Santa Rally brings together a series of US-listed companies that are likely to benefit during the holiday shopping season, ranging from traditional retail giants to emerging e-commerce platforms, and from home improvement chains to payment service providers. This sector comprehensively reflects the diversified needs and consumption patterns of modern consumers during the holiday period. These companies typically experience sales peaks during the Christmas season and are therefore viewed as Christmas concept stocks.

- 1945.790

- -76.145-3.77%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

US Morning News Call | Stock index futures rebound a day after a selloff prompted by the Fed

Is online shopping in the USA down again? During the busy Christmas shopping season, thousands of workers at Amazon are striking.

On Thursday, during the Eastern Time, thousands of Amazon employees will hold a strike, which comes at a crucial moment during the last few days of the holiday season, significantly impacting Amazon's operation; The International Brotherhood of Teamsters stated that they are demanding Amazon to raise workers' wages and improve working conditions, and are urging Amazon to begin negotiations by the end of this week, but observers say it is unlikely that Amazon will come to the negotiation table.

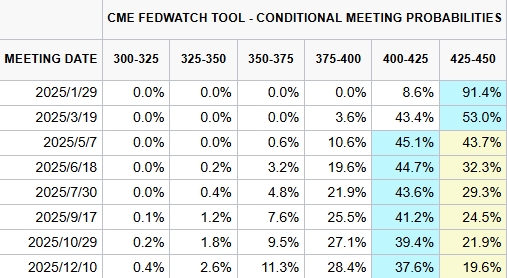

Fed Meeting Causes Market Plunge: Hawkish Tone Surprises Expectations

MacKenzie Scott's Mission-Driven Investing Pushes Back Against Wealth Concentration: Amazon Stock Rich Philanthropist Pledges $2 Billion In Donations

Trump-Backed World Liberty Financial Forges Partnership With Ethena Labs — ENA Token Gains Amid Broader Slump

Micron Technology, Quantum Corporation, Meta, Amazon, Tesla: Why These 5 Stocks Are On Investors' Radars Today

Comments

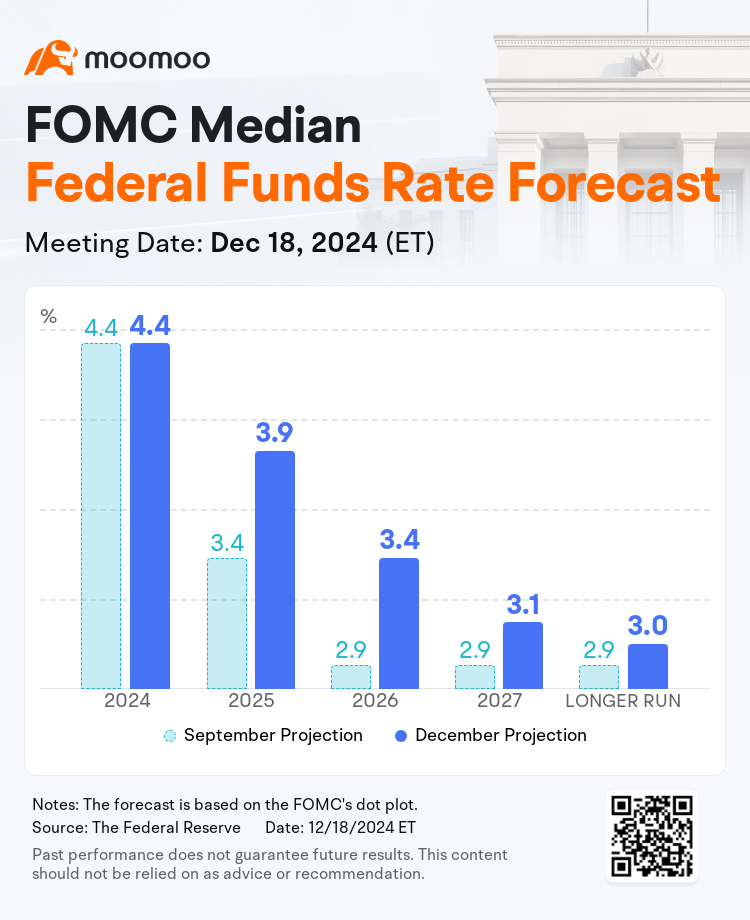

1、Significant Reduction in Rate Cut Projections

2、Notable Increase in 2024 PCE Inflation Forecasts

3、Clear Indication of Upside Risks to In...

Here is how it happened!

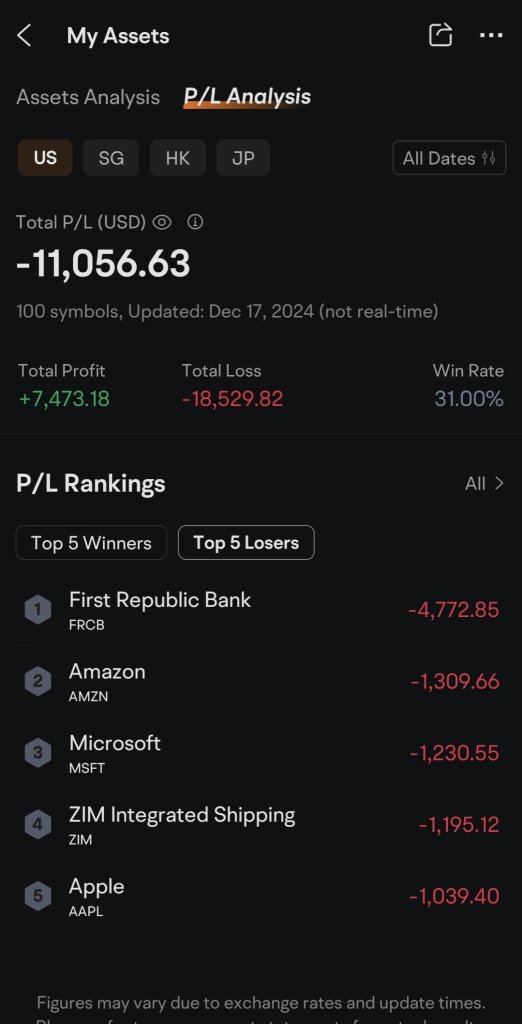

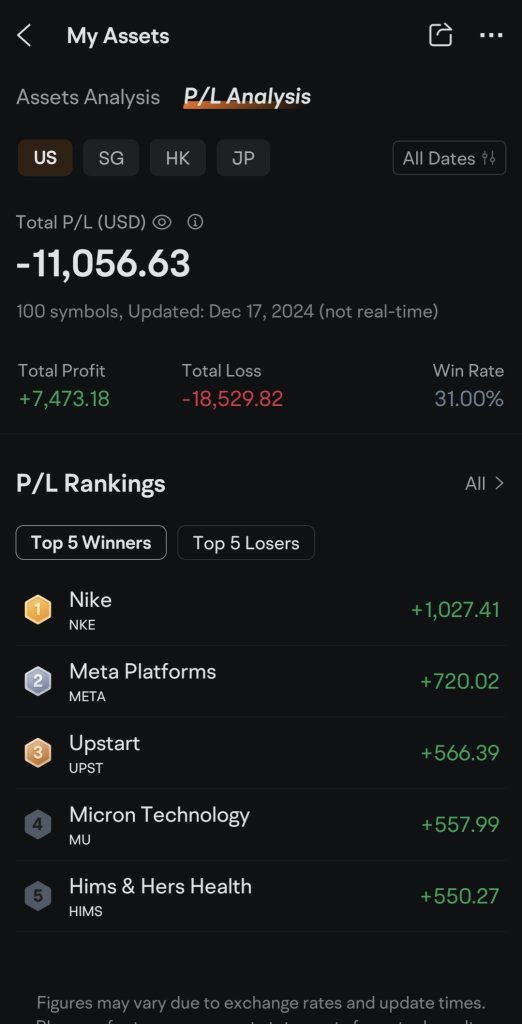

Those stocks I invested below normally go up slowly but went down fast, and I caught on top buying expensive one and selling out with a loss (stop loss) in 2022-23.

I am now trading only options because I lost all my investment funds during the bear run. (I sold out all with loss because of fear of holding dipping stocks)

After losing more than 10 K++, I learn...

104088143 : How is it?

70024960 : brace for it boys...timber !