Apple Inc. is a market leader of technology products and services, and one of the largest companies in the world by market cap. Investors closely watch Apple's key decisions as they can impact the other major US listed companies connected to Apple in this list. These companies are involved in the development, production, and distribution of Apple products and services. Investing in these companies offers exposure to the potential growth opportunities of Apple's products and services. As Apple continues to innovate and release new products, investors see potential for more growth in revenue and earnings, and higher stock prices.

- 1835.418

- -52.912-2.80%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

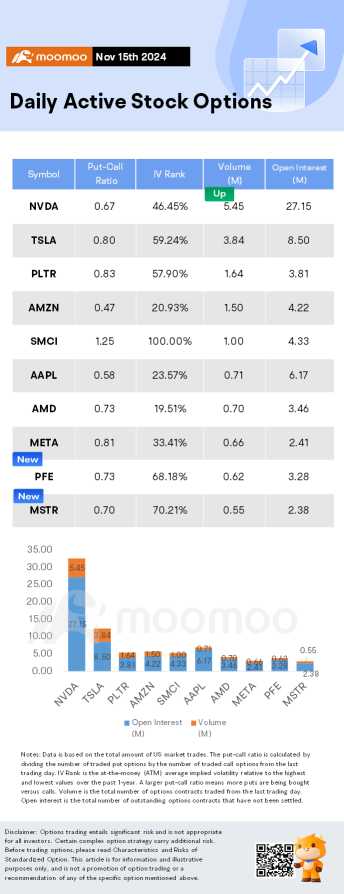

Options Market Statistics: Nvidia to Report Q3 Earnings Wednesday as AI Fever Continues to Power Wall Street, Options Pop

Weekly Buzz: Not All Parties Last Forever

Market Falls to End All-Time High Week | Wall Street Today

$100 Invested In Texas Instruments 20 Years Ago Would Be Worth This Much Today

10 Information Technology Stocks With Whale Alerts In Today's Session

Market Falls Friday After Light Earnings and 13F's | Live Stock

Comments

thank me later by buying me a beer

$NVIDIA (NVDA.US)$ will report its Q3 earnings after the bell next Wednesday, giving Wall Street its best and latest look into the strength of the AI trade.

The world’s largest publicly traded company by market cap, Nvidia’s stock price has continued to rocket higher throughout 2024, thanks to the explosive growth in AI across the tech landscape and beyond. Shares of Nvidia were up 189% year to date as of Friday, easily outpacing any of the company’s chip rivals. $Advanced Mic...

1. $NVIDIA (NVDA.US)$ will report its Q3 earnings after the bell next Wednesday, giving Wall Street its best and latest look into the strength of the AI trade.

The world’s largest publicly traded company by market cap, Nvidia’s stock price has continued to rocket higher throughout 2024, thanks to the explosive growth in AI across the tech landscape and beyond. S...

Seraphicall : Bought in a bit last night. Let’s see if any consolidation in coming week.

Moneycomepls : Is there a chance to go to 168?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)