Investment ThemesDetailed Quotes

Fed Rate Cut Beneficiaries

Watchlist

The list includes stocks that are expected to benefit from a Federal Reserve rate cut, covering companies from technology, cryptocurrency, real estate, and high-dividend sectors.

- 2524.599

- -16.297-0.64%

Close Dec 13 16:00 ET

2551.317High2511.712Low

2541.794Open2540.896Pre Close604.54MVolume4Rise43.87P/E (Static)128.96BTurnover--Flatline0.64%Turnover Ratio21.87TMarket Cap19Fall20.27TFloat Cap

Constituent Stocks: 23Top Rising: TSLA+4.34%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

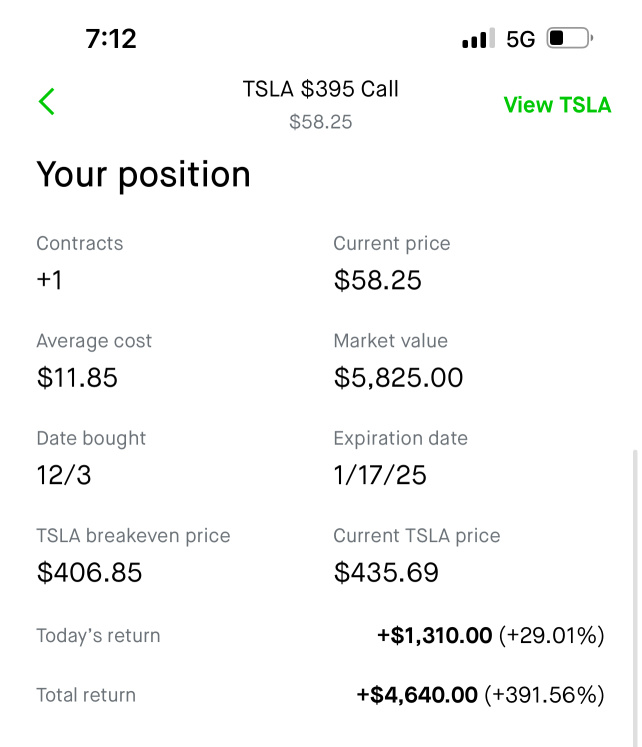

TSLATesla

436.23018.130+4.34%88.69M37.96B420.000418.100436.300415.7101.40T1.21T3.21B2.78B+12.08%+26.38%+40.19%+78.84%+132.84%+72.08%+75.56%--3.19%119.52101.454.93%Auto Manufacturers

MSTRMicroStrategy

408.67016.480+4.20%21.50M8.63B400.070392.190409.710388.88097.94B89.69B239.65M219.47M+3.46%+5.47%+24.72%+182.50%+173.22%+616.45%+547.02%--9.80%Loss154.685.31%Software - Application

MARAMARA Holdings

22.7300.150+0.66%40.40M922.54M22.87022.58023.30022.2957.32B7.16B321.83M315.04M-14.00%-17.10%+9.33%+47.12%+18.08%+24.28%-3.24%--12.83%27.0621.444.45%Capital Markets

AAPLApple

248.1300.170+0.07%33.14M8.21B247.815247.960249.290246.2403.75T3.74T15.12B15.09B+2.18%+4.55%+8.72%+8.53%+18.95%+26.21%+29.51%0.39%0.22%40.8140.811.23%Consumer Electronics

MSFTMicrosoft

447.270-2.290-0.51%20.18M9.04B448.435449.560451.430445.5803.33T3.32T7.43B7.42B+0.83%+5.62%+4.98%+2.16%-0.44%+21.55%+19.83%0.67%0.27%36.9337.901.30%Software - Infrastructure

AMZNAmazon

227.460-1.510-0.66%28.76M6.55B228.400228.970230.200225.8612.39T2.13T10.52B9.38B+0.19%+9.41%+7.56%+19.80%+22.07%+51.67%+49.70%--0.31%48.6078.431.90%Internet Retail

LENLennar Corp

154.390-1.080-0.69%2.76M423.94M153.920155.470155.140152.32041.88B37.32B271.24M241.73M-5.54%-11.47%-9.08%-19.55%+4.14%+4.76%+4.92%1.21%1.14%10.2611.241.81%Residential Construction

COINCoinbase

310.580-2.380-0.76%5.82M1.82B316.000312.960317.180305.25077.75B62.06B250.35M199.81M-9.62%+4.85%+11.38%+84.61%+40.08%+109.99%+78.58%--2.91%52.73839.413.81%Financial Data & Stock Exchanges

PBRPetroleo Brasileiro SA Petrobras

13.610-0.116-0.85%15.54M211.16M13.77013.72613.81013.45087.71B54.11B6.44B3.98B+2.02%-0.98%+1.07%-3.42%+1.56%+6.88%+0.06%17.74%0.39%6.214.262.62%Oil & Gas Integrated

DHID.R. Horton

149.870-1.340-0.89%4.90M729.21M148.870151.210150.400147.78048.13B47.37B321.17M316.06M-5.45%-11.20%-8.47%-23.76%+7.15%+0.67%-0.57%0.80%1.55%10.4510.451.73%Residential Construction

CRMSalesforce

354.310-3.720-1.04%5.54M1.98B364.000358.030364.800352.500339.07B329.21B957.00M929.16M-2.12%+7.37%+6.83%+33.20%+47.01%+36.04%+35.25%0.34%0.60%58.3784.363.44%Software - Application

ECEcopetrol

8.220-0.090-1.08%1.43M11.74M8.2808.3108.3458.15016.90B1.92B2.06B233.42M+4.58%+2.37%+6.34%-10.07%-26.41%-20.91%-21.68%25.80%0.61%4.253.482.35%Oil & Gas Integrated

ORCLOracle

173.390-1.930-1.10%8.35M1.44B175.000175.320176.140171.640484.96B280.37B2.80B1.62B-9.55%-6.19%-7.30%+3.69%+25.22%+69.87%+66.47%0.92%0.52%42.3946.742.57%Software - Infrastructure

GOOGLAlphabet-A

189.820-2.140-1.11%25.13M4.80B191.010191.960192.730189.6402.32T2.08T12.24B10.94B+8.77%+12.48%+8.23%+17.21%+3.40%+43.67%+36.38%0.21%0.23%25.1832.731.61%Internet Content & Information

GOOGAlphabet-C

191.380-2.250-1.16%18.88M3.64B192.710193.630194.340191.2602.34T2.09T12.24B10.94B+8.56%+12.38%+8.03%+17.37%+3.38%+43.51%+36.29%0.21%0.17%25.3833.001.59%Internet Content & Information

METAMeta Platforms

620.350-10.440-1.66%8.45M5.25B627.220630.790631.080616.8861.57T1.35T2.52B2.18B-0.55%+8.01%+7.48%+10.96%+21.61%+85.78%+75.79%0.24%0.39%29.2841.722.25%Internet Content & Information

ADBEAdobe

465.690-8.940-1.88%11.39M5.27B473.980474.630474.910456.800205.00B204.46B440.20M439.04M-15.78%-9.74%-12.11%-11.54%-11.61%-20.35%-21.94%--2.59%39.4339.403.82%Software - Infrastructure

VALEVale SA

9.260-0.210-2.22%27.08M251.11M9.3709.4709.3759.22039.55B37.17B4.27B4.01B-0.19%-5.25%-4.96%-13.17%-12.71%-32.36%-36.20%15.00%0.68%4.125.061.64%Other Industrial Metals & Mining

NVDANVIDIA

134.250-3.090-2.25%231.29M31.22B138.940137.340139.600132.5403.29T3.16T24.49B23.50B-5.75%-2.89%-8.52%+13.90%+6.49%+174.68%+171.17%0.02%0.98%53.00112.535.14%Semiconductors

KBHKB Home

71.420-2.110-2.87%1.40M100.38M72.65073.53073.10070.8705.24B5.06B73.33M70.80M-9.05%-13.68%-9.05%-20.09%+3.72%+19.48%+15.99%1.26%1.98%9.1710.163.03%Residential Construction

TOLToll Brothers

133.850-4.610-3.33%2.51M335.85M135.880138.460136.820132.30013.36B13.26B99.79M99.07M-13.14%-18.96%-12.91%-12.45%+16.13%+31.59%+31.20%0.67%2.53%8.928.923.26%Residential Construction

TMHCTaylor Morrison Home

64.720-2.450-3.65%673.65K43.70M66.26067.17066.48064.2346.70B6.53B103.48M100.85M-6.05%-12.39%-7.78%-9.94%+17.18%+25.82%+21.31%--0.67%8.579.273.34%Residential Construction

MTHMeritage Homes

168.430-9.020-5.08%741.69K125.09M173.930177.450174.390166.4506.09B6.00B36.18M35.59M-6.74%-11.85%-7.06%-21.18%+3.28%-1.40%-2.06%1.50%2.08%7.628.454.47%Residential Construction

News

Weekly Buzz: Tech stocks hit high scores on ominous day

D-Wave Quantum Shares Are On The Rise Friday: What's Going On?

Friday the 13th Ends with Flat S&P 500 | Wall Street Today

AI Showdown Between Nvidia, Palantir: Which Stock's Dreams Shine Brighter?

Earnings Week Ahead: FDX, NKE, CCL, BB, ACN, MU, and More

Adobe Shares Are Falling Today: What's Going On?

Comments

$Tesla (TSLA.US)$ Prepare for next week, and u will know why today is Black Friday sale.

1

3

$NVIDIA (NVDA.US)$ Hopefully next week will be better for Nvidia.

5

$MicroStrategy (MSTR.US)$ This stock you play the volatility. Not for short or even long term investing.

2

$Tesla (TSLA.US)$ wouldn't hold it long over the weekend

1

Read more

Hold Long : doesnt change a thing, tesla is building supercharger stations around the world increasing tesla orders. Countries are ordering tesla vehicles to get ahead of the rush. New things are happening it is too early for the stock to decline. Im holding

DoRaeMi OP Hold Long : I know next week confirm will rise due to interest rate drop. To be honest, Tesla use to be around Meta price

Hold Long DoRaeMi OP : yeah. thats on the 18th december isn’t it?. IShould watch the stock on the upcoming of it.