Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1246.911

- +21.347+1.74%

Close Mar 14 16:00 ET

1248.114High1227.807Low

1233.752Open1225.564Pre Close120.32MVolume11Rise28.45P/E (Static)19.80BTurnover--Flatline0.49%Turnover Ratio4.71TMarket Cap4Fall4.69TFloat Cap

Constituent Stocks: 15Top Rising: SRE+3.48%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

SRESempra Energy

70.2102.360+3.48%5.80M404.01M68.50067.85070.35067.88045.74B45.67B651.46M650.41M+1.31%-1.90%-16.28%-21.25%-13.68%+3.16%-19.96%3.53%0.89%15.8815.883.64%Utilities - Diversified

LNGCheniere Energy

218.5306.980+3.30%1.59M345.60M214.140211.550219.790213.63648.88B48.55B223.67M222.16M-0.76%-4.39%+4.07%+2.80%+20.60%+39.71%+1.94%0.83%0.71%15.3915.392.91%Oil & Gas Midstream

MPCMarathon Petroleum

141.1504.130+3.01%1.71M240.24M137.330137.020141.650137.01644.12B43.98B312.58M311.60M+2.62%-6.01%-7.87%-2.47%-14.17%-23.72%+1.77%2.40%0.55%14.0014.003.38%Oil & Gas Refining & Marketing

COPConocoPhillips

98.9502.760+2.87%7.63M752.62M96.94096.19099.64096.220125.90B125.64B1.27B1.27B+9.18%-0.20%+2.94%-1.25%-9.14%-14.99%+0.59%3.15%0.60%12.6712.673.56%Oil & Gas E&P

HSTHost Hotels & Resorts

14.9100.390+2.69%11.95M177.85M14.74014.52014.98014.68010.42B9.58B699.11M642.79M-8.70%-7.56%-9.20%-18.37%-17.24%-24.23%-14.90%5.37%1.86%15.0615.062.07%REIT - Hotel & Motel

WORWorthington Enterprises

40.8000.900+2.26%284.99K11.57M40.74039.90040.95040.1102.04B1.27B50.04M31.04M-2.86%-2.42%-5.33%+4.42%-11.59%-32.67%+2.15%1.20%0.92%48.5718.552.11%Metal Fabrication

CVXChevron

157.0203.410+2.22%6.67M1.04B153.990153.610157.240153.010276.45B268.14B1.76B1.71B+0.43%-1.01%+1.85%+3.18%+10.62%+5.21%+9.61%4.15%0.39%16.1516.152.75%Oil & Gas Integrated

AAPLApple

213.4903.810+1.82%60.11M12.77B211.250209.680213.950209.5803.21T3.21T15.02B15.02B-10.70%-11.72%-11.61%-13.87%-6.51%+23.99%-14.65%0.46%0.40%33.8935.112.08%Consumer Electronics

TXNTexas Instruments

176.4202.820+1.62%4.93M868.52M175.595173.600176.860175.070160.53B160.12B909.92M907.63M-7.40%-9.99%-2.42%-7.24%-13.82%+5.97%-5.22%2.98%0.54%33.9333.931.03%Semiconductors

MAMasterCard

527.6407.810+1.50%2.37M1.25B522.600519.830528.410520.950481.05B476.82B911.71M903.69M-3.50%-8.45%-6.83%-0.11%+7.33%+10.67%+0.35%0.50%0.26%37.9937.991.44%Credit Services

SCLStepan

57.6900.850+1.50%98.93K5.72M57.28056.84058.54056.9801.30B1.22B22.50M21.21M-1.92%-6.00%-6.88%-21.08%-24.72%-31.54%-10.27%2.62%0.47%26.2226.222.75%Specialty Chemicals

MRKMerck & Co

94.570-0.140-0.15%12.68M1.20B94.28094.71094.87593.450238.89B238.51B2.53B2.52B-0.08%+2.51%+12.02%-6.54%-18.68%-19.89%-4.94%3.30%0.50%14.0314.031.51%Drug Manufacturers - General

VRSKVerisk Analytics

288.580-0.470-0.16%740.81K213.59M289.050289.050290.030286.76340.48B40.37B140.28M139.88M-3.81%-2.65%-2.19%+2.00%+8.82%+24.66%+4.94%0.54%0.53%43.0143.011.13%Consulting Services

FSLRFirst Solar

132.510-0.300-0.23%2.11M280.62M136.020132.810136.020131.52014.19B13.20B107.06M99.58M-4.76%-2.69%-17.36%-33.64%-44.89%-11.30%-24.81%--2.12%11.0211.023.39%Solar

JBHTJB Hunt Transport Services

149.000-0.430-0.29%1.66M246.41M151.540149.430151.540147.00014.90B11.81B100.01M79.25M-8.84%-7.56%-9.95%-16.91%-14.35%-24.07%-12.46%1.15%2.10%26.8026.803.04%Integrated Freight & Logistics

News

Apple's iPhone 16e Outsells iPhone SE By 60%, But Analysts Say It Won't Stop China Sales From Sliding In 2025

Apple Reportedly Fights UK Government's 'Unacceptable' Encryption Order Behind Closed Doors — No Press Or Public Allowed

Shale Executives Worry About Likely Peak Oil in Coming Years Despite 'Drill Baby Drill' Mantra

Nasdaq Rally: Nvidia Among Winners in Index's Strongest Day in 4 Months

Here's How Much $100 Invested In Marathon Petroleum 5 Years Ago Would Be Worth Today

Mastercard on Track to End Its Six-session Decline

Comments

$Apple (AAPL.US)$ wait for entry between 200 - 205

1

1

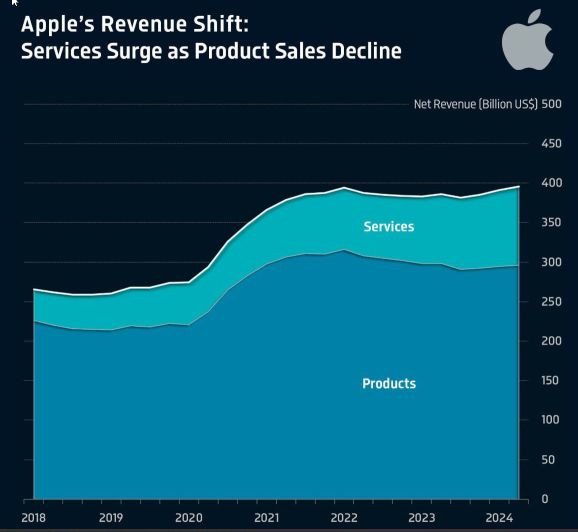

$Apple (AAPL.US)$ 's significant shift in revenue composition from 2021-2024 reveals a calculated strategic evolution that merits investor attention. Examining the financial data:

– Product revenue: Declined 3.2% ($306B → $296B)

– Services revenue: Increased 37.7% ($72B → $99B)

– Services now represent 25% of total revenue (up from 19% in 2021)

This transformation reflects Apple's deliberate strategic realignment rather than a reactive response to market conditions. ...

– Product revenue: Declined 3.2% ($306B → $296B)

– Services revenue: Increased 37.7% ($72B → $99B)

– Services now represent 25% of total revenue (up from 19% in 2021)

This transformation reflects Apple's deliberate strategic realignment rather than a reactive response to market conditions. ...

$Apple (AAPL.US)$ well i’ll be dipped in 💩 and rolled in breadcrumbs 🏌🏿🏋🏾

$Apple (AAPL.US)$

Strong closing last night. Next week, looking forward to 216.84😎

Strong closing last night. Next week, looking forward to 216.84😎

1

$Apple (AAPL.US)$ Wall Street Today: Nasdaq Composite and S&P 500 Both Rebound 2%+ on a Day With No Tariff Drama.

Read more

Deep Sea : unlikely. trend is up from the bottom.