The list includes stocks that are expected to benefit from a Federal Reserve rate cut, covering companies from technology, cryptocurrency, real estate, and high-dividend sectors.

- 2353.569

- +16.438+0.70%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Google's Parent Alphabet Shares Dip During Tuesday Pre-Market: What's Going On?

Nvidia helps Google tackle the barriers of quantum technology, completing a week's task in just a few minutes.

① The Google Quantum AI team will use the CUDA-Q platform and the Eos supercomputer to simulate the characteristics of quantum processors; ② Google's Guifre Vidal stated that controlling noise and scaling quantum hardware is key to developing commercially viable quantum computers; ③ With the CUDA-Q platform, Google can perform large-scale dynamic simulations of quantum devices, reducing noise simulation time from a week to just a few minutes.

Tesla Is Back In The Future Fund Active ETF's Top 5 Holdings

Google's Gemini Chatbot Draws Scrutiny After Hostile Interaction With User: Here's What The Search Giant Has To Say

Nvidia Shares To Climb Over $140+ Levels, Says Technical Analyst Ahead Of Q3 Results: '...Will Have To Beat Street Expectations For The Trend To Continue'

Nasdaq Gains Over 100 Points As Tesla Surges: Investor Sentiment Declines, Fear & Greed Index Remains In 'Neutral' Zone

Comments

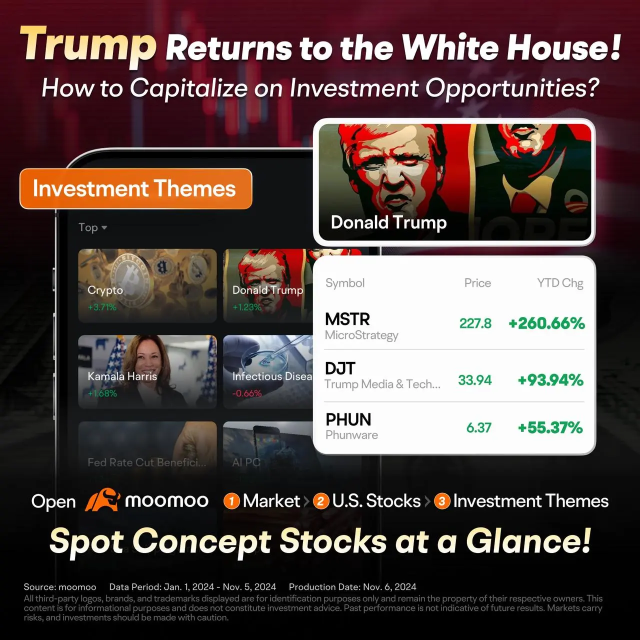

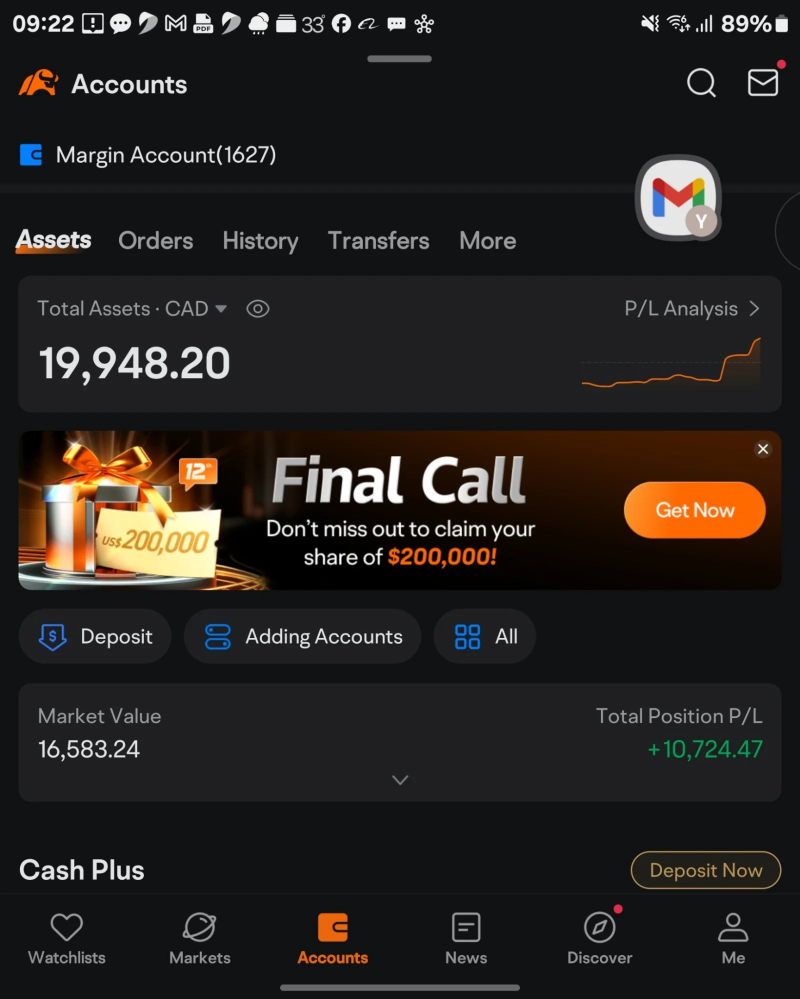

Last Wednesday, the 2024 US elections concluded with a decisive win for Trump. Alongside expectations of a 25 basis point rate cut by the Federal Reserve, US stocks surged, with banks jumping 10% after Trump's victory. Major US stock indices increased by nearly 5% for the week, Bitcoin hit record highs, $Tesla (TSLA.US)$ surged 29%, and $NVIDIA (NVDA.US)$ rose 9%. However, the strong bullish sentiment before the election brings some un...