Investment ThemesDetailed Quotes

Live Streaming

Watchlist

- 617.529

- -35.699-5.46%

Close Nov 12 16:00 ET

629.707High613.688Low

628.030Open653.228Pre Close13.17MVolume--Rise89.75P/E (Static)187.01MTurnover1Flatline2.09%Turnover Ratio14.92BMarket Cap6Fall9.01BFloat Cap

Constituent Stocks: 7Top Rising: CTKYY0.00%

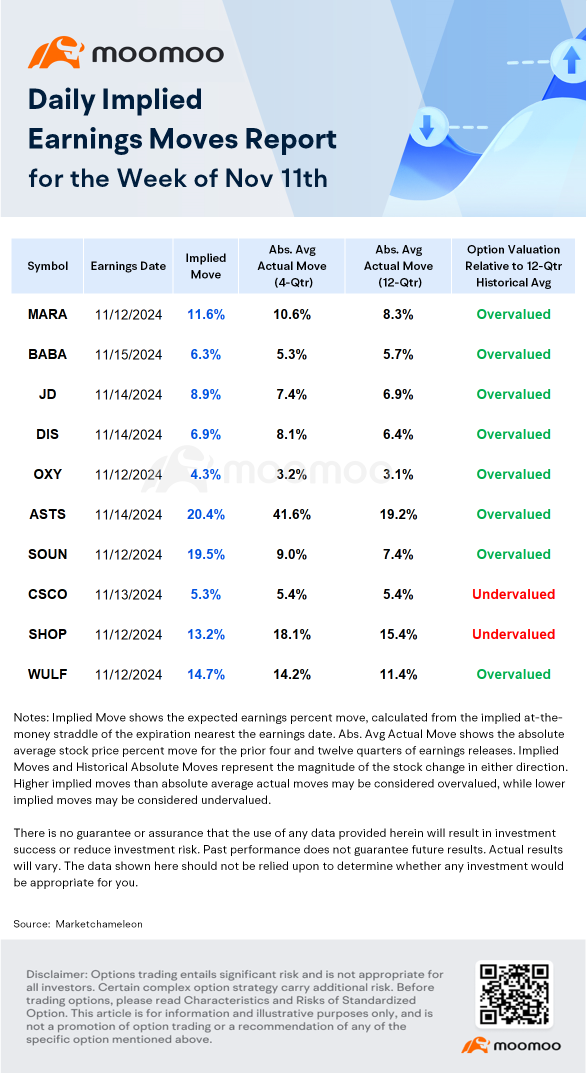

Implied volatility often spikes before a company releases its earnings, as market uncertainty drives up demand for options from speculators and hedgers. This heightened demand inflates both the implied volatility and the price of the options. Following the earnings announcement, implied volatility generally returns to normal levels.

Here are the top earnings and volatility for the week:

$MARA Holdings (MARA.US)$

E...

Here are the top earnings and volatility for the week:

$MARA Holdings (MARA.US)$

E...

+5

19

1

December to February is typically a unique period in financial markets due to a combination of seasonal trends, holiday spending, tax-related activities, and year-end corporate earnings. Here are some notable historical trends during this period:

1. The Santa Claus Rally (Late December)

The "Santa Claus Rally" refers to a historical tendency for stock markets to perform well in the last week of December and the first two trading days of January. This pattern is ...

1. The Santa Claus Rally (Late December)

The "Santa Claus Rally" refers to a historical tendency for stock markets to perform well in the last week of December and the first two trading days of January. This pattern is ...

15

cmon buy buy buy

$Jet.AI (JTAI.US)$ 👀because 7 cents is too much right ?

$Tencent (TCEHY.US)$ $DouYu (DOYU.US)$ $Li Auto (LI.US)$

$Tencent (TCEHY.US)$ $DouYu (DOYU.US)$ $Li Auto (LI.US)$

$HUYA Inc (HUYA.US)$

HUYA presents a moderate risk level for traders, in my analysis. This assessment reflects the positive momentum from recent news and key breakout levels, countered by the inherent risk of past unprofitability and sector volatility. The company's healthy cash position mitigates some financial risks, although the negative retained earnings and leverage must be carefully considered. Traders should be mindful of market fluctuations and potential downturns within the entertainment...

HUYA presents a moderate risk level for traders, in my analysis. This assessment reflects the positive momentum from recent news and key breakout levels, countered by the inherent risk of past unprofitability and sector volatility. The company's healthy cash position mitigates some financial risks, although the negative retained earnings and leverage must be carefully considered. Traders should be mindful of market fluctuations and potential downturns within the entertainment...

3

2

6

$NIO Inc (NIO.US)$ $Bilibili (BILI.US)$ $JD.com (JD.US)$ what good news tdy? why all china stocks gg up and will it continue over the next few days?

3

2

No comment yet

my friend

my friend

It's like the consolidation of the big A.

It's like the consolidation of the big A.

104088143 : What happened?