Trump-Election Stocks refer to securities closely associated with business dealings, political actions, or events related to Donald Trump. These stocks may benefit from Trump's potential win in the 2024 US presidential election.

- 1358.957

- +8.045+0.60%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Trump or Harris? Analysts are hotly debating the impact of the election results on various sectors of the US stock market.

①Over the past 8 years, the Trump administration and the Biden-Harris administration have fully demonstrated their policy orientations; ②Overall, industries such as finance and technology that are under the focus of regulation by the Biden administration are more likely to benefit from the rollback policies of the Trump administration, while the bullish impact on other industries is relatively less pronounced.

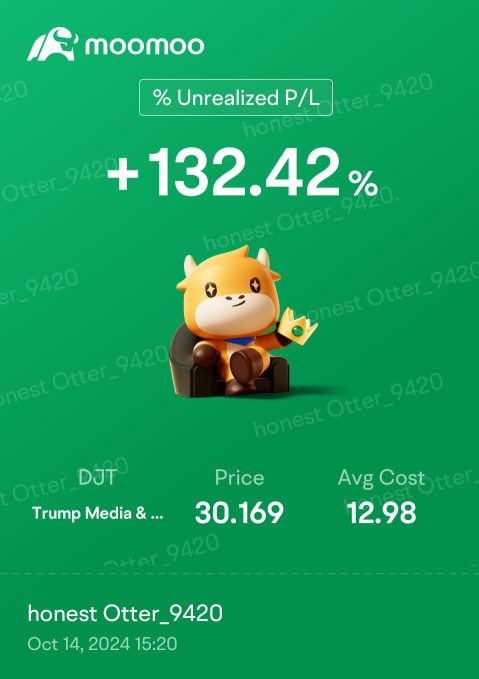

Investors are betting on the US election: Trump's media technology group's stock price has surged 90% in the past month.

①Trump Media Technology Group (DJT) stock price surged 18% on Monday, with a nearly 90% increase this month; ②The sharp rise in the company's stock price reflects the increasing likelihood of Trump winning the election, with Harris's advantage over Trump disappearing on the gambling website PredictIt.

Bitcoin breaks through $66,000! Harris promises to support the regulatory framework for digital currency.

USA presidential candidate and current Vice President Harris has pledged to support the regulatory framework for digital currencies, boosting the trend of digital currencies on Monday. In addition, the bankrupt Mt. Gox crypto exchange postponed the deadline for repaying the remaining assets to creditors by one year last week, alleviating concerns of oversupply that may arise from creditors selling back Bitcoin. Bitcoin and Ether both surged at least 6%.

Here's the Major Earnings Before the Open Tomorrow

The CEO is bullish, but Wall Street is bearish? There is a significant divergence in earnings expectations for the US stock market this earnings season.

Analysts expect that the s&p 500 constituent companies will see a year-on-year profit growth of 4.2% in the third quarter, while these companies' own guidance predicts a growth of 16%. This difference implies that corporate performance is likely to exceed Wall Street expectations.

A Glimpse of Bank of America's Earnings Potential