- 650.004

- +1.640+0.25%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

The NASDAQ broke through 0.02 million points for the first time, Tesla led a group of tech giants to a new high, and Bitcoin climbed to 0.1 million dollars

The Dow and Apple fell, the Nasdaq rose nearly 2%, Tesla and Google rose nearly 6%, while Meta, Amazon, and Netflix all reached new highs. NVIDIA rose over 3%, Broadcom rose nearly 7%, Super Micro Computer once dropped over 8%, the decline of Chinese concepts narrowed, and Fangdd Network turned to rise over 11%. The U.S. November CPI confirms interest rate cut bets for next week, with a pause on rate cuts expected in January next year. The dollar and U.S. Treasury yields rebounded in a V-shape, while spot Gold reached its highest level in five weeks. The yen plunged below 152, while the offshore yuan once dropped over 300 points, falling below 7.29 yuan. After a significant interest rate cut by the Bank of Canada, the Canadian dollar and Canadian bond yields turned to rise, and oil prices increased by about 2%.

Shares of US-listed Chinese Stocks Are Trading Lower, Possibly Continuing to Fall Following Weak Import Data.

China Central Economic Work Conference: A Key Indicator for Future Market Trends

U.S. stocks closed: The Dow Jones fell for four consecutive days, Chinese concept stocks plummeted over 4%, as the market focused on the CPI report.

① The Nasdaq China Golden Dragon Index fell 4.34%, as China Concept Stocks collectively declined; ② Apple is reportedly planning to equip its smartwatches with satellite communication capabilities; ③ Google A rose 5.62%, as the company launched its latest quantum chip "Willow," achieving significant technological breakthroughs; ④ Microsoft shareholders voted against the Bitcoin investment proposal.

Which Subsectors to Own and Which to Avoid – Wolfe Research

Citigroup Maintains Neutral on Hello Gr, Raises Price Target to $7

Comments

Cut LPR by 35bps to 3.1%

Cut interbank rates 8bps to 1.744%

Approved $1.4T in additional debt

Approved $1.4T in local govt debt swap

Approved $838B in additional local govt debt issuance

Cut rates on $5.3T of outstanding mortgages

Reduced the downpayment on new and 2nd hand home purchases from 25% to 15%

Approved tens of billions in loans to financial institutions and listed firms for share buybacks

Yes, they have been working to stimulate ...

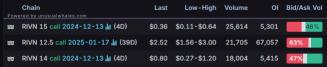

1. $Rivian Automotive (RIVN.US)$ shares surged 11% in Monday's trading, with the most traded calls are contracts of $15 strike price that expire on Dec. 13. The total volume reaches 25,614 with the open interest of 5,301.

Benchmark analyst Mickey Legg initiated coverage on the stock with a Buy rating and $18 price target. Legg believes Rivian can attract more custo...