Includes major US listed cloud computing service providers. These companies provide IAAS, SAAS, and PAAS services, infrastructure, and solutions for companies and individuals, enabling them to quickly deploy and manage their own operations, applications, and systems. Cloud computing is a significant investment opportunity for its potential cost savings. By moving IT infrastructure to the cloud, companies can reduce capital expenditures on hardware and software and only pay for the services they use, freeing up resources to invest in other areas such as research and development or marketing. Increasing demand for storage and processing power is driving the growth of cloud computing. As more businesses move to digital platforms and adopt technologies like AI, the amount of data being generated is growing exponentially. Cloud computing offers a scalable solution to handle this data.

- 1288.226

- -51.608-3.85%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Is online shopping in the USA down again? During the busy Christmas shopping season, thousands of workers at Amazon are striking.

On Thursday, during the Eastern Time, thousands of Amazon employees will hold a strike, which comes at a crucial moment during the last few days of the holiday season, significantly impacting Amazon's operation; The International Brotherhood of Teamsters stated that they are demanding Amazon to raise workers' wages and improve working conditions, and are urging Amazon to begin negotiations by the end of this week, but observers say it is unlikely that Amazon will come to the negotiation table.

Apple in Discussions With ByteDance, Tencent to Integrate AI Models in IPhones in China - Report

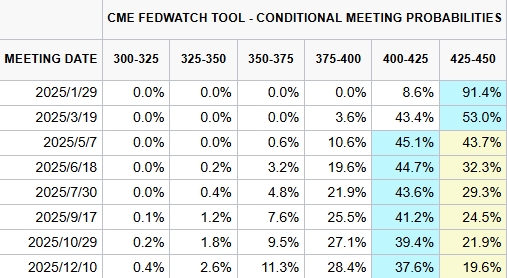

Fed Meeting Causes Market Plunge: Hawkish Tone Surprises Expectations

Jeff Bezos-Backed Perplexity Raises $500 Million, Tripling Its Valuation To $9 Billion As Competition With Google And OpenAI Heats Up

Waymo Completes 4 Million Autonomous Rides In Key US Metropolitan Areas In 2024 Ahead Of Tokyo Launch

Quantum Computing, Rigetti, D-Wave Skyrocket Up To 300% In 5 Sessions After Google Unveils Willow Chip, But Analysts Urge Caution: 'Not Every TikTok Guitarist Is The Next Taylor Swift'

Comments

$Oracle (ORCL.US)$

Just hit the bottom cloud, there is a chance that it follows within the cloud, if this does not happen then I will add more at 200EMA lines.

Let's see…

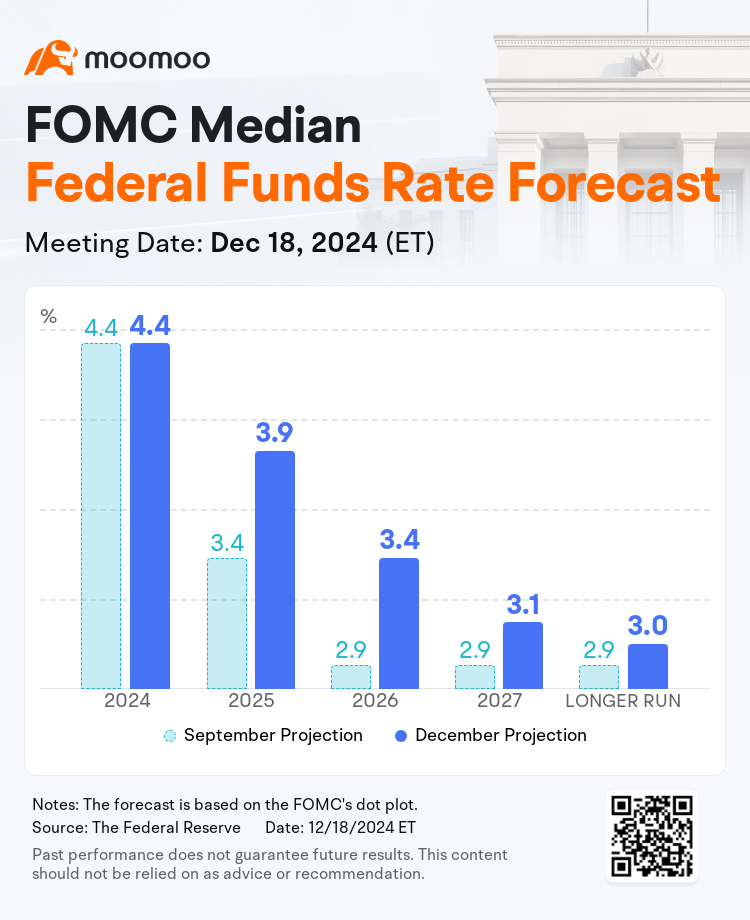

1、Significant Reduction in Rate Cut Projections

2、Notable Increase in 2024 PCE Inflation Forecasts

3、Clear Indication of Upside Risks to In...

WolfMat : short then

101721316 OP WolfMat : nah not going to short im loading more when the time come

WolfMat 101721316 OP : lmao