The list includes stocks that are expected to benefit from a Federal Reserve rate cut, covering companies from technology, cryptocurrency, real estate, and high-dividend sectors.

- 2401.606

- +30.511+1.29%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Cathie Wood-Led Ark's Prediction: AI Will Turn Digital Wallets Into $9 Trillion E-Commerce Powerhouses — Google, Amazon Dominance Set For Disruption?

Crypto Themed After Baby Hippo 'Moo Deng' Leaves Dogecoin, Shiba Inu In The Dust, Zooms 84% After Coinbase Announces Listing Plans

Elon Musk's "demand for salary" fails again! US judge rules Tesla's $56 billion compensation package invalid.

1. A judge in Delaware, usa upheld the original ruling that Tesla's promise of a $56 billion compensation package to Musk in 2018 is invalid; 2. Tesla shareholders previously voted to approve this compensation agreement, but the judge stated that the board of directors does not have the authority to restore Musk's compensation through a re-vote; 3. The judge also ordered Tesla to pay $0.345 billion in legal fees as compensation for the lawyers who won the case against Musk's invalid compensation package.

SpaceX's latest valuation: 350 billion USD?

In half a month, SpaceX's valuation soared by $100 billion.

Cathie Wood Slams Delaware Judge As 'Activist' Over Elon Musk's $56B Pay Plan Block, Tesla Warns Of Shareholder Rights Crisis Amid Appeal

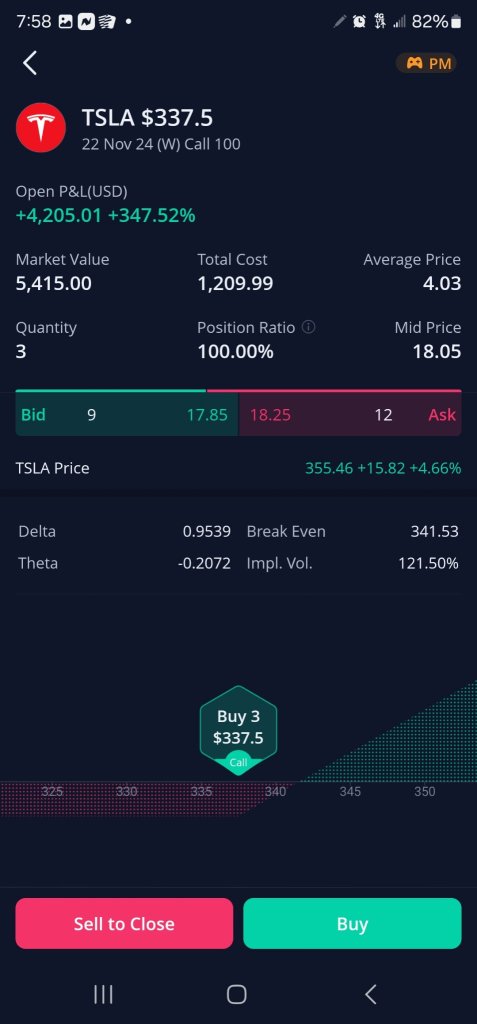

Options Market Statistics: Investors Cheered Tesla's Long-Awaited FSD Update; Options Pop

Comments

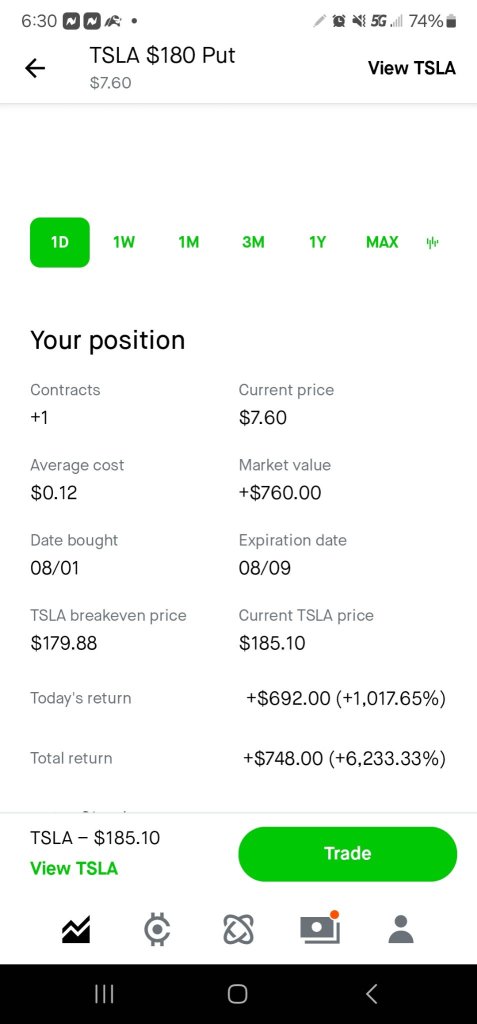

the put option was due to the economy in Japan wen they released the news of the recession

Duration: < 30 min