Apple Inc. is a market leader of technology products and services, and one of the largest companies in the world by market cap. Investors closely watch Apple's key decisions as they can impact the other major US listed companies connected to Apple in this list. These companies are involved in the development, production, and distribution of Apple products and services. Investing in these companies offers exposure to the potential growth opportunities of Apple's products and services. As Apple continues to innovate and release new products, investors see potential for more growth in revenue and earnings, and higher stock prices.

- 1852.948

- -90.074-4.64%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

The after-hours price surged nearly 13%, rekindling hopes for a rise in the AI Concept within the U.S. stock market.

① Broadcom released better-than-expected Earnings Reports on Thursday, with first-quarter revenue of 14.92 billion dollars, and revenue from AI chips surged 77% to 4.1 billion dollars; ② Broadcom is optimistic, forecasting second-quarter revenue of about 14.9 billion dollars, with AI chip revenue reaching 4.4 billion dollars; ③ Broadcom also revealed that it is collaborating with four major customers to develop custom chips, which will further enhance its profit prospects.

Express News | In Overnight Trading, Broadcom Soars While HPE, BBAI Plummet Following Their Financial Results, LUNR Extends Losses for Space Mission Failure

Earnings Call Summary | Broadcom(AVGO.US) Q1 2025 Earnings Conference

The Nasdaq has fallen nearly 10% in two weeks, with chip stocks facing heavy short-selling.

In yesterday's Nasdaq crash, chip stocks led the decline, with the PHLX Semiconductor Index plummeting by 4.5%. Short sellers are aggressively shorting Technology stocks, pushing the shorting costs for the VanEck Semiconductor ETF to this year's highest point. The market is worried that Trump's trade disputes, stubborn inflation in the USA, and large-scale layoffs dominated by DOGE could trigger a recession or even stagflation in the USA. Additionally, the improvement of AI capabilities in China has sparked market concerns about the future demand for chips.

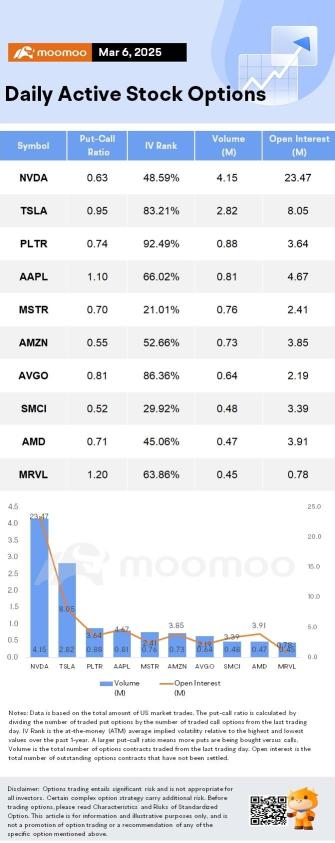

Options Market Statistics: Strong Demand for Custom AI Chips Drives Broadcom's Earnings Beat; Options Pop

The AI craze is not over! Broadcom's Q2 guidance exceeds expectations, with expectations of continued high investment from major clients, increasing by 17% in after-hours trading | Earnings Reports news.

Broadcom's Earnings Reports show that the company's first-quarter performance and second-quarter revenue guidance both exceeded expectations, and it is anticipated that AI semiconductor revenue in the second quarter will reach 4.4 billion USD, sending a strong signal to investors that AI computing spending remains robust, which stimulated the company's stock price to rise by 17% in after-hours trading. Analysts believe that Broadcom's latest Earnings Reports indicate that the historical spending boom in the AI field is still ongoing. As the complexity of AI computing tasks and the demand for customization increase, large Technology companies will further turn to custom chips instead of relying on standard chips, a trend that is expected to continue benefiting Broadcom. More updates to follow.

Comments

A month of tariff exemptions hasn't boosted U.S. stocks.

FBM KLCI Index ends lower dragged down by financial stocks.

Stocks to watch: SAPNRG, SDS, MHB.

- Moomoo News MY

Wall Street Summary

$S&P 500 Index (.SPX.US)$ 5,738.52 (-1.78%)

$Dow Jones Industrial Average (.DJI.US)$ 42,579.08 (-0.99%)

$Nasdaq Composite Index (.IXIC.US)$ 18,069.26 (-2.61%)

The indexes dropp...

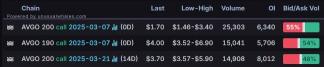

1. $Broadcom (AVGO.US)$ shares fell 6% on Thursday but surged more than 12% in after-hours trading. The most traded calls are contracts of $200 strike price that expire on Mar 7 and the total volume reaching 25,303 with the open interest of 6,340.

Broadcom's revenue saw a 25% year-over-year increase, reaching $14.92 billion, surpassing analyst estimates from Visible Alpha. The ...

104659872 : Better to regret selling than to regret keeping!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

you can always buy back a good price!