Trump-Election Stocks refer to securities closely associated with business dealings, political actions, or events related to Donald Trump. These stocks may benefit from Trump's potential win in the 2024 US presidential election.

- 1388.434

- +45.176+3.36%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

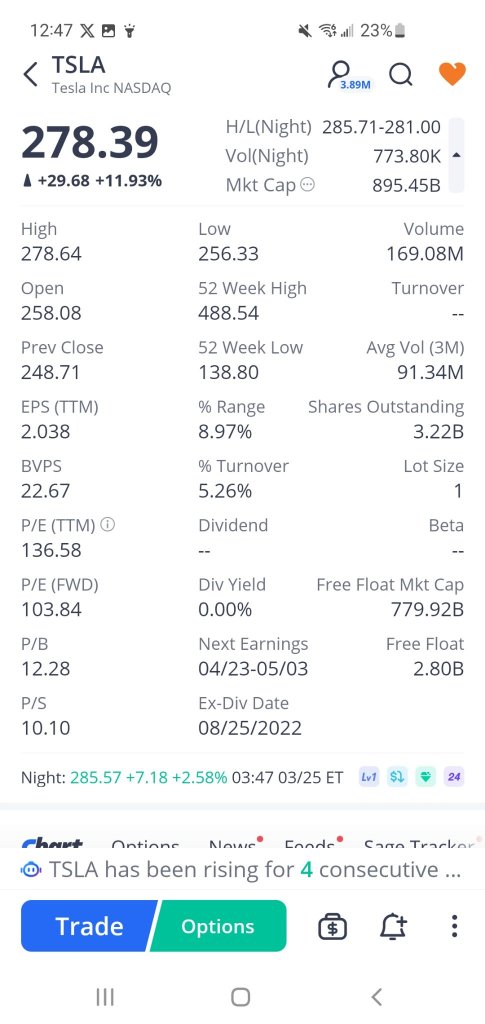

Gordon Johnson Defends Tesla Short Thesis As Margins Shrink, Discounts Rise: Jim Chanos Notes 35% YTD Drop In San Diego County Sales

Tesla's Market Share In Europe Declines For Second Consecutive Month Despite Growing EV Demand

Gene Munster Predicts 2025 As The Year Of Humanoid Investor Hype, Citing Elon Musk And Jensen Huang's Influence—Tesla, Nvidia, And XPeng Poised To Benefit

Core & Main, KB Home And 3 Stocks To Watch Heading Into Tuesday

Dow Jumps Nearly 600 Points As Recession Fears Ease, Tesla Rallies 12%: Greed Index Moves To 'Fear' Zone

"Wooden Sister" firmly holds a bullish view on Tesla, boldly proclaiming "tenfold growth in five years"!

"Sister Wood" believes that the new Model Y entering the market, the imminent launch of robotaxi Business Services, and the introduction of a "budget version" model in the second quarter will help Tesla overcome its current difficulties. It is estimated that Tesla's robotaxi business will account for 90% of its future value, with the stock price expected to rise to $2,600 in the next five years.