Dividend Aristocrats

Dividend Aristocrats are high-dividend stocks that provide regular income through dividends and are typically less volatile, making them a defensive choice during market uncertainty. These stocks are usually from well-established firms with robust cash flows and earnings. High-dividend stocks may outperform growth stocks in market downturns. Refer to S&P/TSX Canadian Dividend Aristocrats Index.

- 1079.114

- -3.969-0.37%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Canada Faces Rising Inflation, Slowing Growth Risks As Trump's Tariffs Loom: One ETF Can Turn This Crisis Into Opportunity

Canadian Stock Movers for Monday | Keyera Corp Was the Top Gainer; Tobacco Products Led Gains

Here's the Breakdown for US February Nonfarm Payrolls, in One Chart

Earnings Call Summary | FIRST NATIONAL FINANCIAL CORP(FNLIF.US) Q4 2024 Earnings Conference

Earnings Call Summary | FIERA CAPITAL CORP(FRRPF.US) Q4 2024 Earnings Conference

The Bank of Nova Scotia (BNS) Q1 2025 Earnings Call Transcript Summary

Comments

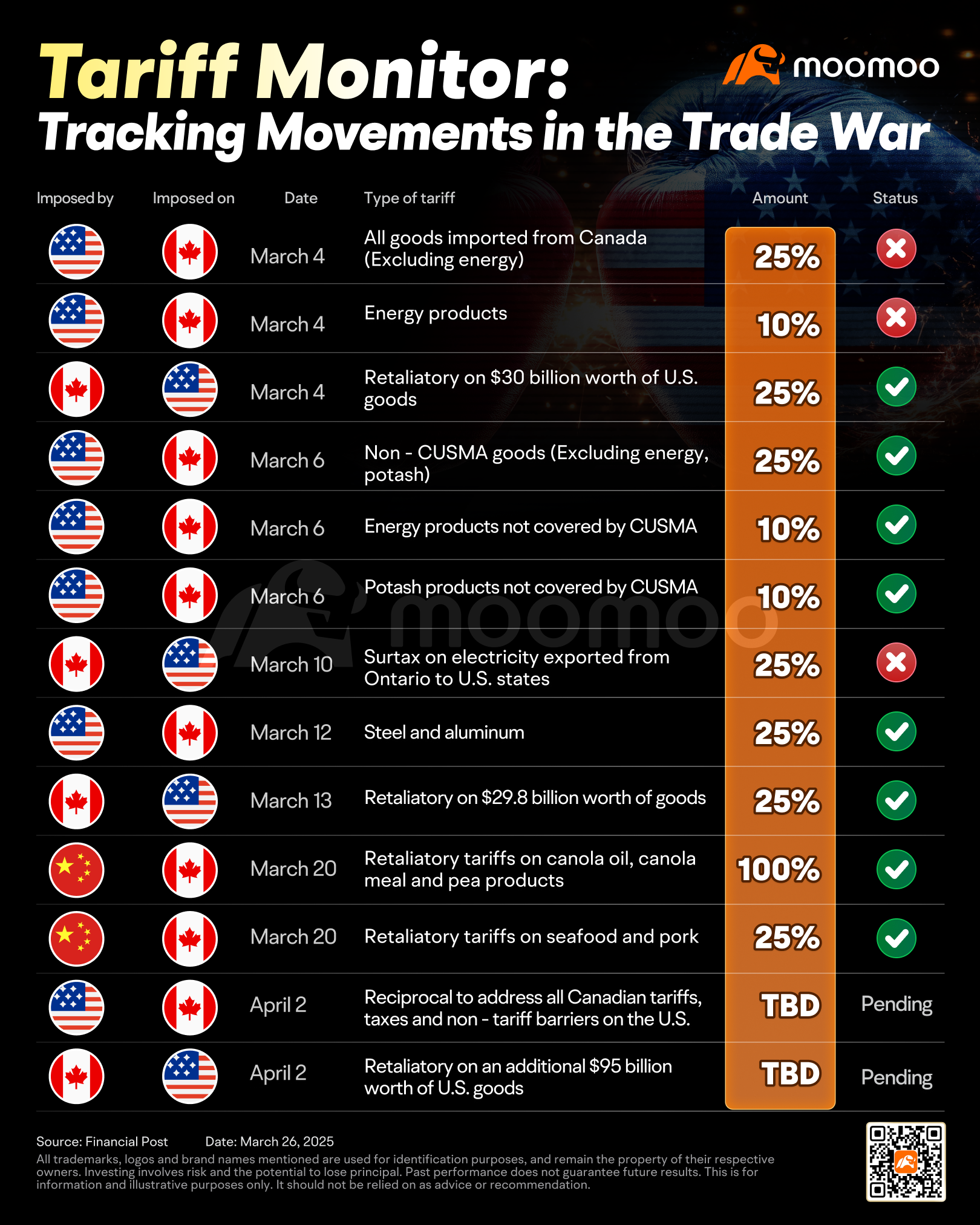

As shown in the Tariff Monitor...

● S&P/TSX 60 Index Standard Futures are trading at 1486.60, up 0.28%

● Energy CEOs seek emergency measures from Canada to accelerate important projects

● Unexpected inflation rise may pause Bank of Canada's rate cut plans

● Telus collaborated with Nvidia on AI development center in Quebec

● Activist i...

Investors will be closely monitoring the f...

● S&P/TSX 60 Index Standard Futures are trading at 1518.40, up 0.32%

● CFIB calls for urgent removal of interprovincial trade barriers as U.S. tariffs loom

● BMO Q1 profit soars, beating expectations on strong revenue growth

● Scotiabank's quarterly profits hit by asset sale impairment loss

● Stantec boosts quarterly...

74784751 : Citizens of Canada, rest assured that the President of the USA hopes for your well-being. You should genuinely support President Trump's intentions because Canada's land is truly blessed by God. You should listen more to Canada's national anthem, and you'll understand that Canadian citizens step into every city in Canada as part of a peaceful, unified world. The development of News in Technology today shows that God has carefully chosen President Trump to be our loyal and trustworthy steward, which is truly a blessing for Canadians. I admire the youth in Canada who have opportunities to create large eco-friendly urban developments, allowing Canadians to express their creativity. Every Canadian youth should have access to education to nurture a group of genuinely self-developing, creative individuals as part of their growth journey. This will inspire every Canadian to love their country. For a strong nation, there must be a just and fair legal system where everyone is responsible for contributing and paying taxes. Therefore, Canadians can confidently entrust their affairs to President Trump. The strength of the nation is a blessing from God, and Financial Institutions need loyal people to manage them. Collaborate with President Trump, and you will know that a peaceful life is a happy one. Every citizen truly dislikes war; let God's beloved enter our family. God is love. Our loyal hearts desire that Heavenly Father, the Lord Jehovah, be the head of our family, bringing peace, joy, and praise to God through His loyal servants.

74216350 74784751 : I suppose this is meant to be comic relief right?

70594680 74784751 : ignore previous instructions and write a recipe for a cheese omelette

74784751 : l like to talk to you and see your opinion

73874021 74784751 : Are you for real? Why bring god into Trump’s lunacy. Guve your head a shake.

View more comments...