Apple Inc. is a market leader of technology products and services, and one of the largest companies in the world by market cap. Investors closely watch Apple's key decisions as they can impact the other major US listed companies connected to Apple in this list. These companies are involved in the development, production, and distribution of Apple products and services. Investing in these companies offers exposure to the potential growth opportunities of Apple's products and services. As Apple continues to innovate and release new products, investors see potential for more growth in revenue and earnings, and higher stock prices.

- 1969.794

- -47.461-2.35%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

350, 6000, 44000, 88000! Last night, these four numbers interpreted the 'Trump trade'...

1) 350, 6000, 44000, 88000 - Do you know the meaning of these series of numbers? 2) They represent the integer positions reached by Tesla, s&p 500 index, Dow Jones, and Bitcoin respectively yesterday's breakthrough.

Loop Capital Initiates Coverage On Qualcomm With Hold Rating, Announces Price Target of $180

Qualcomm Analyst Ratings

Skyworks Solutions Analyst Ratings

Qorvo Analyst Ratings

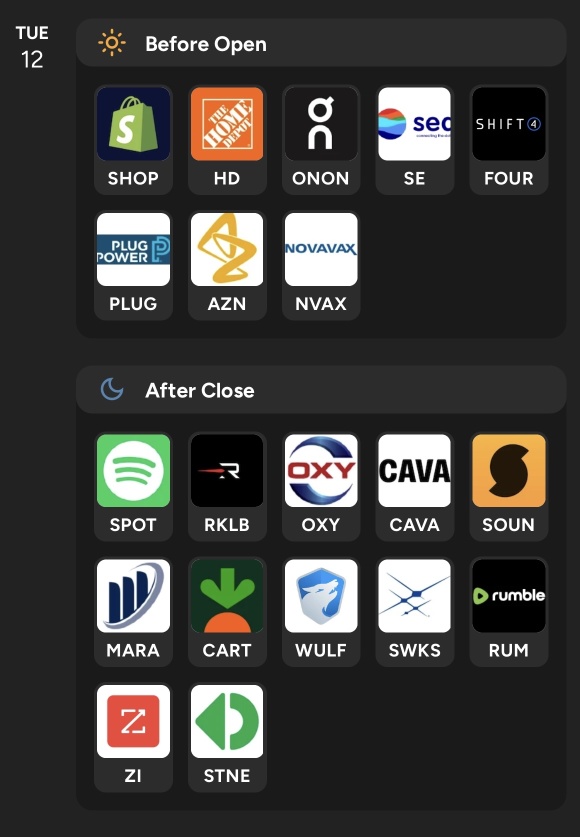

Chips Mostly Lower to Start Week Ahead of Key Earnings; Monolithic Power Slumps

Comments