Santa Rally brings together a series of US-listed companies that are likely to benefit during the holiday shopping season, ranging from traditional retail giants to emerging e-commerce platforms, and from home improvement chains to payment service providers. This sector comprehensively reflects the diversified needs and consumption patterns of modern consumers during the holiday period. These companies typically experience sales peaks during the Christmas season and are therefore viewed as Christmas concept stocks.

- 1951.202

- +20.002+1.04%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Here's the Major Earnings Before the Open Tomorrow

TJX Companies' Unique Business Model Is Seen Boosting Earnings Again

Amazon Snaps Six Straight Sessions of Losses

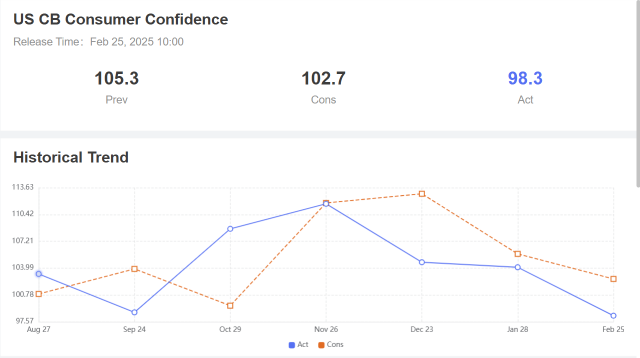

Wall Street Today: All Fun and Games Until Consumers Get Uneasy

Demystifying Amazon.com: Insights From 45 Analyst Reviews

Market Could Enter A 'Real Correction,' Expert Warns, Highlights 2 'Recession-Resistant' Companies

Comments

$Mondelez International (MDLZ.US)$

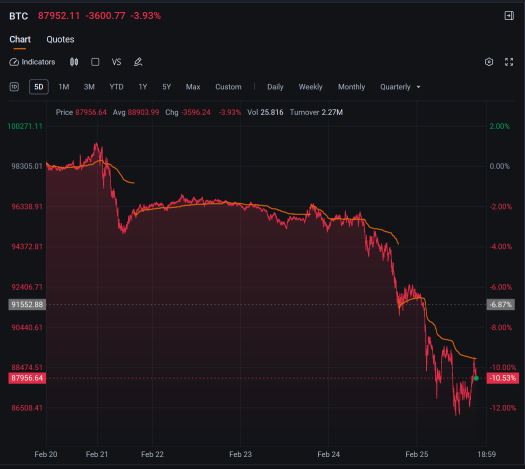

The $Nasdaq Composite Index (.IXIC.US)$ dropped 1.35%, down 5% in the p...