Investment ThemesDetailed Quotes

5G

Watchlist

The 5G concept includes major US-listed companies in the fifth-generation telecommunication technology industry chain.

- 3282.980

- +21.965+0.67%

Close Nov 22 16:00 ET

3289.526High3259.972Low

3260.737Open3261.016Pre Close228.02MVolume16Rise34.14P/E (Static)19.98BTurnover--Flatline0.48%Turnover Ratio5.83TMarket Cap2Fall5.59TFloat Cap

Constituent Stocks: 18Top Rising: DELL+3.81%

Berkshire Hathaway’s most recent portfolio update, based on filings as of Q3 2024, reveals several key holdings and recent changes:

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%...

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%...

1

1

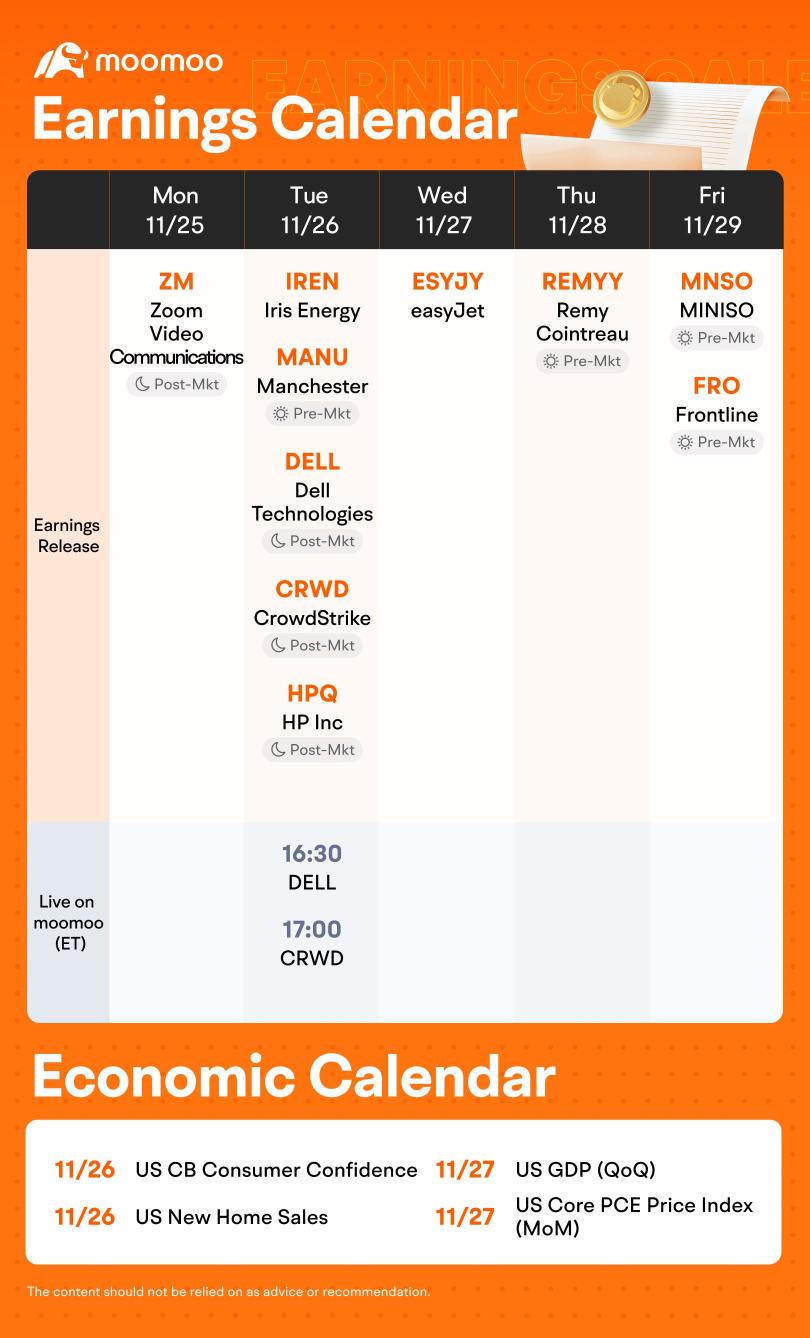

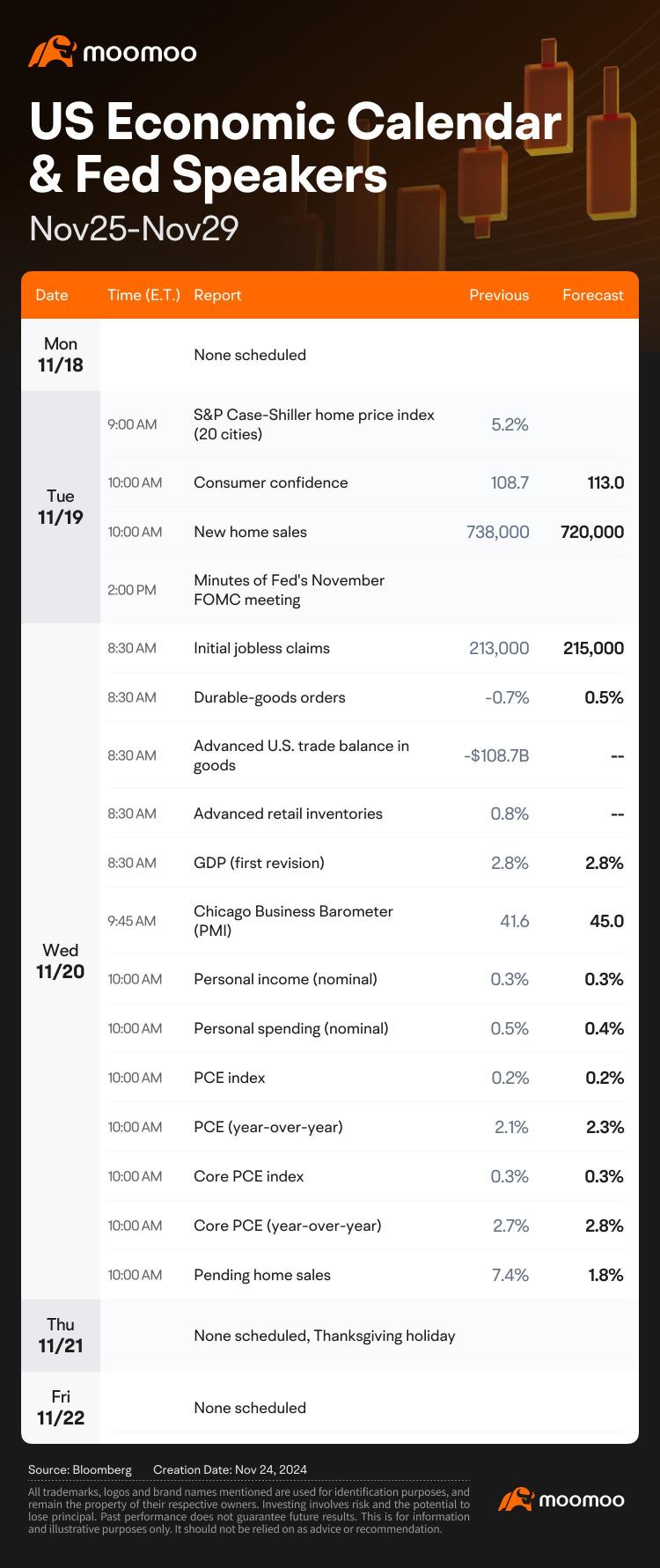

Columns What to Expect in the Week Ahead (DELL, CRWD and MINISO Earnings; GDP, FOMC Minutes and PCE Index )

Earnings Preview

Next week, earnings reports from tech firms Dell Technologies, CrowdStrike, and HP will be among the highlights of the corporate calendar.

Wall Street experts predict that $Dell Technologies (DELL.US)$ will announce quarterly earnings of $2.05 per share in its forthcoming report, indicating a 9% rise from the previous year. Expected revenues are projected to reach $24.53 billion, ma...

Next week, earnings reports from tech firms Dell Technologies, CrowdStrike, and HP will be among the highlights of the corporate calendar.

Wall Street experts predict that $Dell Technologies (DELL.US)$ will announce quarterly earnings of $2.05 per share in its forthcoming report, indicating a 9% rise from the previous year. Expected revenues are projected to reach $24.53 billion, ma...

+4

69

11

$Cisco (CSCO.US)$ 62 by end this week

i think the stock will always be a money maker with solid divedend. buffet is about to but ALOT of things when the market crashes

3

1

A quick update of my trading activities in this week (18 to 22 Nov).

New Positions

$Taiwan Semiconductor (TSM.US)$ , $Broadcom (AVGO.US)$ , $Johnson & Johnson (JNJ.US)$ , $Pfizer (PFE.US)$ , $Coca-Cola (KO.US)$ , $Occidental Petroleum (OXY.US)$

Sold out Positions

$Disney (DIS.US)$

Increased Positions

$Novo-Nordisk A/S (NVO.US)$ , $AstraZeneca (AZN.US)$ , $Huntington Ingalls Industries (HII.US)$

Decreased Positions

None

New Positions

$Taiwan Semiconductor (TSM.US)$ , $Broadcom (AVGO.US)$ , $Johnson & Johnson (JNJ.US)$ , $Pfizer (PFE.US)$ , $Coca-Cola (KO.US)$ , $Occidental Petroleum (OXY.US)$

Sold out Positions

$Disney (DIS.US)$

Increased Positions

$Novo-Nordisk A/S (NVO.US)$ , $AstraZeneca (AZN.US)$ , $Huntington Ingalls Industries (HII.US)$

Decreased Positions

None

+1

loading...

2

$Cisco (CSCO.US)$ rising in the shadows

$Apple (AAPL.US)$ so disappointed!! it really cant hold 230 level. 😰.

5

No comment yet

Old Timer Trader : He sold 80 BILLION DOLLARS of AAPL stock. Just a year ago, he stated that Apple was a stock that he would never sell… can you explain that?