Investment ThemesDetailed Quotes

Kamala Harris

Watchlist

The list includes stocks closely associated with business dealings, political actions, or events related to Kamala Harris. These stocks may benefit from Harris's potential win in the 2024 US presidential election.

- 2021.835

- -1.344-0.07%

Close Nov 18 16:00 ET

2040.425High2016.019Low

2032.522Open2023.180Pre Close348.01MVolume10Rise51.08P/E (Static)16.08BTurnover--Flatline1.36%Turnover Ratio3.59TMarket Cap8Fall3.03TFloat Cap

Constituent Stocks: 18Top Rising: LCID+6.47%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

Latest PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

LCIDLucid Group

2.1400.130+6.47%100.71M215.23M2.0202.0102.2002.0106.45B2.55B3.01B1.19B-8.55%-4.46%-16.08%-49.05%-22.18%-50.69%-49.17%--8.45%LossLoss9.45%Auto Manufacturers

ENPHEnphase Energy

62.4002.880+4.84%7.63M469.46M59.28059.52062.73058.3308.43B8.18B135.11M131.09M-1.98%-28.65%-30.99%-49.27%-50.35%-36.65%-52.78%--5.82%135.6520.267.39%Solar

TGTTarget

156.5604.430+2.91%6.51M1.01B153.000152.130157.030152.78072.12B71.89B460.67M459.18M+2.14%+4.38%+3.74%-1.22%+6.80%+23.45%+12.38%2.81%1.42%16.1717.512.79%Discount Stores

FSLRFirst Solar

195.5605.110+2.68%1.74M335.10M188.110190.450195.750186.23020.94B19.79B107.06M101.20M+0.89%-7.88%-0.35%-15.37%-29.70%+22.77%+13.51%--1.72%16.8425.275.00%Solar

FFord Motor

11.2100.200+1.82%47.81M535.78M11.05011.01011.27011.03044.55B43.60B3.97B3.89B-0.18%+9.68%+4.43%+0.82%-0.18%+16.00%-1.60%5.35%1.23%12.7410.382.18%Auto Manufacturers

NXTNextracker

37.4300.630+1.71%2.12M78.84M36.33036.80037.80035.8605.38B5.35B143.64M143.00M-5.43%-10.80%+14.82%-11.11%-33.53%-5.69%-20.11%--1.48%11.1111.115.27%Solar

COSTCostco

919.51012.440+1.37%1.80M1.65B910.640907.070925.940907.107407.41B406.29B443.07M441.86M-1.43%+3.77%+3.83%+4.72%+14.33%+62.87%+40.12%0.47%0.41%55.5355.532.08%Discount Stores

RUNSunrun

10.0100.120+1.21%10.02M99.33M9.7509.89010.1859.5402.25B2.19B224.34M219.05M-2.15%-37.75%-27.20%-53.44%-25.13%-15.95%-49.01%--4.58%LossLoss6.52%Solar

TEVATeva Pharmaceutical Industries

16.4900.060+0.37%8.19M134.15M16.41016.43016.50016.15018.68B18.57B1.13B1.13B-5.07%-11.53%-9.30%-11.15%+0.24%+74.50%+57.95%--0.73%LossLoss2.13%Drug Manufacturers - Specialty & Generic

RIVNRivian Automotive

10.0700.010+0.10%51.70M532.07M10.05010.06010.7209.85010.28B7.37B1.02B731.65M-8.79%-2.14%+0.40%-27.87%-1.47%-40.52%-57.08%--7.07%LossLoss8.65%Auto Manufacturers

DHID.R. Horton

161.450-0.160-0.10%1.96M316.59M160.120161.610163.020160.09052.31B51.49B324.03M318.91M-3.36%-5.21%-13.12%-15.62%+14.66%+26.78%+7.11%0.74%0.61%11.2611.261.81%Residential Construction

WMTWalmart

84.080-0.170-0.20%25.28M2.13B84.82084.25084.85083.660675.86B363.80B8.04B4.33B-0.15%+1.98%+4.05%+11.07%+29.88%+64.62%+61.56%0.95%0.58%43.7944.021.41%Discount Stores

PHMPulteGroup

128.570-0.320-0.25%1.11M143.00M127.990128.890129.550127.46026.37B26.15B205.08M203.35M-3.66%-0.71%-10.88%-4.72%+14.61%+46.68%+25.18%0.62%0.55%9.4910.971.62%Residential Construction

AMZNAmazon

201.700-0.910-0.45%36.51M7.39B204.150202.610204.670200.9502.12T1.89T10.52B9.38B-2.49%+3.02%+6.68%+13.93%+10.81%+38.03%+32.75%--0.39%43.1069.551.84%Internet Retail

RDYDr. Reddy's Laboratories

14.100-0.070-0.49%1.88M26.54M14.10014.17014.18013.97011.75B11.09B833.05M786.34M-6.00%-4.72%-10.46%-14.19%+0.55%+5.06%+1.92%0.67%0.24%18.5817.831.48%Drug Manufacturers - Specialty & Generic

LENLennar Corp

167.920-0.930-0.55%1.66M279.12M167.160168.850168.855166.52045.55B40.50B271.24M241.20M-2.54%-2.73%-7.04%-8.99%+9.68%+32.57%+14.12%1.12%0.69%11.1612.231.38%Residential Construction

GMGeneral Motors

56.250-0.790-1.38%12.28M692.71M57.49057.04057.52055.84061.85B61.62B1.10B1.10B-2.45%+8.59%+14.96%+16.10%+32.60%+99.41%+57.87%0.80%1.12%6.007.682.95%Auto Manufacturers

TLRYTilray Brands

1.320-0.030-2.22%29.28M38.56M1.3301.3501.3501.3001.19B1.18B903.29M897.25M-5.71%-23.70%-16.46%-31.61%-27.07%-27.27%-42.61%--3.26%LossLoss3.70%Drug Manufacturers - Specialty & Generic

News

Options Market Statistics: Super Micro Computer Shares Rise on Plan to Avoid Nasdaq Delisting; Options Pop

The AI Overlay Is the Next Hexa-Billion Dollar Security Market

Short Squeezes With Big Promises

Monday Market Slow but Steady, Trump Buying Crypto Firm | Wall Street Today

Will Walmart's Streak Of Earnings Beats Continue Tuesday? Analysts Say Retailer A 'Core Holding'

Shopify Products Will Be Listed in Perplexity's New AI Shopping Tool

Comments

$Ford Motor (F.US)$

Not interesting, huh? Where is the volatility we had a few months ago? No price movement, no money gain...

Yesterday was a good day because what happened was it finally showed some upper price movement; to be specific, it exceeded 200EMA, which it was unable to break through in the past few days.

The next hurdle is the 200+MA and then the upper Bollinger band. If those are cleared, we can expect a strong, continuing uptrend.

So how strong ...

Not interesting, huh? Where is the volatility we had a few months ago? No price movement, no money gain...

Yesterday was a good day because what happened was it finally showed some upper price movement; to be specific, it exceeded 200EMA, which it was unable to break through in the past few days.

The next hurdle is the 200+MA and then the upper Bollinger band. If those are cleared, we can expect a strong, continuing uptrend.

So how strong ...

loading...

News Highlights

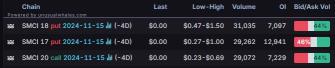

1. $Super Micro Computer (SMCI.US)$ stock surged 15% on Monday, with the most traded calls are contracts of $20 strike price that expire on Nov. 15. The total volume reaches 29,072 with an open interest of 7,229, while the most traded puts are contracts of $18 strike price that expire on Nov. 15. The total volume reaches 31,035 with an open interest of 7,097.

The company has a...

1. $Super Micro Computer (SMCI.US)$ stock surged 15% on Monday, with the most traded calls are contracts of $20 strike price that expire on Nov. 15. The total volume reaches 29,072 with an open interest of 7,229, while the most traded puts are contracts of $18 strike price that expire on Nov. 15. The total volume reaches 31,035 with an open interest of 7,097.

The company has a...

+2

16

6

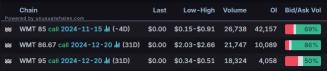

$Walmart (WMT.US)$ Buy, sit and enjoy the rocket 🚀 show.

5

Walmart and Target will report earnings this week, providing fresh insight into how consumers are faring shortly after retail data indicated that Americans have been spending more on "fun" categories

The chains are just two of the retailers set to deliver their latest quarterly results and, potentially, update their outlooks ahead of the holiday period. Walmart $Walmart (WMT.US)$ and Target $Target (TGT.US)$ together ac...

The chains are just two of the retailers set to deliver their latest quarterly results and, potentially, update their outlooks ahead of the holiday period. Walmart $Walmart (WMT.US)$ and Target $Target (TGT.US)$ together ac...

11

Read more