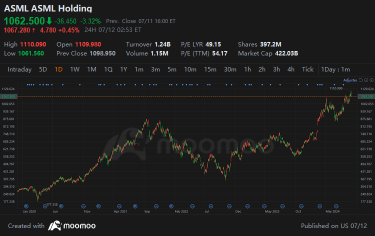

Columns ASML 24Q2 Preview: Expected Lack of Performance Growth Drivers, What Is the Investment Outlook?

$ASML Holding (ASML.US)$ is a leading supplier of lithography systems used in semiconductor manufacturing, holding a significant position in the semiconductor industry. ASML will announce its financial data for the second quarter of 2024 on July 17, Eastern Time. Although its stock price has performed strongly since the end of 2022, with an increase of 52%, factors such as insufficient performance grow...

9

2

No comment yet

104476495 : h