The ARK Holdings selection refers to a family of exchange traded funds (ETFs) managed by ARK Investment Management LLC (ARK). ARK was founded in New York City in 2014 by Cathie Wood, a prominent investor known for her bullish stance on technology stocks. The firm's investment philosophy is centered around identifying disruptive technologies and investing in companies that are positioned to benefit from these trends. The ARK ETFs have gained attention from investors and analysts due to their strong performance and unique investment approach. ARK currently has eight ETFs: ARKK, ARKW, ARKG, ARKQ, ARKF, ARKX, PRNT, LZRL.

- 884.142

- +5.687+0.65%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Dow Falls After Record, Trump Talks Tariffs on Day One | Live Stock

A Closer Look at Coinbase Glb's Options Market Dynamics

Starbucks To Rally Around 13%? Here Are 10 Top Analyst Forecasts For Tuesday

Ubs Group dampens Tesla's spirits: Core autos business only accounts for 12% of market cap, the remaining 1 trillion market cap is all about the unlimited possibilities.

ubs group stated that the phenomenon of "the market cap of the autos business falling below the average level" has only occurred twice in the past four years, resulting in stock price corrections for Tesla of over 30% and 70%, respectively. Moreover, Tesla's current expected pe has reached 100 times, far exceeding the average level of the past two years, and investors need to have a strong sense of belief to continue increasing their shareholding in the stock.

Investment Opportunities in US Stocks Ahead of Trump's Inauguration

Leslie's Posts Weak Results, Joins Zoom Video And Other Big Stocks Moving Lower In Tuesday's Pre-Market Session

Comments

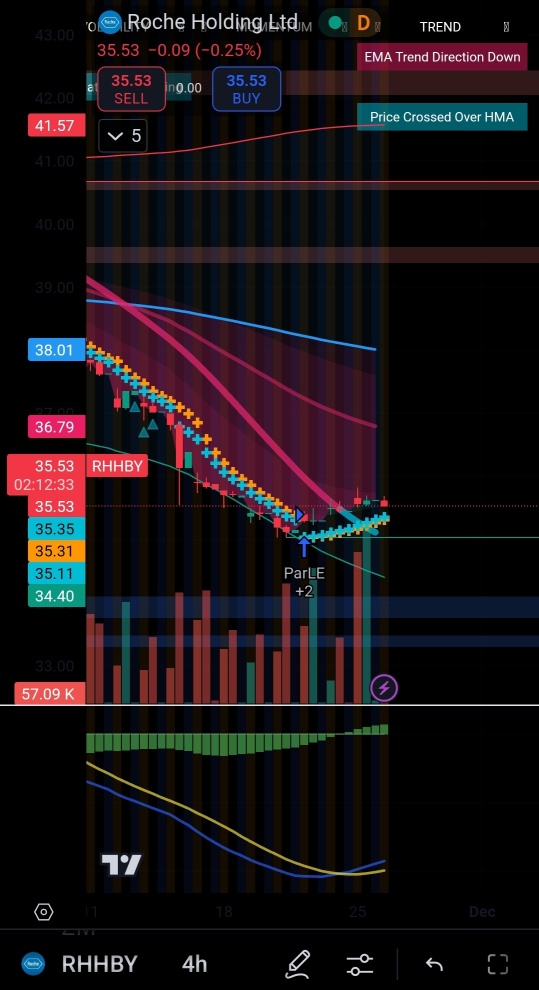

Meanwhile waiting for US stock like $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ correction point, I am testing this ADR stock.