- 1110.876

- +6.352+0.58%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

What kind of week will this be? Global stock markets are facing a "tariff storm," and U.S. Treasury bonds are back in focus.

Since this quarter, U.S. Treasury bonds have outperformed Stocks, with a cumulative increase of more than 2%, while the S&P 500 Index has declined by about 5%. Analysis suggests that the 'reciprocal tariff' policy may impact the stock of Industries such as Autos, chips, and Pharmaceuticals, while the outlook of economic downturn and declining stock market will continue to elevate U.S. Treasury bonds as a safe haven Assets.

Key Deals This Week: XAI Acquires X; Bluebird Bio, Nvidia, Dollar Tree and More

SA Asks: What Are the Best Large-cap Cardiology Stocks Right Now?

Trump's Medical Tariffs Could Significantly Hurt These European Healthcare Firms

Pfizer and Other Pandemic Favorites in Focus as FDA's Top Vaccine Regulator Resigns

Top FDA Vaccine Official Resigns Citing RFK Jr.'s 'Misinformation and Lies'

Comments

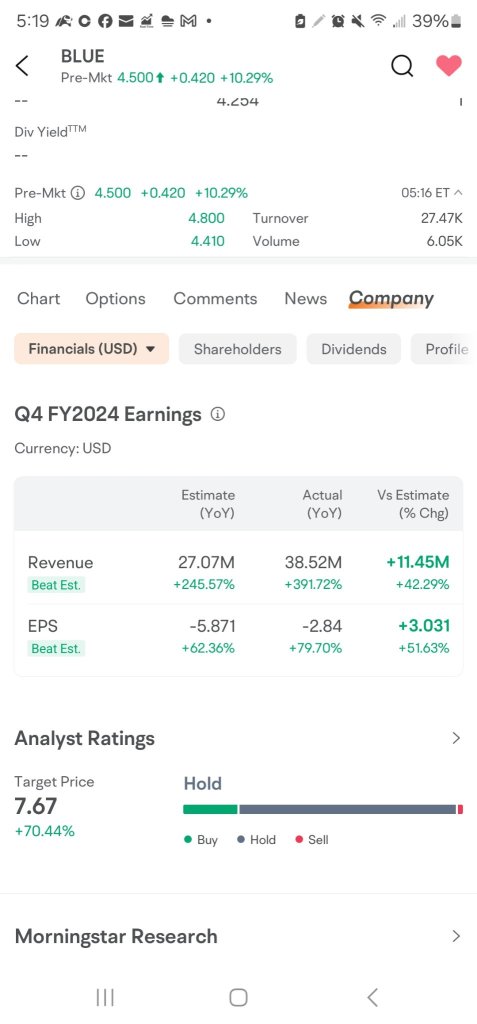

SOMERVILLE, Mass.—(BUSINESS WIRE)—March 28, 2025— bluebird bio, Inc. (NASDAQ: BLUE) (“bluebird”) today confirmed it has received an unsolicited non-binding written proposal (the “Ayrmid Proposal”) from Ayrmid Ltd (“Ayrmid”) to acquire bluebird for an upfront cash payment of $4.50 per share and a one-time contingent value right...

Bluebird Gets New M&A Bid, Seeking To Top Private Equity Offer' - Endpoints News