The ARK Holdings selection refers to a family of exchange traded funds (ETFs) managed by ARK Investment Management LLC (ARK). ARK was founded in New York City in 2014 by Cathie Wood, a prominent investor known for her bullish stance on technology stocks. The firm's investment philosophy is centered around identifying disruptive technologies and investing in companies that are positioned to benefit from these trends. The ARK ETFs have gained attention from investors and analysts due to their strong performance and unique investment approach. ARK currently has eight ETFs: ARKK, ARKW, ARKG, ARKQ, ARKF, ARKX, PRNT, LZRL.

- 996.066

- +12.056+1.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Options Market Statistics: Tesla's Cheaper 'Model Q' Is on the Way; Options Pop

Gamestop, US Steel, Walgreens, Rigetti Computing, Tesla: Why These 5 Stocks Are On Investors' Radars Today

Microsoft Shareholders Reject Proposal To Explore Bitcoin Investment

U.S. stocks closed: The Dow Jones fell for four consecutive days, Chinese concept stocks plummeted over 4%, as the market focused on the CPI report.

① The Nasdaq China Golden Dragon Index fell 4.34%, as China Concept Stocks collectively declined; ② Apple is reportedly planning to equip its smartwatches with satellite communication capabilities; ③ Google A rose 5.62%, as the company launched its latest quantum chip "Willow," achieving significant technological breakthroughs; ④ Microsoft shareholders voted against the Bitcoin investment proposal.

Market Falls Wednesday, but Googles Chip Impresses | WST

Jake Paul, Mike Tyson, Simone Biles And More: The Most-Searched Athletes On Google In 2024

Comments

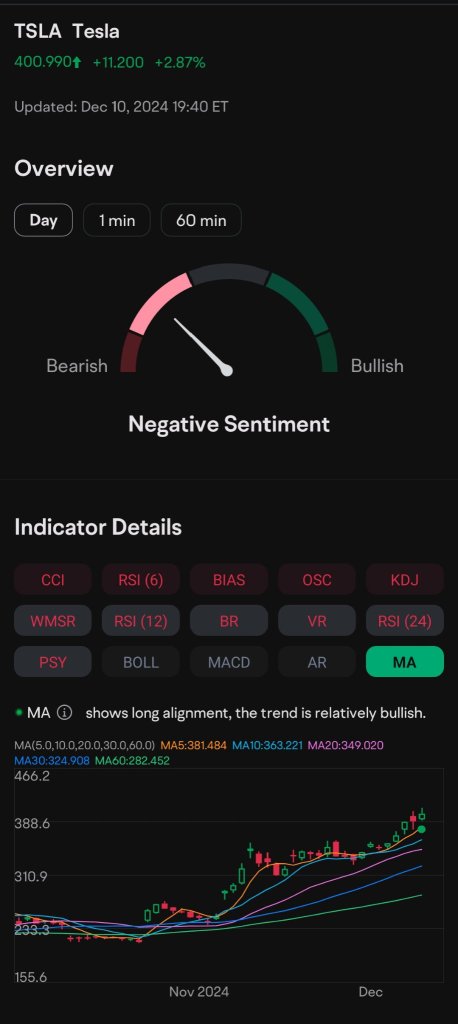

1) Moomoo's Indicators Feature

Moomoo has 15 TA Indicators to view and they are updated daily.

Go Menu>Watchlists and select a stock. After scrolling down, you should see "Indicator Sentiment". You can check the different types ...

The U.S. gaming market is one of the largest globally, characterized by substantial growth and innovation driven by technological advancements and diverse consumer demands. New gaming formats and business models, such as esports, virtual reality (VR), and cloud gaming, continue to emerge, providing fresh avenues for market expansion.

Market Size and Growth

$NVIDIA (NVDA.US)$

Current Size: The U.S. gamin...