Investment ThemesDetailed Quotes

Kamala Harris

Watchlist

The list includes stocks closely associated with business dealings, political actions, or events related to Kamala Harris. These stocks may benefit from Harris's potential win in the 2024 US presidential election.

- 2046.596

- +50.422+2.53%

Close Nov 6 16:00 ET

2048.268High1997.395Low

2004.603Open1996.174Pre Close710.04MVolume8Rise52.25P/E (Static)46.74BTurnover--Flatline2.71%Turnover Ratio3.76TMarket Cap13Fall3.17TFloat Cap

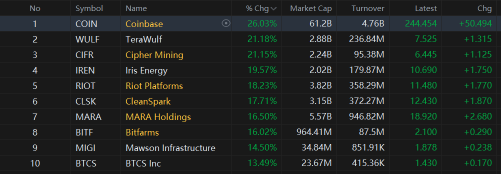

Constituent Stocks: 21Top Rising: COIN+31.11%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

Latest PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

COINCoinbase

254.31060.350+31.11%35.28M8.48B221.479193.960257.680221.11063.67B50.81B250.35M199.81M+20.10%+27.84%+52.31%+28.48%+27.68%+187.94%+46.22%--17.66%43.18687.3218.85%Financial Data & Stock Exchanges

MARAMARA Holdings

19.3203.080+18.97%85.17M1.59B17.61016.24019.60017.2405.69B5.57B294.47M288.15M+5.69%+6.92%+25.13%+24.73%-1.68%+125.96%-17.75%--29.56%21.4718.2314.53%Capital Markets

MSTRMicroStrategy

257.81030.010+13.17%26.17M6.65B260.000227.800261.200242.69052.24B47.04B202.64M182.47M+4.25%+20.50%+36.47%+90.43%+79.04%+443.33%+308.17%--14.34%Loss97.588.13%Software - Application

FFord Motor

11.1900.590+5.57%100.23M1.11B10.95010.60011.23010.83544.47B43.52B3.97B3.89B+6.88%+1.18%+5.37%+10.36%-8.20%+17.54%-3.09%5.36%2.58%12.7210.363.73%Auto Manufacturers

RDYDr. Reddy's Laboratories

15.2000.590+4.04%547.82K8.34M15.30014.61015.40515.14012.66B9.12B833.05M600.13M+2.48%-2.66%-3.50%-8.79%+10.31%+15.22%+9.87%0.63%0.09%19.9719.141.81%Drug Manufacturers - Specialty & Generic

AMZNAmazon

207.0907.590+3.80%71.94M14.69B200.010199.500207.550199.1402.18T1.94T10.52B9.38B+7.45%+12.12%+11.84%+21.65%+12.78%+45.76%+36.30%--0.77%44.2571.414.22%Internet Retail

GMGeneral Motors

55.0501.350+2.51%19.14M1.04B54.48053.70055.38053.14060.53B60.31B1.10B1.10B+5.93%+4.02%+14.85%+27.40%+20.63%+101.95%+54.51%0.82%1.75%5.887.524.17%Auto Manufacturers

COSTCostco

899.2509.080+1.02%2.43M2.17B898.280890.170899.900886.280398.43B397.34B443.07M441.86M+2.43%+0.14%-0.95%+4.12%+13.70%+63.05%+37.03%0.48%0.55%54.3054.301.53%Discount Stores

WMTWalmart

83.440-0.240-0.29%19.84M1.65B85.14083.68085.54082.060670.71B361.03B8.04B4.33B+2.52%+0.20%+3.78%+22.82%+30.73%+54.42%+60.33%0.95%0.46%43.4643.694.16%Discount Stores

TGTTarget

147.290-3.700-2.45%7.50M1.10B151.700150.990151.700145.08067.85B67.63B460.67M459.18M-0.83%-0.51%-4.56%+8.62%-7.60%+38.49%+5.72%2.99%1.63%15.2216.484.38%Discount Stores

PHMPulteGroup

129.170-4.090-3.07%3.67M467.36M126.590133.260129.660124.34026.49B26.26B205.08M203.32M-0.84%-3.00%-7.33%+4.67%+9.20%+59.22%+25.76%0.62%1.81%9.5311.023.99%Residential Construction

DHID.R. Horton

166.710-6.560-3.79%6.45M1.06B163.520173.270167.090159.76054.02B53.50B324.03M320.94M-1.52%-7.53%-10.01%-4.76%+10.61%+37.99%+10.33%0.72%2.01%11.6311.634.23%Residential Construction

LENLennar Corp

168.700-8.580-4.84%4.59M765.67M168.110177.280168.950163.93545.76B40.68B271.24M241.16M-1.63%-2.24%-6.51%-0.71%+2.76%+41.36%+14.65%1.11%1.90%11.2112.292.83%Residential Construction

LCIDLucid Group

2.130-0.120-5.33%105.11M222.80M2.2702.2502.2702.0205.57B2.54B2.62B1.19B-9.36%-14.46%-37.17%-30.62%-26.04%-46.08%-49.41%--8.81%LossLoss11.11%Auto Manufacturers

NXTNextracker

41.630-2.460-5.58%9.40M381.14M39.00044.09042.45537.7525.98B5.95B143.64M143.00M+30.22%+32.50%+18.13%+6.44%-4.98%+17.33%-11.14%--6.57%12.3612.3510.67%Solar

TEVATeva Pharmaceutical Industries

17.430-1.340-7.14%18.21M321.63M19.06018.77019.31017.18019.75B19.63B1.13B1.13B-6.24%-5.32%-1.69%+1.75%+6.93%+90.49%+66.95%--1.62%LossLoss11.35%Drug Manufacturers - Specialty & Generic

RIVNRivian Automotive

9.710-0.880-8.31%68.96M669.17M10.10010.59010.2409.5009.79B7.10B1.01B731.65M-6.54%-4.43%-6.81%-28.29%-4.15%-42.88%-58.61%--9.43%LossLoss6.99%Auto Manufacturers

FSLRFirst Solar

194.020-21.870-10.13%13.75M2.58B188.540215.890198.000173.37020.77B19.64B107.06M101.20M-1.76%+0.84%-14.17%-15.74%-0.31%+40.77%+12.62%--13.58%16.7125.0711.41%Solar

TLRYTilray Brands

1.540-0.230-12.99%55.72M86.16M1.6301.7701.6901.5001.39B1.38B903.29M897.25M-8.88%-8.33%-5.52%-17.43%-27.36%-11.49%-33.04%--6.21%LossLoss10.73%Drug Manufacturers - Specialty & Generic

ENPHEnphase Energy

74.810-15.130-16.82%16.13M1.20B77.18089.94077.80071.38010.11B9.81B135.11M131.09M-9.29%-4.66%-28.97%-33.51%-35.98%-2.72%-43.39%--12.30%162.6324.297.14%Solar

RUNSunrun

11.900-5.010-29.63%39.81M491.05M14.21016.91014.40011.5402.66B2.46B223.54M206.40M-15.54%-14.08%-28.53%-38.25%-2.86%+13.88%-39.38%--19.29%LossLoss16.91%Solar

News

Market Prices in Trump Victory with Index Records | Wall Street Today

Deplay Cash And Reduce Hedges, Short Term Opportunities At Hand, Prepare For Long Term Opportunties

Election Buzz: Tesla Soars on Expectations of Green Lights for Autonomous Driving Approvals

Alibaba's AI Strategy: Massive Ad Spend to Dominate Crowded Market

SA Asks: How Will the U.S. Election Results Impact Healthcare Stocks?

Coinbase +31%: CEO Brian Armstrong Welcomes 'Most Pro-Crypto Congress Ever'

Comments

$Bitcoin (BTC.CC)$ So excited BTC has reached new high…have been condidence that it has very strong supports at 65000-68000 based on detailed tech analysis

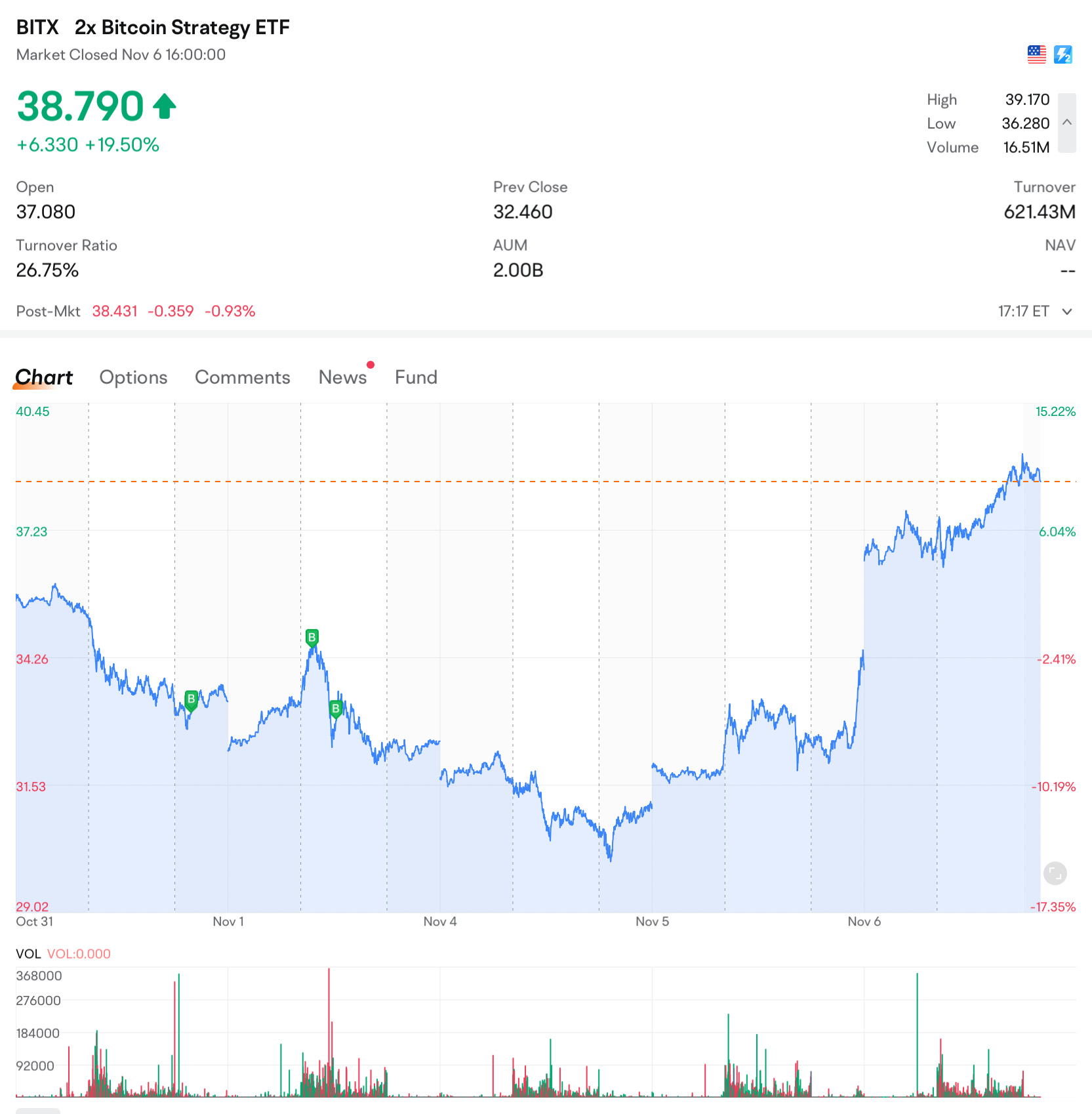

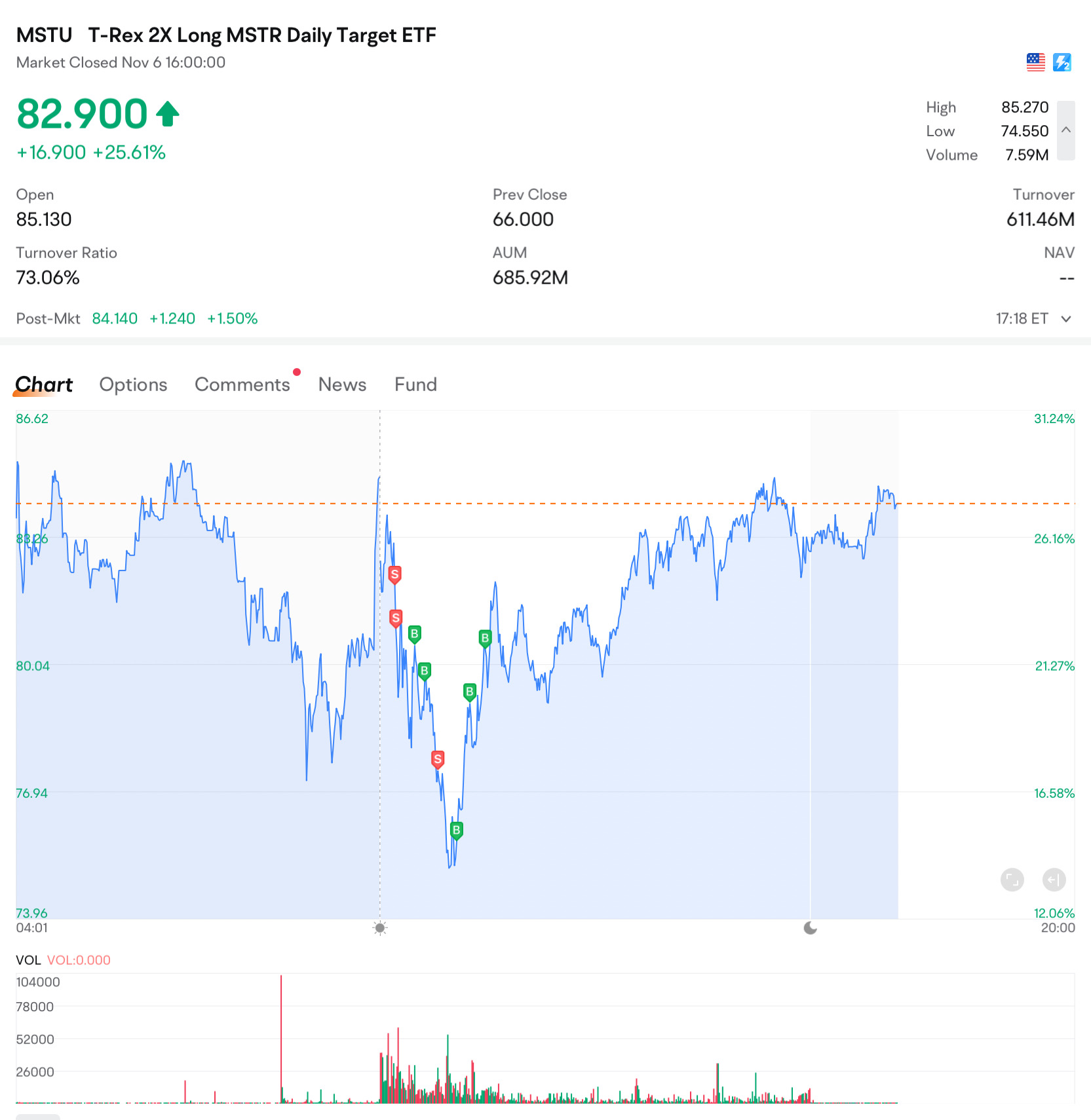

$2x Bitcoin Strategy ETF (BITX.US)$ $MicroStrategy (MSTR.US)$ $T-Rex 2X Long MSTR Daily Target ETF (MSTU.US)$

$2x Bitcoin Strategy ETF (BITX.US)$ $MicroStrategy (MSTR.US)$ $T-Rex 2X Long MSTR Daily Target ETF (MSTU.US)$

It was a roaring day on the stock market after Former President Trump became presumptive President Trump. In the early morning hours, AP News called the election for Trump, who won nearly every swing state.

Every major index ran past all-time highs, excluding the small-cap Russell 2000, which flew 5% higher. The Dow climbed more than 1,000 points, the most in a single day since November 2022. Bitcoin hit an intra-day high of $...

Every major index ran past all-time highs, excluding the small-cap Russell 2000, which flew 5% higher. The Dow climbed more than 1,000 points, the most in a single day since November 2022. Bitcoin hit an intra-day high of $...

+1

5

1

Read more