Includes major US listed cloud computing service providers. These companies provide IAAS, SAAS, and PAAS services, infrastructure, and solutions for companies and individuals, enabling them to quickly deploy and manage their own operations, applications, and systems. Cloud computing is a significant investment opportunity for its potential cost savings. By moving IT infrastructure to the cloud, companies can reduce capital expenditures on hardware and software and only pay for the services they use, freeing up resources to invest in other areas such as research and development or marketing. Increasing demand for storage and processing power is driving the growth of cloud computing. As more businesses move to digital platforms and adopt technologies like AI, the amount of data being generated is growing exponentially. Cloud computing offers a scalable solution to handle this data.

- 1312.890

- +5.856+0.45%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Google Wants FTC To Dismantle Microsoft's Exclusive Cloud Hosting Deal With OpenAI: Report

Google has complained to regulators: Microsoft and OpenAI are suspected of monopolistic practices and must terminate their exclusive Cloud Computing Service.

The exclusive agreement makes Microsoft the only Cloud Computing Service provider for OpenAI technology, which places other competitors, such as Google and Amazon, at a significant disadvantage. These companies hope to host OpenAI's AI models so that their cloud customers can access OpenAI's technology without the need to use Microsoft's Server.

Auto Disruption: Amazon Joins Costco as a Source for Consumers to Buy Cars

Amazon Autos: Buy Your Next Car Online, It's Just A Click Away

Microsoft Shareholders Reject Proposal To Explore Bitcoin Investment

U.S. stocks closed: The Dow Jones fell for four consecutive days, Chinese concept stocks plummeted over 4%, as the market focused on the CPI report.

① The Nasdaq China Golden Dragon Index fell 4.34%, as China Concept Stocks collectively declined; ② Apple is reportedly planning to equip its smartwatches with satellite communication capabilities; ③ Google A rose 5.62%, as the company launched its latest quantum chip "Willow," achieving significant technological breakthroughs; ④ Microsoft shareholders voted against the Bitcoin investment proposal.

Comments

Saylor argued Microsoft had missed an opportunity to build significant value, claiming the company forfeited $200 billion in capital by choosing sto...

U.S. stocks slipped for second consecutive session on Tuesday as the end-of-year rally hit resistance ahead of inflation data due today (11 Dec), mainly driven by profit-taki...

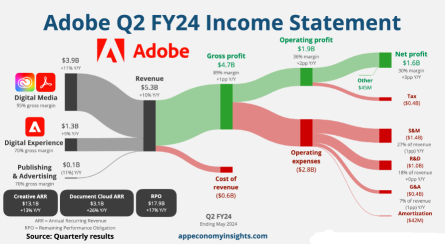

ADBE is expected to report a rise in fourth-quarter revenue, owing to healthy demand for its large suite of design software as it invests into generative artificial intelligence features. For fourth-quarter fiscal 2024, Adobe projects total revenues between $5.50 billion and $5.55 billion.

Adobe expects non-GAAP ea...