Includes major US listed cloud computing service providers. These companies provide IAAS, SAAS, and PAAS services, infrastructure, and solutions for companies and individuals, enabling them to quickly deploy and manage their own operations, applications, and systems. Cloud computing is a significant investment opportunity for its potential cost savings. By moving IT infrastructure to the cloud, companies can reduce capital expenditures on hardware and software and only pay for the services they use, freeing up resources to invest in other areas such as research and development or marketing. Increasing demand for storage and processing power is driving the growth of cloud computing. As more businesses move to digital platforms and adopt technologies like AI, the amount of data being generated is growing exponentially. Cloud computing offers a scalable solution to handle this data.

- 1218.064

- -35.217-2.81%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

IBM, Disney And Other Large Advertisers Return To Elon Musk's X After A Year-Long Boycott: 'We Super Appreciate'

What Investors Need to Know Ahead of Nvidia Q3 Earnings

Elon Musk's XAI Seeks $6B At $50B Valuation To Acquire 100K Nvidia Chips For Memphis Data Center

Weekly Buzz: Not All Parties Last Forever

Market Falls to End All-Time High Week | Wall Street Today

Expert Outlook: Oracle Through The Eyes Of 30 Analysts

Comments

the earnings called established SOP for shares buyback as part of BABA policy.

so, every time price goes down, will buy back?

What's the objective?

to prop up the price?

this is good?

how likely these 2 patterns are so similar?

previously 8 weeks down, now 6 weeks down, next 2 weeks will it continue?

Consensus Estimates

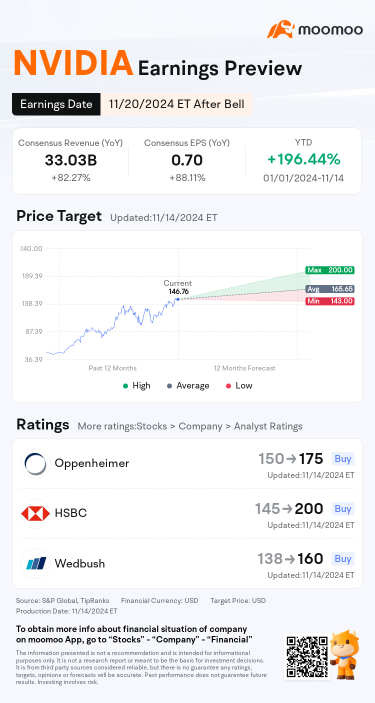

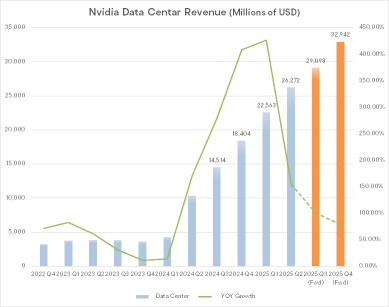

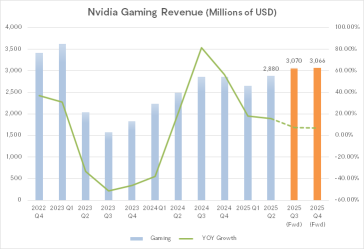

● The analyst consensus has Nvidia reporting revenue of $33.03 billion, up 82% year-over-year. The world's most valuable company’s stock has nearly tripled in 2024 driven by demand for the company’...

102702622 : Good for some companies but not for others .