Aluminum

- 1608.946

- -1.863-0.12%

Close Nov 18 16:00 ET

1614.729High1576.948Low

1613.077Open1610.809Pre Close6.84MVolume1RiseLossP/E (Static)238.60MTurnover--Flatline1.50%Turnover Ratio16.43BMarket Cap3Fall15.23BFloat Cap

$Aluminum Futures(FEB5) (ALImain.US)$ prices have shown a tentative upward trend since mid-August. Towards the end of the year, concerns about possible aluminum supply shortages in the coming year, coupled with the expectation that the Fed's aggressive rate hikes are coming to an end, have once again bolstered aluminum prices. According to Goldman Sachs analysts, aluminum prices could...

17

2

Copper Has Been a Bad Investment Over the Past Couple Years

Copper futures have been in a bear market for most of 2022 and 2023. This was mainly caused by weakened demand due to slow economic conditions caused by high interest rates worldwide.

Copper is Almost in A Bull Market

More recently, copper has been in a strong rally, just like most of the equity market. The price of copper futures sits just below the two hundred day moving averages.

Below the...

Copper futures have been in a bear market for most of 2022 and 2023. This was mainly caused by weakened demand due to slow economic conditions caused by high interest rates worldwide.

Copper is Almost in A Bull Market

More recently, copper has been in a strong rally, just like most of the equity market. The price of copper futures sits just below the two hundred day moving averages.

Below the...

1

So when I started investing I thought i was smart buying lithium miner stocks. They are now all down 30-40% and I am really considering taking the hit to shed my portfolio of them or stick it out to try and recover. Here are the stocks I have:

Albermarle at $215 SQM at $80 PLL at $55 SLI at $5.25 I had quite a bit of LAC but I kneejerk sold it all last night after the recent stock split and it just bleeding since

I think the EV focu...

Albermarle at $215 SQM at $80 PLL at $55 SLI at $5.25 I had quite a bit of LAC but I kneejerk sold it all last night after the recent stock split and it just bleeding since

I think the EV focu...

2

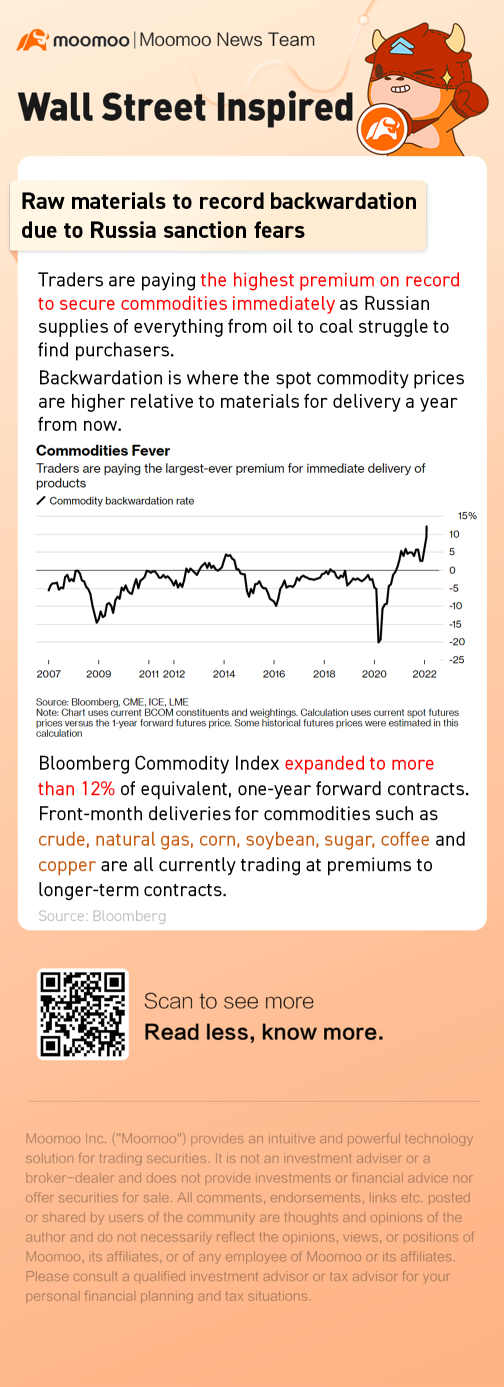

Foreign refiners are seeking alternatives to Russian products while trading houses can't find buyers for cargoes. On Wednesday, $Alcoa (AA.US)$, the largest U.S. aluminum producer, said it will halt raw-material purchases from Russia.

$S&P 500 Index (.SPX.US)$ $PHLX Oil Service Sector Index (.OSX.US)$ $Oil & Gas Drilling (LIST2274.US)$ $Aluminum (LIST2211.US)$

$S&P 500 Index (.SPX.US)$ $PHLX Oil Service Sector Index (.OSX.US)$ $Oil & Gas Drilling (LIST2274.US)$ $Aluminum (LIST2211.US)$

Expand

Expand 19

$Aluminum (LIST2211.US)$ $Metal Fabrication (LIST2270.US)$ Soaring energy prices in Europe have left the region's biggest gas and electricity consumers facing heavy losses, forcing industrial giants to cut production and threatening the economic recovery. With energy costs setting daily records, financial pressures are mounting in industries such as metals and fertiliser, with aluminium smelters in particular cutting production. Aluminium Dunkerque Industries France, Europe's largest smelter, is understood to have restricted production over the past two weeks.

4

$Gold (LIST2110.US)$ $Aluminum (LIST2211.US)$ Gold prices recorded their biggest one-day increase in three weeks, and the Fed and the Bank of England said they were not in a hurry to raise interest rates. Spot gold closed up 1.3%, at $1,791.7 per ounce. US gold futures for December delivery rose 1.7% to $1,793.50 per ounce.

Aluminum prices plummeted because China, the largest aluminum producer, said that its coal production has increased significantly and will continue to increase, helping to alleviate the power crisis that has forced aluminum plants to reduce production. At 1743 GMT, the London Metal Exchange (LME) index futures aluminum fell 3.7% to US$2,559 per ton. LME copper fell 0.3% to 9,434 US dollars per ton.

Article excerpted from Reuters Financial Morning Post

Aluminum prices plummeted because China, the largest aluminum producer, said that its coal production has increased significantly and will continue to increase, helping to alleviate the power crisis that has forced aluminum plants to reduce production. At 1743 GMT, the London Metal Exchange (LME) index futures aluminum fell 3.7% to US$2,559 per ton. LME copper fell 0.3% to 9,434 US dollars per ton.

Article excerpted from Reuters Financial Morning Post

4

Citi: Raise the aluminum price forecast in 2022 to an average of US$3013/ton.

$Aluminum (LIST2211.US)$

$Aluminum (LIST2211.US)$

The EU will suspend the implementation of anti-dumping tariffs on Chinese aluminum products for nine months

$Aluminum (LIST2211.US)$ The European Aluminum Association stated that the EU is scheduled to levy anti-dumping duties on Chinese aluminum profile products from October, but will suspend the implementation of the measure for nine months. The association said that this measure would threaten employment and send the wrong signal to Beijing. The European Commission stated that the investigation is still ongoing. If there are clear measures, they need to be implemented before October 11. Has not yet made a final decision

Article excerpted from Reuters Financial Morning Post

$Aluminum (LIST2211.US)$ The European Aluminum Association stated that the EU is scheduled to levy anti-dumping duties on Chinese aluminum profile products from October, but will suspend the implementation of the measure for nine months. The association said that this measure would threaten employment and send the wrong signal to Beijing. The European Commission stated that the investigation is still ongoing. If there are clear measures, they need to be implemented before October 11. Has not yet made a final decision

Article excerpted from Reuters Financial Morning Post

1

Metal market

$Gold (LIST2110.US)$ $Aluminum (LIST2211.US)$ The price of gold climbed to a one-week high due to the fall in the U.S. dollar and lower-than-expected inflation in the U.S., making the timetable for the Fed to cut monetary stimulus measures uncertain. Spot gold closed up 0.6% to 1,804.27 US dollars per ounce, and the US gold futures settlement price rose 0.7% to 1,807.1 US dollars per ounce.

Most industrial metals fell because the market was concerned about the real estate market in China, the largest consumer; the decline in aluminum and nickel prices from multi-year highs triggered profit-taking. At 1644 GMT, the London Metal Exchange (LME) benchmark copper futures closed down 1.3% at $9,439 per ton, and fell 1.3% on Monday.

Article excerpted from Reuters Financial Morning Post

$Gold (LIST2110.US)$ $Aluminum (LIST2211.US)$ The price of gold climbed to a one-week high due to the fall in the U.S. dollar and lower-than-expected inflation in the U.S., making the timetable for the Fed to cut monetary stimulus measures uncertain. Spot gold closed up 0.6% to 1,804.27 US dollars per ounce, and the US gold futures settlement price rose 0.7% to 1,807.1 US dollars per ounce.

Most industrial metals fell because the market was concerned about the real estate market in China, the largest consumer; the decline in aluminum and nickel prices from multi-year highs triggered profit-taking. At 1644 GMT, the London Metal Exchange (LME) benchmark copper futures closed down 1.3% at $9,439 per ton, and fell 1.3% on Monday.

Article excerpted from Reuters Financial Morning Post

1

Aluminum prices soar to 13-year highs

Institutional warning: demand has passed its peak, aluminum prices may collapse $Aluminum (LIST2211.US)$

Institutional warning: demand has passed its peak, aluminum prices may collapse $Aluminum (LIST2211.US)$

No comment yet

nyseoption : Aluminum these nuts

美股洛杉矶小虾 : Thanks for sharing