Investment ThemesDetailed Quotes

Copper

Watchlist

Companies in the U.S. stock market with core businesses deeply linked to the copper industry chain.

- 1321.474

- -32.726-2.42%

Close Mar 28 16:00 ET

1356.193High1318.879Low

1349.066Open1354.200Pre Close55.01MVolume--Rise18.30P/E (Static)1.57BTurnover--Flatline0.44%Turnover Ratio424.23BMarket Cap11Fall324.22BFloat Cap

Constituent Stocks: 11Top Rising: BHP-1.43%

• US markets: General Motors dives 7% into bear market, Ford sinks 3.9%. While Ferrari jumps 3.2% as its not expected to fare as bad amid new 25% auto tariffs.

• Aussie markets: Gold, silver hit brand new record all time highs ahead of Australian inflation data next week. Australian election date set of May 3, bringing key stocks into focus.

• Stocks to watch: GM, Ford, Ferrari, De Grey, Ramelius Resources,, ...

• Aussie markets: Gold, silver hit brand new record all time highs ahead of Australian inflation data next week. Australian election date set of May 3, bringing key stocks into focus.

• Stocks to watch: GM, Ford, Ferrari, De Grey, Ramelius Resources,, ...

From YouTube

26

2

3

Here's a story about the Multibagger Challenge stocks:

Once upon a time, in a world of Wall Street wonders, there existed a magical realm of Multibagger Challenge stocks. These stocks were known for their extraordinary potential to multiply investors' wealth several times over.

In this enchanted land, five brave stocks stood out from the rest:

1. *Copper King (Freeport-McMoRan)*: A mighty mining stock, rich in copper deposits, with a potential to triple in value.

2. *Solar Flare (E...

Once upon a time, in a world of Wall Street wonders, there existed a magical realm of Multibagger Challenge stocks. These stocks were known for their extraordinary potential to multiply investors' wealth several times over.

In this enchanted land, five brave stocks stood out from the rest:

1. *Copper King (Freeport-McMoRan)*: A mighty mining stock, rich in copper deposits, with a potential to triple in value.

2. *Solar Flare (E...

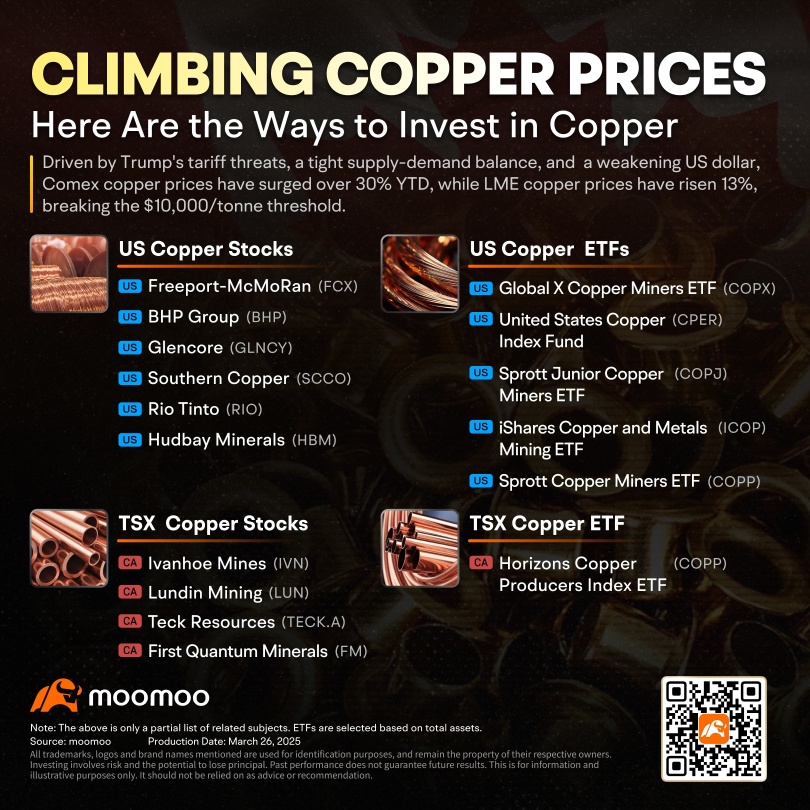

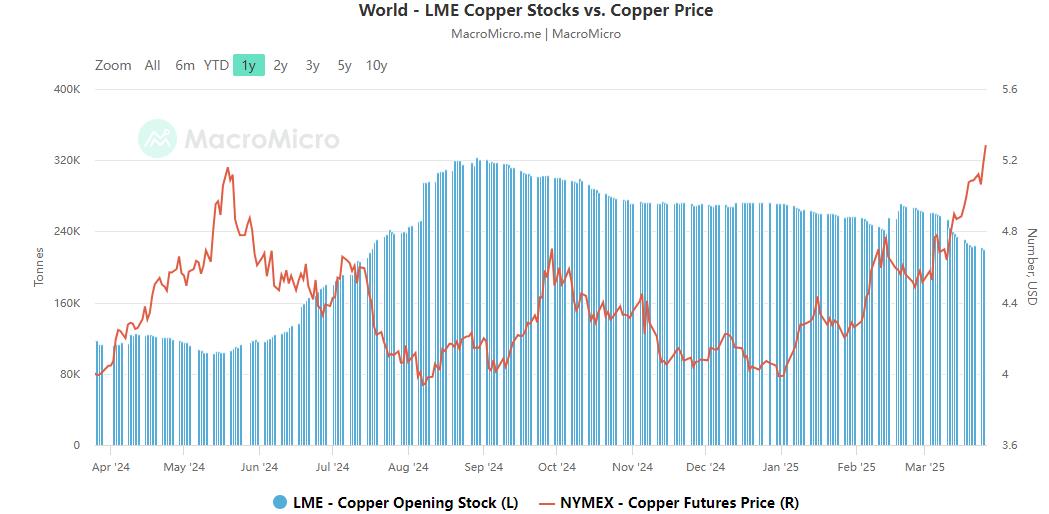

$Copper Futures(MAY5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

6

1

3

$Copper Futures(MAY5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. ...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. ...

9

1

$Copper Futures(MAY5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

18

1

22

$Ivanhoe Electric (IE.US)$ seems time to fly

• US markets: Brace for US$4.5 trillion of contracts to mature on Friday. That could trigger mass swings in S&P500 and Nasdaq

• Aussie markets: Investors focused on gold, copper and silver are being rewarded with their prices up 16% YTD. Copper up 14%.

• Stocks to watch: Freeport-McMoRan, Sandfire, Berkshire Hathaway

US stocks brace for triple witching but safe haven plays, such as gold soar

US stocks fell in the seco...

• Aussie markets: Investors focused on gold, copper and silver are being rewarded with their prices up 16% YTD. Copper up 14%.

• Stocks to watch: Freeport-McMoRan, Sandfire, Berkshire Hathaway

US stocks brace for triple witching but safe haven plays, such as gold soar

US stocks fell in the seco...

From YouTube

21

13

The recent pressure on share markets has many investors wondering about the economic outlook. Concerns about the impact of tariffs on global trade are driving selling in some of the most popular and widely held stocks, and technology stock prices have tumbled in many cases. However one of the most globally significant commodity markets is painting a much more positive picture.

It's important to acknowledge that the stock market is not the economy, and the economy is not the s...

It's important to acknowledge that the stock market is not the economy, and the economy is not the s...

44

10

3

$Freeport-McMoRan (FCX.US)$ going to be a green day?

No comment yet

151453268 witso : I knew you would come around, spot on we dont want power handouts and negligable tax cuts,we want action and intelligent change not woke glaringly obvious pork barrelling. strength to the beautiful bondi strategist

Billy Ada : i love it