ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1391.328

- -4.781-0.34%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

How To Unlock Apple Intelligence Features With iOS 18.2: Everything You Need To Know

The two major US Energy giants are targeting the "fat" of the AI era: powering Datacenters.

Executives from the two major Energy giants in the USA, Chevron and Exxon Mobil, stated on Wednesday that they are considering entering the Electrical Utilities Industry and discussing the use of Henry Hub Natural Gas and carbon capture technology to supply power to AI Datacenters in the Technology sector. Previously, USA oil companies typically only produced power for their own Business. However, amid the current surge in demand, they are attempting to enter a broader Electrical Utilities market.

Trump is reportedly set to ring the bell at the NYSE today. What does it signify?

① According to media reports, the USA's incoming president Trump will go to the NYSE on Thursday to ring the opening bell and deliver a speech; ② There are reports that Trump will be named Time Magazine's Person of the Year for 2024, but this has not yet been confirmed by Time; ③ Since Trump's announcement of victory, the three major US stock indices have risen repeatedly, with the market encouraged by promises of tax cuts and deregulation.

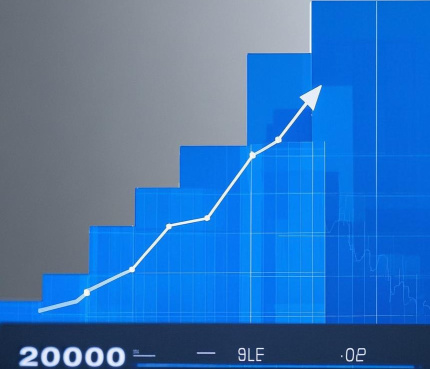

The NASDAQ broke through 0.02 million points for the first time, Tesla led a group of tech giants to a new high, and Bitcoin climbed to 0.1 million dollars

The Dow and Apple fell, the Nasdaq rose nearly 2%, Tesla and Google rose nearly 6%, while Meta, Amazon, and Netflix all reached new highs. NVIDIA rose over 3%, Broadcom rose nearly 7%, Super Micro Computer once dropped over 8%, the decline of Chinese concepts narrowed, and Fangdd Network turned to rise over 11%. The U.S. November CPI confirms interest rate cut bets for next week, with a pause on rate cuts expected in January next year. The dollar and U.S. Treasury yields rebounded in a V-shape, while spot Gold reached its highest level in five weeks. The yen plunged below 152, while the offshore yuan once dropped over 300 points, falling below 7.29 yuan. After a significant interest rate cut by the Bank of Canada, the Canadian dollar and Canadian bond yields turned to rise, and oil prices increased by about 2%.

If You Invested $1000 In This Stock 15 Years Ago, You Would Have This Much Today

Magnificent Seven Tech Titans Hit $18.2 Trillion Market Cap: Alphabet, Amazon, Apple, Meta, Tesla Jointly Notch All-Time Highs

Comments

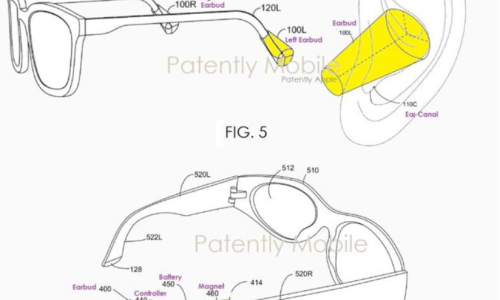

It is learned that recently, the US Patent and Trademark Office announced a new patent application from Google, which focuses on the field of s...

Industry Overview In recent years, the short-video industry has witnessed vigorous development in the United States and has become an important part of the Internet entertainment field. Short videos, with their features of being concise, rich in content, and spreading rapidly, have attracted a la...

Market analysis

The strong performance of technology stocks

Nasdaq's rise was mai...

AVGO is expected to report a 51.6% increase in revenue to $14.091 billion from $9.3 billion a year ago. This is higher than the revenue guidance given on 05 September 2024 for the period ending 31 October which is expected for $14 billion.

AVGO is expected to show a rise in quar...