Santa Rally brings together a series of US-listed companies that are likely to benefit during the holiday shopping season, ranging from traditional retail giants to emerging e-commerce platforms, and from home improvement chains to payment service providers. This sector comprehensively reflects the diversified needs and consumption patterns of modern consumers during the holiday period. These companies typically experience sales peaks during the Christmas season and are therefore viewed as Christmas concept stocks.

- 2008.871

- +7.265+0.36%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Shopify Investors May Have a Chance to Buy the Dip After Earnings - RBC Capital

Salesforce CEO Says Q4 to See Thousands of Agentforce Deals; Praises Google's Gemini

Shopify Analyst Ratings

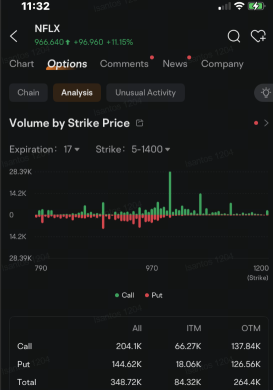

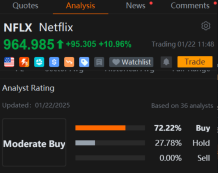

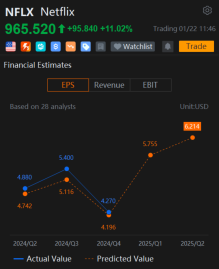

Netflix Options Volume Jump as Shares Climb to Record After Earnings, Outlook Beat

OpenAI Plans to Launch New ChatGPT Feature That Performs Tasks - Report

Databricks Accumulates $15B Through Funding; Meta Joins as Investor

Comments

Shares of the streaming giant climbed as much as 15% to an all-time high of $999 after Netflix announced price increases. That came after net subscribers grew more than double the ...

• $S&P 500 Index (.SPX.US)$ (+0.63%): Continued to climb, reflecting positive sentiment across the broader market.

• Tech Giants Leading the Charge:

• Microsoft ( $Microsoft (MSFT.US)$ +3.11%) and NVIDIA ( $NVIDIA (NVDA.US)$ +3.59%) outperformed

• Meta Pla...

D624Li : How long have you been holding it?