Santa Rally brings together a series of US-listed companies that are likely to benefit during the holiday shopping season, ranging from traditional retail giants to emerging e-commerce platforms, and from home improvement chains to payment service providers. This sector comprehensively reflects the diversified needs and consumption patterns of modern consumers during the holiday period. These companies typically experience sales peaks during the Christmas season and are therefore viewed as Christmas concept stocks.

- 1829.817

- +1.405+0.08%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Dollar Tree Q4 Earnings Preview: Visitor Growth, Tariffs, Family Dollar Sale Among Key Items To Watch

10 Consumer Discretionary Stocks With Whale Alerts In Today's Session

Carvana Analyst Says It's Time To Buy The Potential 'Amazon Of Auto Retail'

Is Amazon's Valuation 'More Attractive' Than Ever Before? Analyst Says It's Time To 'Aggressively' Buy His 'Favorite' Stock

India to Toss Out Digital Ad Tax for Foreign Firms Ahead of Talks With U.S. Delegation

FedEx Now Offering FedEx Easy Returns

Comments

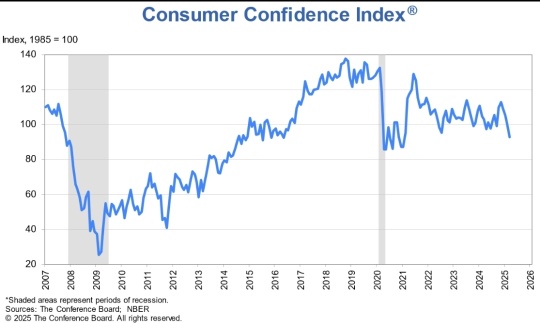

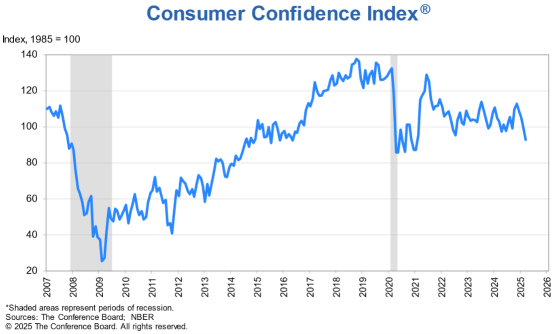

The Conference Board's measure for future expectations tumbled 9.6 points to 65.2, the lowest reading in 12 years.

The board's monthly confidence index of current conditions slipped to 92.9, a 7.2-point decline and the fourth consecutive monthly contraction

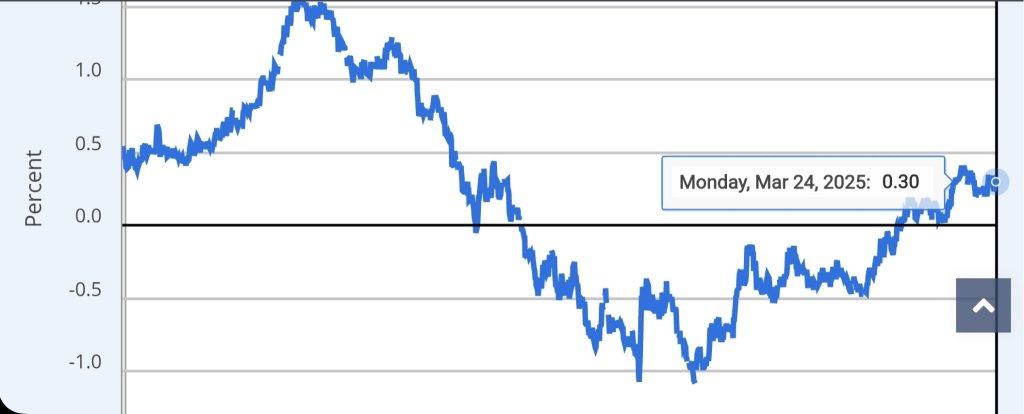

Whether or not these pessimism in the economy has been priced in or not is uncertain,...

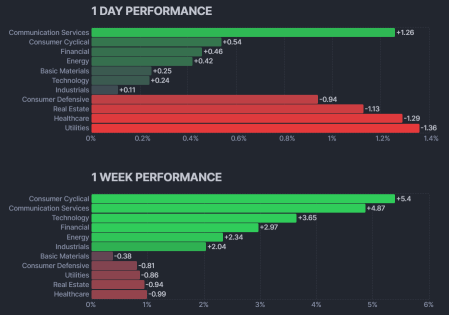

But if we were to look closer, there are some big resistance above on the SPY and QQQ, which might see the bears coming back for some disruption, I will be sharing more of that later in t...

The market is still taking comfort from signs that President Trump could offer flexibility ahead of the next major tariff deadline - 2 Apr.

Stocks have risen since last Friday.

PS: things work both ways. If Trump gives us some negative tariff news, the market can pull back faster than you could imagine.

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Alibaba (BABA.US)$ $BYD COMPANY (01211.HK)$ $Tesla (TSLA.US)$ $Super Micro Computer (SMCI.US)$ $iShares Bitcoin Trust (IBIT.US)$ $NVIDIA (NVDA.US)$ $Alphabet-A (GOOGL.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $MARA Holdings (MARA.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Amazon (AMZN.US)$ $Netflix (NFLX.US)$ $Apple (AAPL.US)$

...

103787717 : possible, but not sure

cryptonerd OP 103787717 : if can be 100% sure everyone wld be rich already haha