Copper

- 3793.274

- +18.409+0.49%

Trading Nov 19 10:43 ET

3797.084High3746.331Low

3778.641Open3774.865Pre Close3.27MVolume6Rise38.51P/E (Static)101.64MTurnover--Flatline0.14%Turnover Ratio151.61BMarket Cap1Fall77.78BFloat Cap

Gold FLAT @ $2553

Paper Silver up 0.44% to $29.65

Platinum up 2.1% to $975

Palladium up 3% to $942

Copper up 1% to $4.20

Brent Crude down 1.46% to $76.05

Iron ore up 3% to $98.30 $Rio Tinto Ltd (RIO.AU)$ $BHP Group Ltd (BHP.AU)$

Paper Silver up 0.44% to $29.65

Platinum up 2.1% to $975

Palladium up 3% to $942

Copper up 1% to $4.20

Brent Crude down 1.46% to $76.05

Iron ore up 3% to $98.30 $Rio Tinto Ltd (RIO.AU)$ $BHP Group Ltd (BHP.AU)$

1

[Interview] Leigh Goehring On The Present State of The Energy Markets

came across this superb writeup and accompanying video. THE PDF is also detailed and informative.

Exciting developments are unfolding in the global oil and North American natural gas markets, presenting a unique opportunity for investors willing to take a contrarian approach. We believe there is substantial profit potential in both sectors, with promising outcomes expected by the end of this decade.

In a...

came across this superb writeup and accompanying video. THE PDF is also detailed and informative.

Exciting developments are unfolding in the global oil and North American natural gas markets, presenting a unique opportunity for investors willing to take a contrarian approach. We believe there is substantial profit potential in both sectors, with promising outcomes expected by the end of this decade.

In a...

4

OPEC maintains its forecast for strong growth in oil demand and remains optimistic about the global economic outlook.

Global oil demand is expected to increase by 2.25 million barrels/day in 2024 and by 1.85 million barrels/day in 2025, both predictions unchanged from last month.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Cboe/COMEX Gold Volatility Index (.GVX.US)$ $Occidental Petroleum (OXY.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Chevron (CVX.US)$ $Copper (LIST2510.US)$

Global oil demand is expected to increase by 2.25 million barrels/day in 2024 and by 1.85 million barrels/day in 2025, both predictions unchanged from last month.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Cboe/COMEX Gold Volatility Index (.GVX.US)$ $Occidental Petroleum (OXY.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Chevron (CVX.US)$ $Copper (LIST2510.US)$

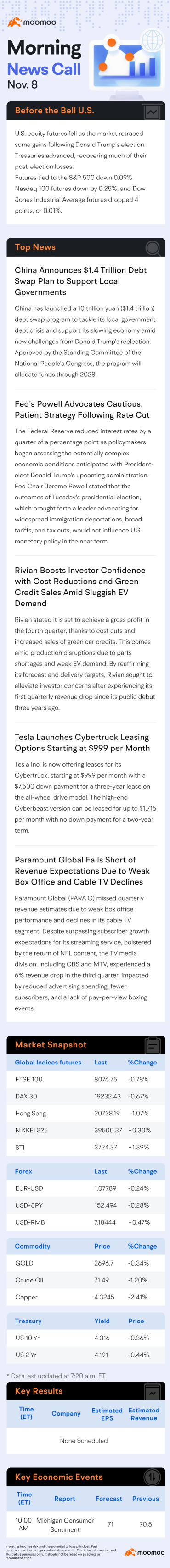

U.S. Stocks:

- Ahead of the key CPI report, the S&P made a narrow rebound, while the Nasdaq saw its second consecutive gain, closing at a new record high.

- Dow Jones: +0.32%

- S&P 500: +0.48%

- Nasdaq: +0.75%

Commodities:

- WTI June Crude Oil Futures: -$1.10, -1.39%, at $78.02/barrel (nine-week low)

- Brent July Crude Oil Futures: -$0.98, -1.18%, at $82.38/barrel

- COMEX Gold Futures: +0.87%, at $2363.5/ounce

- LME Copper: -$72, at $10114/ton

- New York Copper Futures: +5% a...

- Ahead of the key CPI report, the S&P made a narrow rebound, while the Nasdaq saw its second consecutive gain, closing at a new record high.

- Dow Jones: +0.32%

- S&P 500: +0.48%

- Nasdaq: +0.75%

Commodities:

- WTI June Crude Oil Futures: -$1.10, -1.39%, at $78.02/barrel (nine-week low)

- Brent July Crude Oil Futures: -$0.98, -1.18%, at $82.38/barrel

- COMEX Gold Futures: +0.87%, at $2363.5/ounce

- LME Copper: -$72, at $10114/ton

- New York Copper Futures: +5% a...

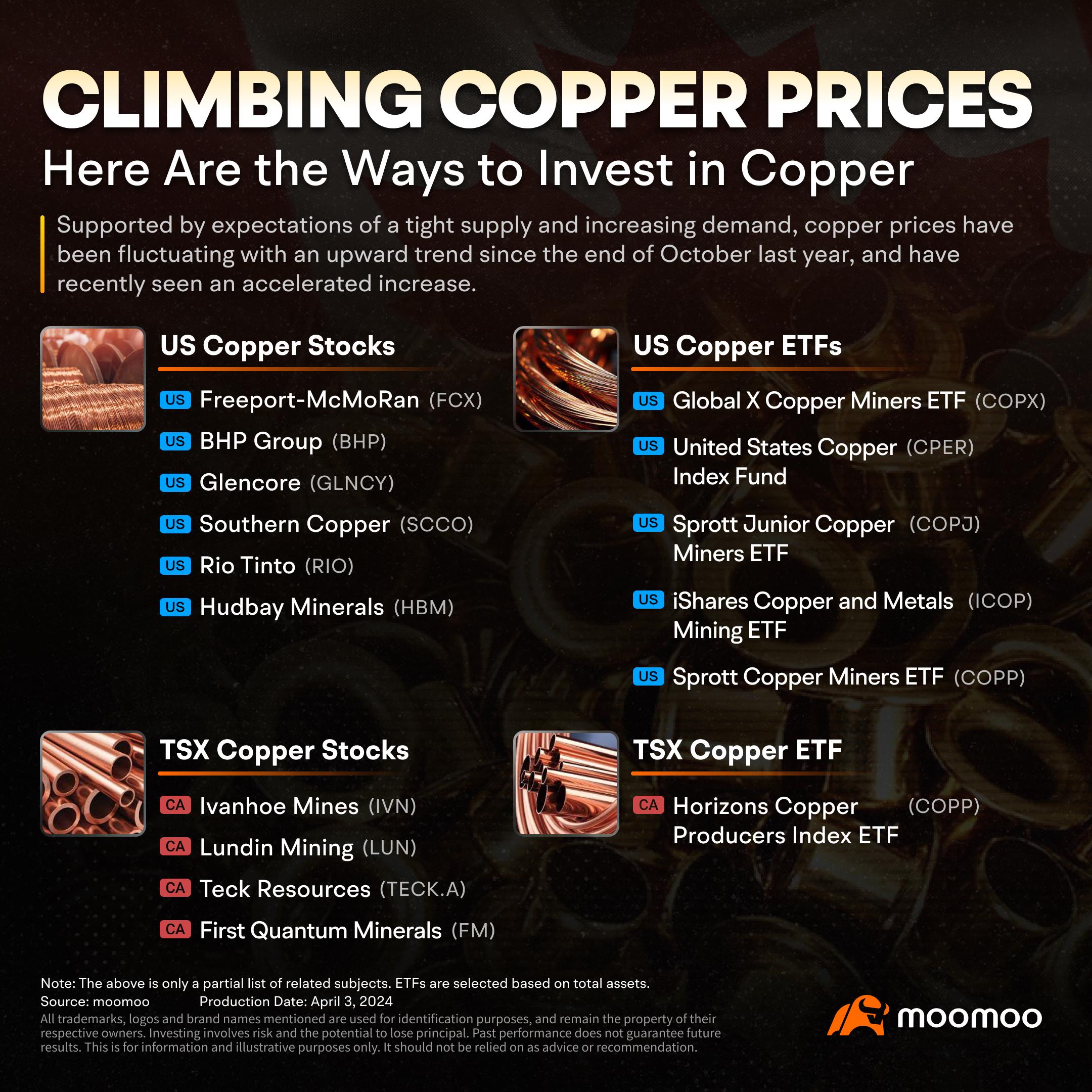

The copper market is currently experiencing a robust upswing, propelled by a confluence of factors, including supply challenges and cyclical improvements in the global economy. LME's copper futures have surged above the psychological mark of US$10,000 per metric ton and are heading toward US$15,000.

What are the driving forces behind this surge, and how can you effectively tap into this metal's potential through dive...

What are the driving forces behind this surge, and how can you effectively tap into this metal's potential through dive...

32

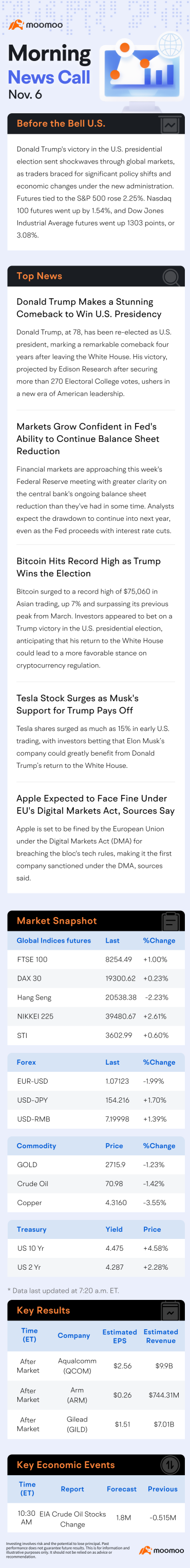

🌐 Inflation and Employment Surge Together, Toppling Rate Cut Expectations

After the U.S. The Bureau of Statistics released the hot non-farm payroll data for March last week. This Wednesday's key CPI data showed a higher-than-expected increase for the second month in a row, with growth rates exceeding expectations for three consecutive months. Housing and energy continue to be the main drivers of the CPI increase. 👇

...

After the U.S. The Bureau of Statistics released the hot non-farm payroll data for March last week. This Wednesday's key CPI data showed a higher-than-expected increase for the second month in a row, with growth rates exceeding expectations for three consecutive months. Housing and energy continue to be the main drivers of the CPI increase. 👇

...

![Rate Cut Hopes Dashed: What's Next for the Market? [Learn Premium Weekly Review]](https://ussnsimg.moomoo.com/sns_client_feed/71220648/20240412/1712915548758-31a9a01f4d.png/thumb?area=999&is_public=true)

![Rate Cut Hopes Dashed: What's Next for the Market? [Learn Premium Weekly Review]](https://ussnsimg.moomoo.com/sns_client_feed/71220648/20240412/1712915623712-5e4617e046.png/thumb?area=999&is_public=true)

![Rate Cut Hopes Dashed: What's Next for the Market? [Learn Premium Weekly Review]](https://ussnsimg.moomoo.com/sns_client_feed/71220648/20240412/1712915901967-1519765cda.png/thumb?area=999&is_public=true)

+1

21

4

No comment yet

104437220 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104437220 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104088143 : like

74537620 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)