Investment ThemesDetailed Quotes

Donald Trump

Watchlist

Trump-Election Stocks refer to securities closely associated with business dealings, political actions, or events related to Donald Trump. These stocks may benefit from Trump's potential win in the 2024 US presidential election.

- 1480.440

- +10.149+0.69%

Close Nov 29 13:00 ET

1483.537High1474.621Low

1474.725Open1470.291Pre Close320.17MVolume23Rise24.29P/E (Static)41.16BTurnover1Flatline0.88%Turnover Ratio6.22TMarket Cap14Fall5.96TFloat Cap

Constituent Stocks: 38Top Rising: PHUN+5.22%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

Latest PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

PHUNPhunware

4.64000.2300+5.22%1.07M4.86M4.34004.41004.70004.310092.28M92.09M19.89M19.85M+5.45%-5.88%-34.37%+41.46%-18.02%-26.11%+13.17%--5.38%LossLoss8.84%Software - Application

DJTTrump Media & Technology

31.6001.160+3.81%10.95M344.12M30.30030.44032.36030.1706.85B2.73B216.92M86.51M+3.64%+17.08%-10.58%+81.61%-24.92%+80.78%+80.57%--12.66%LossLoss7.19%Internet Content & Information

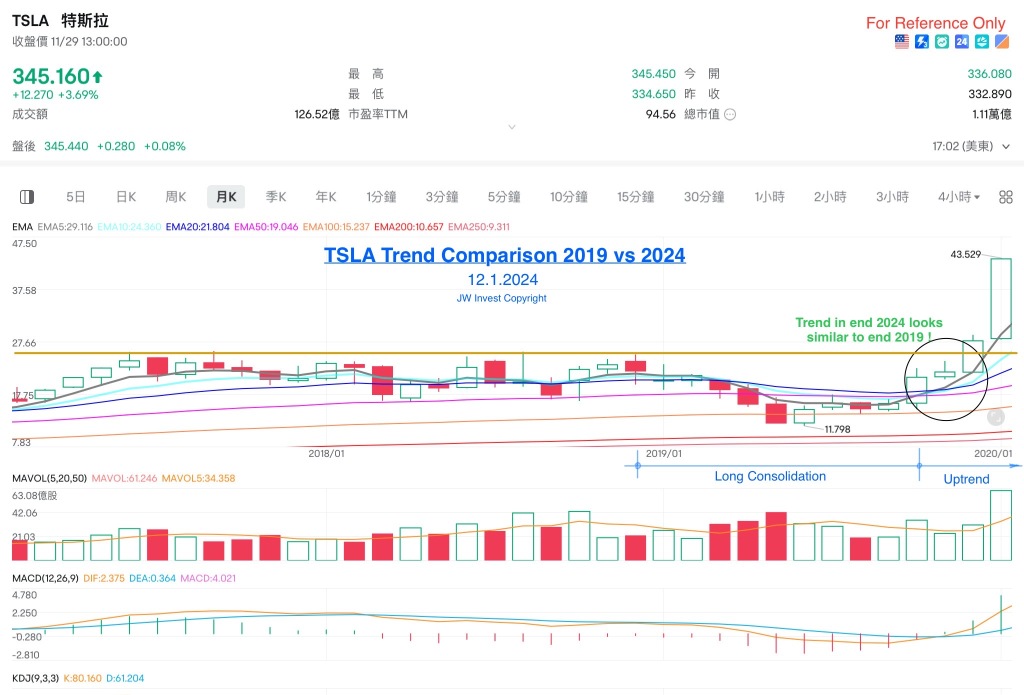

TSLATesla

345.16012.270+3.69%37.17M12.65B336.080332.890345.450334.6501.11T958.73B3.21B2.78B+1.63%+10.92%+38.15%+49.96%+98.61%+44.52%+38.91%--1.34%94.5680.273.24%Auto Manufacturers

CLSKCleanSpark

14.3500.490+3.54%28.95M425.87M14.35913.86015.15014.2203.63B3.52B253.14M245.48M+10.68%+2.65%+18.99%+65.42%-7.89%+129.97%+30.10%--11.79%LossLoss6.71%Capital Markets

RIOTRiot Platforms

12.6500.280+2.26%21.89M284.62M12.59012.37013.34012.4204.20B3.90B332.33M307.92M+7.57%+6.62%+36.90%+89.09%+27.84%-8.13%-18.23%--7.11%84.33Loss7.44%Capital Markets

MARAMARA Holdings

27.4200.500+1.86%89.54M2.58B27.52026.92030.28027.1408.82B8.64B321.83M315.04M+13.40%+31.89%+63.51%+98.12%+40.90%+100.15%+16.73%--28.42%32.6425.8711.66%Capital Markets

FLRFluor

56.1300.880+1.59%1.14M64.21M55.77055.25056.55055.4509.63B9.52B171.52M169.58M+2.58%+10.49%+7.36%+21.31%+26.28%+43.92%+43.30%--0.67%38.71103.941.99%Engineering & Construction

DGDollar General

77.2701.010+1.32%2.44M188.72M77.97076.26077.98576.30016.99B16.86B219.92M218.19M+4.53%+0.29%-3.46%-3.23%-38.78%-41.49%-42.04%3.05%1.12%12.0210.232.21%Discount Stores

LNGCheniere Energy

224.0102.240+1.01%860.34K192.84M222.700221.770225.080222.50050.26B49.91B224.37M222.80M-0.44%+6.28%+17.34%+23.88%+42.50%+24.63%+32.59%0.78%0.39%14.245.501.16%Oil & Gas Midstream

STLDSteel Dynamics

145.2701.440+1.00%552.24K80.26M144.360143.830146.080144.13022.12B20.62B152.24M141.92M+0.21%+5.41%+11.32%+30.98%+18.33%+23.03%+24.31%1.24%0.39%13.069.921.36%Steel

KRThe Kroger

61.0800.580+0.96%2.53M154.49M60.82060.50061.16060.61544.16B43.76B723.00M716.36M+4.27%+3.95%+10.12%+15.07%+19.65%+40.17%+36.76%1.90%0.35%15.9920.640.90%Grocery Stores

BLDRBuilders FirstSource

186.4701.720+0.93%372.91K69.47M187.940184.750188.540185.00021.46B20.95B115.08M112.36M+6.00%+2.91%+8.79%+11.29%+26.89%+33.88%+11.70%--0.33%18.2315.621.92%Building Products & Equipment

TXNTexas Instruments

201.0301.840+0.92%3.17M637.26M200.080199.190202.510199.700183.38B182.94B912.22M910.03M+1.43%-2.41%-1.05%+0.40%+3.06%+33.21%+21.30%2.59%0.35%37.3728.431.41%Semiconductors

LLYEli Lilly and Co

795.3507.160+0.91%2.21M1.76B791.330788.190800.330789.331755.04B753.40B949.32M947.25M+6.06%+1.33%-3.99%-12.72%-7.77%+37.07%+37.34%0.63%0.23%85.98137.131.40%Drug Manufacturers - General

COPConocoPhillips

108.3400.950+0.88%3.92M423.99M107.750107.390108.520107.360140.14B139.91B1.29B1.29B-3.18%-4.06%-0.40%+1.53%-3.01%-3.34%-4.04%2.70%0.30%12.8511.961.08%Oil & Gas E&P

TSCOTractor Supply

283.6701.710+0.61%763.89K217.47M284.070281.960286.980282.54530.31B30.20B106.84M106.48M+4.08%+2.78%+7.26%+5.16%+4.51%+37.28%+34.12%1.53%0.72%27.5928.111.57%Specialty Retail

SWKStanley Black & Decker

89.4500.500+0.56%523.99K46.87M89.75088.95090.13588.82013.79B13.74B154.16M153.59M+2.97%+5.19%-2.87%-8.22%+10.95%-1.16%-5.51%3.63%0.34%LossLoss1.48%Tools & Accessories

GSGoldman Sachs

608.5703.140+0.52%1.17M713.80M609.310605.430612.730607.064191.04B191.01B313.91M313.87M+2.09%+3.39%+17.53%+24.74%+34.97%+78.01%+60.78%1.85%0.37%17.8426.610.94%Capital Markets

OXYOccidental Petroleum

50.5800.260+0.52%3.82M193.20M50.40050.32050.77050.35047.46B45.65B938.34M902.47M-1.86%-0.18%+0.94%-5.48%-16.01%-12.75%-14.31%1.66%0.42%13.1712.970.84%Oil & Gas E&P

MSMorgan Stanley

131.6100.400+0.30%4.07M536.52M132.280131.210132.730131.420212.03B161.89B1.61B1.23B-2.50%-0.62%+13.21%+33.24%+38.86%+68.63%+46.28%2.64%0.33%20.0025.411.00%Capital Markets

UNHUnitedHealth

610.2001.820+0.30%2.01M1.23B608.800608.380615.780606.620561.56B560.03B920.28M917.78M+2.13%+2.87%+8.10%+2.83%+24.24%+12.84%+17.27%1.30%0.22%39.6725.571.51%Healthcare Plans

XOMExxon Mobil

117.9600.300+0.25%9.43M1.11B117.440117.660118.500116.950518.45B517.50B4.40B4.39B-3.26%-2.16%+1.87%+5.15%+6.09%+18.65%+22.26%3.22%0.22%14.6913.271.32%Oil & Gas Integrated

EVREvercore

307.9000.600+0.20%141.21K43.57M310.880307.300311.997307.39011.72B10.99B38.07M35.69M-0.27%+3.02%+16.86%+29.08%+59.55%+108.33%+82.56%1.01%0.40%39.4748.341.50%Capital Markets

LUVSouthwest Airlines

32.3600.0000.00%2.67M86.36M32.40032.36032.61032.17019.41B17.27B599.74M533.68M+1.79%-0.19%+5.82%+8.55%+10.32%+24.16%+14.05%2.22%0.50%Loss42.581.36%Airlines

DEDeere

465.900-0.100-0.02%732.23K341.79M466.000466.000469.090464.170127.47B127.18B273.60M272.98M+6.48%+18.06%+15.13%+21.86%+27.45%+28.21%+17.82%1.26%0.27%18.1918.191.06%Farm & Heavy Construction Machinery

JPMJPMorgan

249.720-0.070-0.03%5.49M1.38B249.860249.790251.770249.445703.05B699.17B2.82B2.80B+2.03%+3.25%+12.53%+15.45%+26.57%+63.03%+50.32%1.84%0.20%13.8815.390.93%Banks - Diversified

NUENucor

154.690-0.080-0.05%920.70K142.57M155.410154.770156.179153.99036.32B36.07B234.81M233.15M+3.13%+5.68%+9.06%+11.21%-0.96%-8.04%-10.23%1.40%0.40%14.898.591.41%Steel

HUMHumana

296.380-0.300-0.10%533.89K158.72M294.920296.680298.920294.84535.69B35.58B120.41M120.04M+0.23%+4.68%+14.95%-18.61%-14.72%-39.56%-34.76%1.19%0.45%25.8614.821.37%Healthcare Plans

CVXChevron

161.930-0.180-0.11%5.08M820.25M162.250162.110162.750160.660291.00B276.52B1.80B1.71B+0.19%+1.10%+9.92%+16.07%+5.53%+16.64%+13.24%3.95%0.30%17.7914.251.29%Oil & Gas Integrated

MSTRMicroStrategy

387.470-1.370-0.35%21.99M8.78B405.750388.840417.619381.00089.30B81.49B230.48M210.30M-2.47%+18.25%+58.47%+224.05%+142.18%+634.29%+513.45%--10.46%Loss146.669.42%Software - Application

1

2

News

Fidelity Marks up Value of Its Stake in Elon Musk's X by 32%: Report

Gaming Company Bets Big On Bitcoin, Selling Ethereum For $50M Boost

Profit Outlook Contradicts Estimates for Rate Cuts: Societe Generale

Earnings Week Ahead: CRM, DOCU, OKTA, ZS, S, MRVL, LULU, DG, and More

Elon Musk Files Injunction to Stop OpenAI's Conversion to For-profit Structure

Black Friday Spending Hits $10.8B, Keeping up the Holiday Season's Record-setting Pace

Comments

$CleanSpark (CLSK.US)$ earnings days tomorrow after the close

1

1

$Tesla (TSLA.US)$

Al Root

An update from a Tesla engineer on Saturday should excite investors on Monday.

特斯拉工程师在周六的一次更新可能会让投资者在周一感到兴奋。

Ashok Elluswamy, Tesla's vice president of AI software, tweeted Saturday night that version 13 of Tesla's highest-level driver assistance software called Full Self-Driving began rolling out to customers.

特斯拉人工智能软件副总裁阿舒克·埃卢斯瓦米周六晚上在推特上发文,称特斯拉最高级别的驾驶员辅助软件版本13全自动驾...

Al Root

An update from a Tesla engineer on Saturday should excite investors on Monday.

特斯拉工程师在周六的一次更新可能会让投资者在周一感到兴奋。

Ashok Elluswamy, Tesla's vice president of AI software, tweeted Saturday night that version 13 of Tesla's highest-level driver assistance software called Full Self-Driving began rolling out to customers.

特斯拉人工智能软件副总裁阿舒克·埃卢斯瓦米周六晚上在推特上发文,称特斯拉最高级别的驾驶员辅助软件版本13全自动驾...

1

3

Read more