Investment ThemesDetailed Quotes

Fed Rate Cut Beneficiaries

Watchlist

The list includes stocks that are expected to benefit from a Federal Reserve rate cut, covering companies from technology, cryptocurrency, real estate, and high-dividend sectors.

- 2393.491

- +39.922+1.70%

Close Nov 19 16:00 ET

2395.643High2343.478Low

2343.842Open2353.569Pre Close662.91MVolume18Rise41.57P/E (Static)130.74BTurnover--Flatline0.70%Turnover Ratio20.74TMarket Cap5Fall19.23TFloat Cap

Constituent Stocks: 23Top Rising: MSTR+11.89%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

Latest PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

MSTRMicroStrategy

430.54045.750+11.89%50.95M21.29B389.500384.790449.000381.00096.73B88.05B224.68M204.50M+20.74%+89.00%+95.97%+193.08%+179.39%+773.24%+581.64%--24.92%Loss162.9617.67%Software - Application

MARAMARA Holdings

19.8601.755+9.69%88.68M1.74B18.30018.10520.65018.2706.39B5.72B321.83M288.15M-21.28%+22.29%+4.69%+7.00%-0.90%+92.63%-15.45%--30.78%23.6418.7413.15%Capital Markets

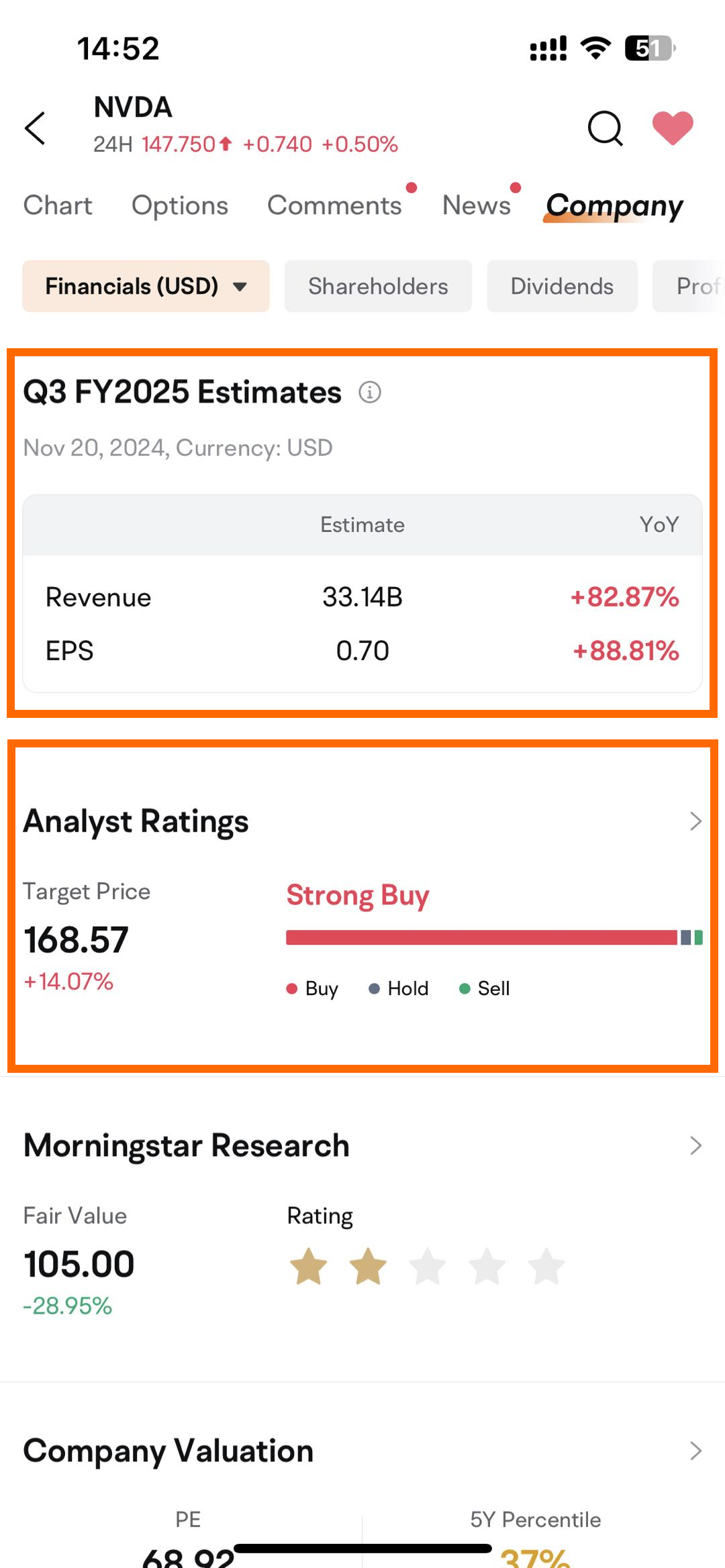

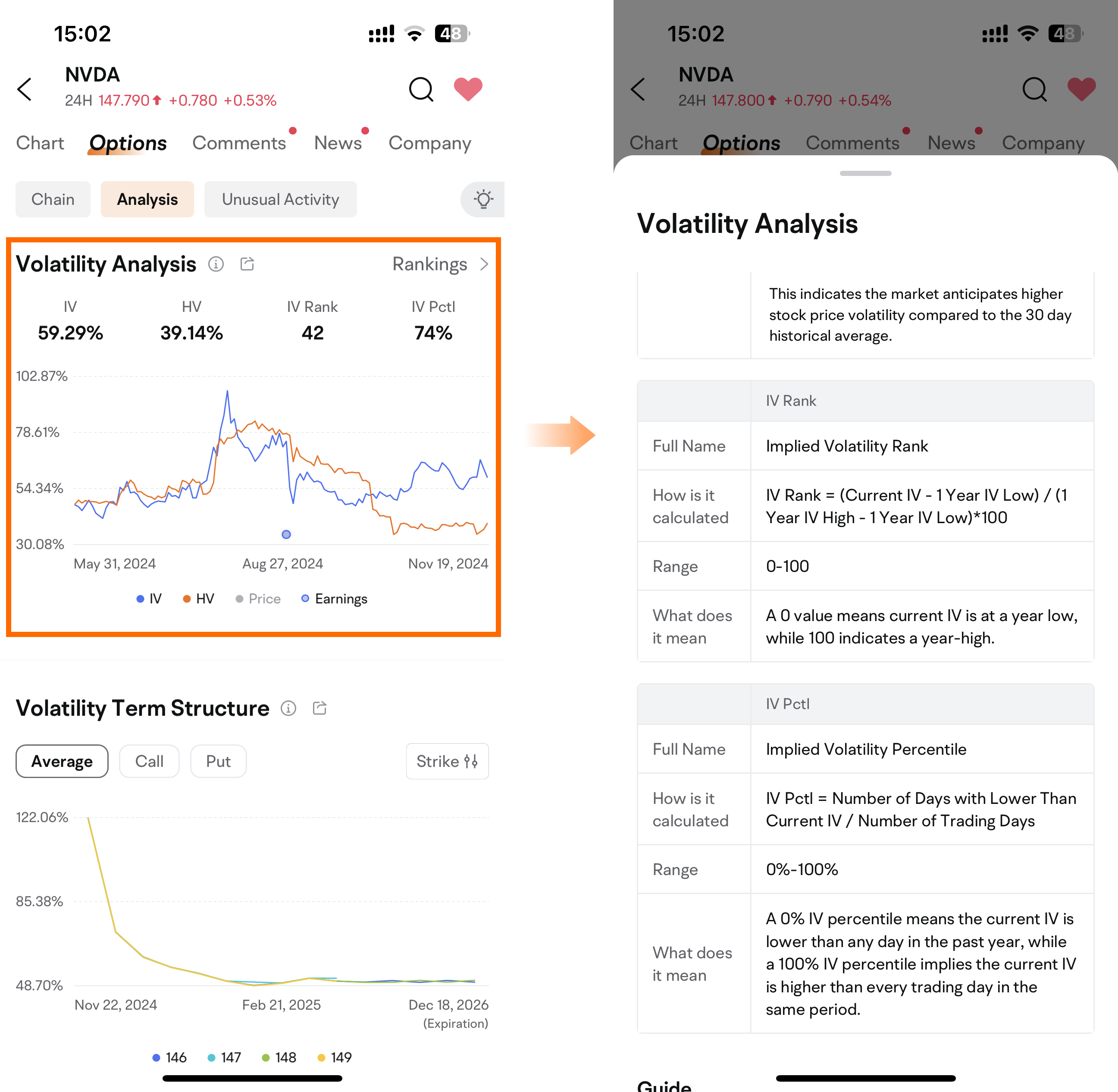

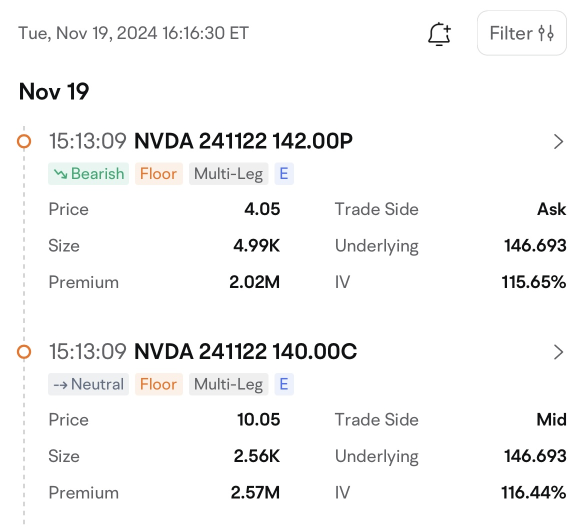

NVDANVIDIA

147.0106.860+4.89%227.83M32.95B141.320140.150147.130140.9903.61T3.46T24.53B23.54B-0.86%+5.07%+2.38%+16.26%+33.07%+194.47%+196.95%0.01%0.97%68.92123.234.38%Semiconductors

TSLATesla

346.0007.260+2.14%88.85M30.44B335.760338.740347.380332.7501.11T961.07B3.21B2.78B+5.33%+37.61%+58.74%+62.28%+93.52%+43.45%+39.25%--3.20%94.7980.474.32%Auto Manufacturers

ORCLOracle

188.9003.170+1.71%8.12M1.53B184.890185.730189.320184.320523.45B305.45B2.77B1.62B-0.36%+9.97%+7.75%+36.30%+62.15%+64.73%+81.37%0.85%0.50%48.6950.922.69%Software - Infrastructure

GOOGLAlphabet-A

178.1202.820+1.61%23.43M4.15B173.720175.300178.870173.5602.18T1.95T12.24B10.94B-1.93%+4.94%+7.86%+7.34%+3.75%+30.37%+27.83%0.22%0.21%23.6230.713.03%Internet Content & Information

GOOGAlphabet-C

179.5802.780+1.57%15.39M2.75B175.235176.800180.170175.1162.20T1.96T12.24B10.94B-2.04%+4.77%+7.65%+7.08%+3.72%+29.87%+27.74%0.22%0.14%23.8230.962.86%Internet Content & Information

AMZNAmazon

204.6102.910+1.44%31.20M6.34B199.330201.700205.300198.7802.15T1.92T10.52B9.38B-2.06%+2.56%+7.86%+16.59%+14.10%+42.19%+34.66%--0.33%43.7270.563.23%Internet Retail

METAMeta Platforms

561.0906.690+1.21%9.52M5.30B551.860554.400561.430550.6001.42T1.22T2.52B2.18B-4.06%-1.98%-3.59%+7.77%+20.37%+67.01%+59.00%0.27%0.44%26.4837.731.95%Internet Content & Information

KBHKB Home

77.8200.540+0.70%947.26K73.26M76.87077.28078.14075.8705.71B5.49B73.33M70.60M-1.39%-4.83%-0.46%-8.04%+12.06%+48.96%+26.38%1.16%1.34%9.9911.072.94%Residential Construction

DHID.R. Horton

162.3000.850+0.53%2.26M365.27M161.300161.450162.450158.63052.59B51.76B324.03M318.91M+0.29%-6.11%-9.81%-13.95%+12.01%+29.11%+7.67%0.74%0.71%11.3211.322.37%Residential Construction

LENLennar Corp

168.7500.830+0.49%1.91M322.32M167.920167.920169.481166.31045.77B40.70B271.24M241.20M+1.55%-4.81%-2.78%-7.86%+8.14%+34.82%+14.68%1.11%0.79%11.2112.291.89%Residential Construction

MSFTMicrosoft

417.7902.030+0.49%18.13M7.54B413.110415.760417.940411.5503.11T3.10T7.43B7.42B-1.24%+1.54%-2.27%+1.04%+0.93%+12.60%+11.71%0.72%0.24%34.5035.411.54%Software - Infrastructure

TMHCTaylor Morrison Home

69.5300.320+0.46%608.71K42.20M68.96069.21069.67068.0107.19B7.01B103.48M100.82M-0.95%-3.01%+7.23%+2.46%+21.75%+55.90%+30.33%--0.60%9.219.962.40%Residential Construction

MTHMeritage Homes

178.2500.810+0.46%180.55K32.10M176.490177.440178.850174.0906.45B6.34B36.18M35.59M-1.44%-6.57%-3.14%-11.36%+2.47%+28.37%+3.65%1.41%0.51%8.078.942.68%Residential Construction

CRMSalesforce

323.4301.180+0.37%5.47M1.76B319.000322.250324.700316.000309.20B300.52B956.00M929.16M-5.19%+8.72%+12.17%+22.11%+48.82%+44.83%+23.46%0.25%0.59%56.3577.012.70%Software - Application

AAPLApple

228.2800.260+0.11%36.21M8.28B226.980228.020230.160226.6603.45T3.45T15.12B15.09B+1.81%+2.27%-3.11%+0.59%+19.61%+20.33%+19.15%0.43%0.24%37.5537.551.54%Consumer Electronics

ADBEAdobe

499.6100.100+0.02%1.96M980.45M496.000499.510502.410495.460219.93B219.35B440.20M439.04M-5.09%+2.71%+1.32%-10.69%+12.05%-18.23%-16.26%--0.45%42.3042.271.39%Software - Infrastructure

VALEVale SA

10.020-0.010-0.10%17.06M170.88M10.00010.03010.0609.96542.79B40.22B4.27B4.01B+0.50%-7.31%-5.65%-5.56%-14.19%-29.51%-31.58%13.86%0.43%4.455.480.95%Other Industrial Metals & Mining

COINCoinbase

324.570-0.840-0.26%13.45M4.33B322.080325.410327.240315.50081.26B64.85B250.35M199.81M+1.70%+67.34%+54.03%+59.10%+38.26%+207.68%+86.62%--6.73%55.11877.223.61%Financial Data & Stock Exchanges

TOLToll Brothers

151.740-0.670-0.44%916.77K139.18M151.510152.410152.760149.77015.32B15.22B100.97M100.31M-0.06%-1.20%+2.51%+4.88%+26.19%+79.88%+48.73%0.58%0.91%10.4812.281.96%Residential Construction

ECEcopetrol

8.050-0.110-1.35%2.49M20.09M8.1008.1608.1287.99016.55B1.90B2.06B236.59M+7.91%+6.48%-1.11%-22.67%-30.29%-20.55%-23.30%28.40%1.05%4.213.451.69%Oil & Gas Integrated

PBRPetroleo Brasileiro SA Petrobras

14.210-0.240-1.66%17.65M252.24M14.36014.45014.45014.18391.57B56.49B6.44B3.98B+3.57%+7.25%+2.38%-9.20%-2.06%+4.94%+0.56%17.08%0.44%6.254.281.85%Oil & Gas Integrated

News

Coinbase To Delist Wrapped Bitcoin On This Date, Citing 'Listing Standards'

Elon Musk Predicts Tesla Cybertrucks, Optimus Robots Will Be Aboard SpaceX Starships To Mars In 2 Years

Earnings Scheduled For November 20, 2024

Tesla Electric Offers Unlimited Overnight Charging For Just $5 A Month As EV Giant Races Toward 500K Sales Target

Nasdaq Gains 1% Ahead Of Nvidia Earnings: Investor Sentiment Improves, Fear & Greed Index Remains In 'Neutral' Zone

Target, Nvidia And 3 Stocks To Watch Heading Into Wednesday

Comments

$Tesla (TSLA.US)$ This counter really very high ups and downs. Always nearly heart attack. Cannot take it. Think change to Nvidia better.![]()

$Tesla (TSLA.US)$ whata going to happen today

1

1

$NVIDIA (NVDA.US)$ why there is no movement???

1

2

Hello everyone![]() !

!

This Wednesday, we're eagerly awaiting $NVIDIA (NVDA.US)$ Q3 earnings report—especially significant as it's their first since joining the Dow Jones Index.

Earnings season is like a market battlefield, full of rapid shifts that can bring joy to some and disappointment to others![]() .

.

In these volatile times, capturing market opportunities isn't easy.

To thrive during earnings season, you need the right skills and ...

This Wednesday, we're eagerly awaiting $NVIDIA (NVDA.US)$ Q3 earnings report—especially significant as it's their first since joining the Dow Jones Index.

Earnings season is like a market battlefield, full of rapid shifts that can bring joy to some and disappointment to others

In these volatile times, capturing market opportunities isn't easy.

To thrive during earnings season, you need the right skills and ...

+1

1

Read more