Investment ThemesDetailed Quotes

Food Delivery

Watchlist

- 1518.202

- +38.112+2.58%

Close Nov 22 16:00 ET

1518.671High1478.795Low

1487.687Open1480.090Pre Close18.37MVolume2Rise180.50P/E (Static)1.67BTurnover--Flatline0.75%Turnover Ratio224.20BMarket Cap--Fall211.73BFloat Cap

Constituent Stocks: 2Top Rising: UBER+2.69%

Happy weekend, investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market overall advanced on Friday. The news followed Nvidia's earnings on Wednesday night and Bitcoin's all-time highs.

Just past the Friday close at 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded...

Make Your Choice

Weekly Buzz

The market overall advanced on Friday. The news followed Nvidia's earnings on Wednesday night and Bitcoin's all-time highs.

Just past the Friday close at 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded...

+11

17

5

$Tesla (TSLA.US)$ $BYD COMPANY (01211.HK)$ $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$

1) Teslarati

Legendary investor Brad Gerstner said that Tesla stock is the replacement for Uber shares in his portfolio because Tesla has so much upside in the self-driving race. Bred Gerstner is the CEO and founder of Altimeter Capital, a hedge fund that manages $10.7 billion in investments. Gerstner was formerly bullish on Ub...

1) Teslarati

Legendary investor Brad Gerstner said that Tesla stock is the replacement for Uber shares in his portfolio because Tesla has so much upside in the self-driving race. Bred Gerstner is the CEO and founder of Altimeter Capital, a hedge fund that manages $10.7 billion in investments. Gerstner was formerly bullish on Ub...

1

1

$Uber Technologies (UBER.US)$

Uber Technologies Inc. plans to invest in Pony AI Inc.'s US initial public offering, which is expected to be priced next week after being upsized by the autonomous driving firm, people familiar with the matter said.

Uber has been busy scaling up its robotaxi operations.

San Francisco-based Uber is seeking to buy more than USD10 million of shares in Pony AI's IPO, the people said, asking not to be identified dis...

Uber Technologies Inc. plans to invest in Pony AI Inc.'s US initial public offering, which is expected to be priced next week after being upsized by the autonomous driving firm, people familiar with the matter said.

Uber has been busy scaling up its robotaxi operations.

San Francisco-based Uber is seeking to buy more than USD10 million of shares in Pony AI's IPO, the people said, asking not to be identified dis...

17

2

$Uber Technologies (UBER.US)$ Uber Launches 'XXL' Rides With Extra Trunk Space To Tackle Thanksgiving Travel Surge At Over 60 Airports🤬🤬go up

The market climbed its best on Monday, with equities paling in comparison to the explosive first session of last week. The S&P 500 climbed while individual decliners brought down the Dow.

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ climbed 0.39% the $Dow Jones Industrial Average (.DJI.US)$ fell 0.13%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.60%.

$NVIDIA (NVDA.US)$ reports pulled the Dow lower,...

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ climbed 0.39% the $Dow Jones Industrial Average (.DJI.US)$ fell 0.13%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.60%.

$NVIDIA (NVDA.US)$ reports pulled the Dow lower,...

54

11

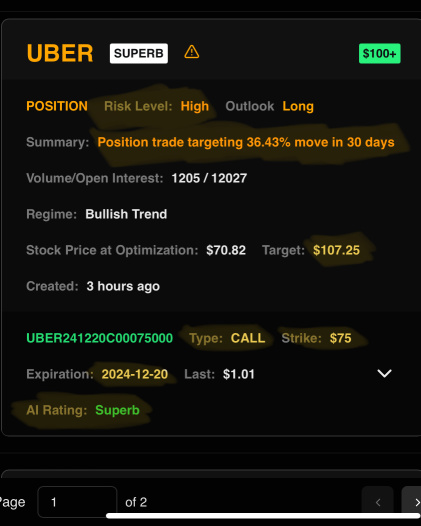

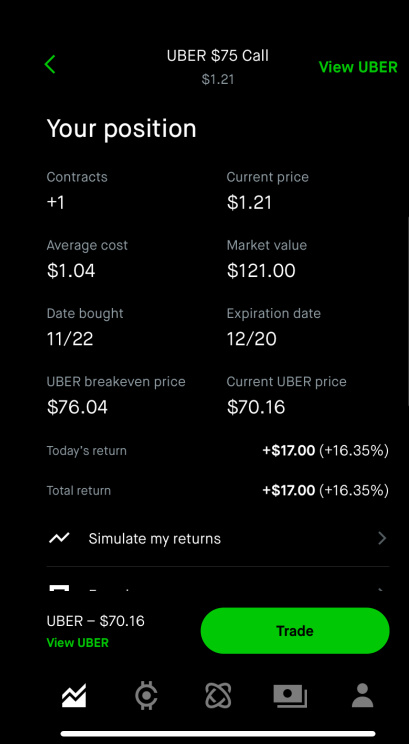

Here are the levels to watch after the steep move down. Watch for support in this area. If 68 fails to hold will likely see the 66.91 level quickly.

Larger Image: tradingview.com...

$Uber Technologies (UBER.US)$

Larger Image: tradingview.com...

$Uber Technologies (UBER.US)$

9

Good morning, traders. Happy Monday, November 18th. You will not make it through the day without news about the animal spirits moving the market today.

My name is Kevin Travers, and the S&P 500 climbed on Monday, but key stocks were pulling down the Dow.

$Super Micro Computer (SMCI.US)$ was the highest climbing stock on the S&P 500, up 11% after a rumor Friday that the firm might file a plan to file their still dela...

My name is Kevin Travers, and the S&P 500 climbed on Monday, but key stocks were pulling down the Dow.

$Super Micro Computer (SMCI.US)$ was the highest climbing stock on the S&P 500, up 11% after a rumor Friday that the firm might file a plan to file their still dela...

32

11

4

No comment yet

Space Dust : the bigs have their AI programs on full scalp. market can not crash as long as so much cash on the sidelines waiting for it.

is that ?

a.) conventional wisdom

b.) unconventional wisdom

c.) contrarian

d.) consensus

HuatLady : I’m keeping a careful watch on my portfolio, especially with a possible Santa rally ahead. While my main focus is on long-term growth, I’ll consider short-term opportunities that match my strategy. Since the market often sees a boost at year-end, I’m open to small, strategic tweaks if they seem worthwhile. I’ll likely hold off on any major shifts until January. My plan is to stay informed and adaptable while keeping the big picture in focus.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102362254 : Sticking with my current portfolio is tempting, but I’m leaning toward some proactive moves. Recent market swings have opened up interesting opportunities in resilient sectors like tech and consumer discretionary. With signs of a soft economic landing and cooling inflation, a little adjustment now could really pay off if things keep trending in a positive direction

HuatEver :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

我只想赚个买菜钱 : ok