Investment ThemesDetailed Quotes

Room-Temp Superconductors

Watchlist

- 692.367

- +0.251+0.04%

Close Dec 26 16:00 ET

693.979High685.113Low

687.095Open692.116Pre Close3.94MVolume2Rise11.41P/E (Static)124.12MTurnover--Flatline0.86%Turnover Ratio17.53BMarket Cap1Fall14.60BFloat Cap

Constituent Stocks: 3Top Rising: AMSC+5.84%

$American Superconductor (AMSC.US)$ I think you'll be able to buy this at $25 or slightly better 24 and 7/8 24 and 3/4 in the very near future.

they had outstanding earnings their guidance is superb they picked up several new analysts writing research on the company it's nothing but positive.

and if you look at the chart it has the 20-day moving average has a nice upward bias and prior to this post earnings rally it has held that 20-day upward trend for an extended period.

so I think with a v...

they had outstanding earnings their guidance is superb they picked up several new analysts writing research on the company it's nothing but positive.

and if you look at the chart it has the 20-day moving average has a nice upward bias and prior to this post earnings rally it has held that 20-day upward trend for an extended period.

so I think with a v...

6

1

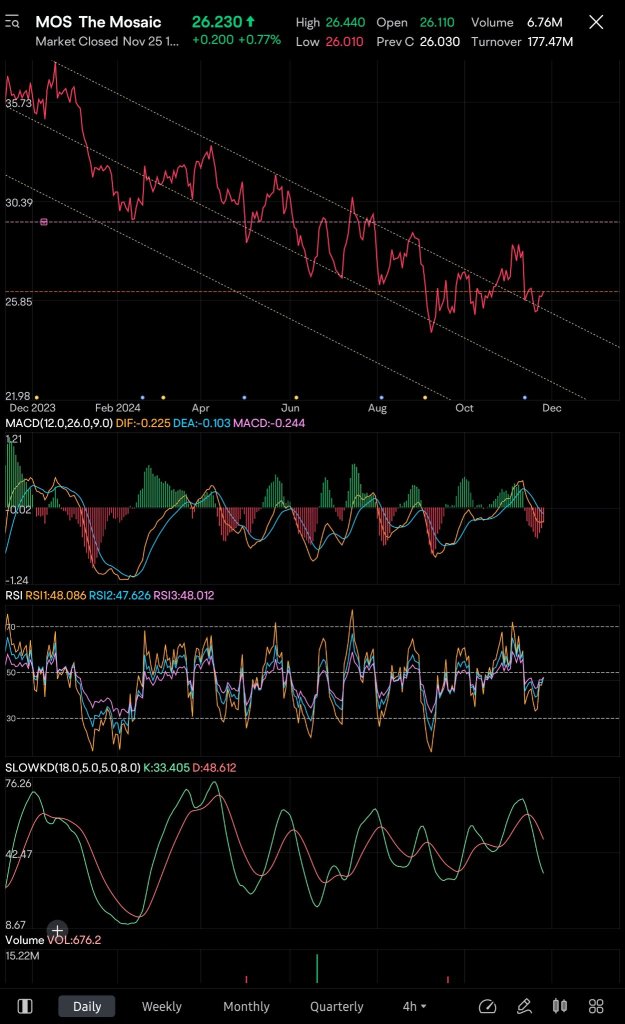

$The Mosaic (MOS.US)$

a nice move off the bottom. It's getting there 👍

how are the others?

$Intrepid Potash (IPI.US)$

$LSB Industries (LXU.US)$

$The Scotts Miracle (SMG.US)$

$Nutrien (NTR.US)$

Let's Go!

Be Safe, Be Careful, Be Wise

and as always

Good Luck 🙏

a nice move off the bottom. It's getting there 👍

how are the others?

$Intrepid Potash (IPI.US)$

$LSB Industries (LXU.US)$

$The Scotts Miracle (SMG.US)$

$Nutrien (NTR.US)$

Let's Go!

Be Safe, Be Careful, Be Wise

and as always

Good Luck 🙏

6

Today is 2/12/24.

Sizing 15% for NPWR at13.41 with 1mins ORB, SL at LOD. SL order triggered but order not filled. At the end sold at12.78. shitty illiquid stock.

AMSC, sold half at34.26 and remain 1/2 for original SL.

at 27/11/24, AMSC, stopped out for remaining 1/2 for original SL.

ATGE, sold half at 90.79 and remain 1/2 for SL at BE.

Sizing 15% for NPWR at13.41 with 1mins ORB, SL at LOD. SL order triggered but order not filled. At the end sold at12.78. shitty illiquid stock.

AMSC, sold half at34.26 and remain 1/2 for original SL.

at 27/11/24, AMSC, stopped out for remaining 1/2 for original SL.

ATGE, sold half at 90.79 and remain 1/2 for SL at BE.

13

A lagging sector. Natgas has been lagging and on the downtrend for years now after the big run-up. We'll that big run up, was only the first leg of this inflation super cycle. Many of the natgas companies have begun to already run. One sector is still lagging. Potash, potash runs with natgas. If anyone is looking for a sector to hold for the next year or so to see huge gains (my favorites go in the hundreds of percent gains), then have i got the sector for you.

$Intrepid Potash (IPI.US)$

here is...

$Intrepid Potash (IPI.US)$

here is...

loading...

10

3

No comment yet

RocketXP9 : same boat

10baggerbamm : this is where it needs to be bought. I hope their earnings are spectacular their guidance is outstanding they have Great Wall Street coverage last quarter after the earnings they picked up more analyst to follow the company you had a huge gap up after last quarter. and if history repeats itself we are going to have another leg up starting real soon and post earnings knock wood next year we will be back mid to upper 30s again