Trump-Election Stocks refer to securities closely associated with business dealings, political actions, or events related to Donald Trump. These stocks may benefit from Trump's potential win in the 2024 US presidential election.

- 1349.907

- +7.706+0.57%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Options Market Statistics: Tesla Drops Despite Offering Interest-Free Loans in China; Options Pop

S&P 500 Exits Q1 in the Red - Here Are Its Largest Losers and Winners

U.S. stocks closed: the three major Indexes closed mixed, with tariff threats causing severe market fluctuations.

① Conservative media stocks in the USA surged over 700% on their debut; ② The Nasdaq Golden Dragon China Index fell 0.61%, with a cumulative decline of 0.08% in March; ③ News of a merger between the chip foundry giants GlobalFoundries and United Microelectronics has emerged; ④ Amazon launched the AI agent Nova Act.

Elon Musk Has 55% Unfavorable Rating In New Poll: How Tesla CEO Could Be Hurting EV Giant's Future Sales

OCC Withdraws From Climate Principles for Large Banks

What's Going On With Lucid Stock Today?

Comments

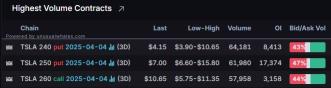

$Tesla (TSLA.US)$ shares fell 1% in Monday's trading. The most traded puts are contracts of $240 strike price that expire on Apr 4 and the total volume reaching 64,181 with the open interest of 8,413.

Tesla announced on Monday that it will provide three-year interest-free loans for the updated Model Y in China until April 30, according to a notice on its social media.

In addition, the ...

However, that couldn’t save the stock market from ending first quarter of 2025 with losses. S&P 500 fell 4.6% and Nasdaq declined more than 10% (correction). This is the worst quarterly decline for both indexes since 2022.

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Alphabet-A (GOOGL.US)$ $Amazon (AMZN.US)$ $Palantir (PLTR.US)$ $Super Micro Computer (SMCI.US)$ $Strategy (MSTR.US)$ $MARA Holdings (MARA.US)$ $Trump Media & Technology (DJT.US)$ $Johnson & Johnson (JNJ.US)$ $Taiwan Semiconductor (TSM.US)$ $Broadcom (AVGO.US)$

Will-RA : There is no way, South Korea is scrambling to buy, whether it's cars or Stocks

74933125 : we want it down

buy at $220

Scorched earf : lol ye ok