Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1273.629

- +14.285+1.13%

Close Mar 21 16:00 ET

1275.727High1247.948Low

1247.836Open1259.344Pre Close303.36MVolume3Rise29.04P/E (Static)44.86BTurnover--Flatline1.24%Turnover Ratio4.81TMarket Cap12Fall4.79TFloat Cap

Constituent Stocks: 15Top Rising: FSLR+2.23%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

FSLRFirst Solar

131.3202.860+2.23%4.51M589.25M128.800128.460131.650127.80014.06B13.08B107.06M99.58M-0.90%-5.61%-15.52%-28.00%-48.63%-13.99%-25.49%--4.53%10.9310.933.00%Solar

AAPLApple

218.2704.170+1.95%94.13M20.35B211.560214.100218.840211.2803.28T3.28T15.02B15.02B+2.24%-8.70%-11.11%-14.14%-3.85%+27.97%-12.74%0.45%0.63%34.6535.903.53%Consumer Electronics

JBHTJB Hunt Transport Services

148.5501.055+0.72%1.12M165.94M146.440147.495148.970144.34014.86B11.77B100.01M79.25M-0.30%-9.12%-11.42%-12.51%-12.96%-24.16%-12.73%1.16%1.42%26.7226.723.14%Integrated Freight & Logistics

CVXChevron

164.750-0.020-0.01%21.63M3.56B164.490164.770164.885163.110290.06B281.34B1.76B1.71B+4.92%+5.38%+4.99%+16.61%+18.51%+10.99%+15.01%3.96%1.27%16.9516.951.08%Oil & Gas Integrated

MAMasterCard

535.690-0.690-0.13%5.97M3.20B535.440536.380538.050530.755488.39B484.10B911.71M903.69M+1.53%-2.03%-3.91%+1.60%+9.35%+10.25%+1.88%0.49%0.66%38.5738.571.36%Credit Services

COPConocoPhillips

101.920-0.390-0.38%55.09M5.62B102.410102.310102.960101.340129.68B129.41B1.27B1.27B+3.00%+12.46%+4.06%+8.02%+1.13%-15.08%+3.61%3.06%4.34%13.0513.051.58%Oil & Gas E&P

SRESempra Energy

69.540-0.460-0.66%7.24M503.15M69.72070.00070.22069.16745.30B45.23B651.46M650.41M-0.05%+1.27%-19.43%-19.16%-13.77%+2.65%-20.00%3.57%1.11%15.7315.731.50%Utilities - Diversified

VRSKVerisk Analytics

285.160-2.520-0.88%1.39M395.63M285.230287.680287.280283.24040.00B39.89B140.28M139.89M-1.19%-4.95%-3.22%+3.16%+7.93%+21.59%+3.69%0.55%0.99%42.5042.501.40%Consulting Services

TXNTexas Instruments

179.000-1.680-0.93%11.82M2.12B178.530180.680179.840177.040162.88B162.47B909.92M907.63M+1.46%-6.05%-11.39%-3.50%-13.26%+6.62%-3.83%2.94%1.30%34.4234.421.55%Semiconductors

MPCMarathon Petroleum

149.960-1.990-1.31%6.81M1.02B151.090151.950152.050147.84046.72B46.58B311.53M310.63M+6.24%+9.02%-2.46%+13.08%-7.19%-23.12%+8.12%2.26%2.19%14.8814.882.77%Oil & Gas Refining & Marketing

LNGCheniere Energy

226.830-3.400-1.48%2.40M544.89M230.000230.230230.100226.83050.73B50.39B223.67M222.16M+3.80%+3.01%+2.56%+8.84%+27.85%+43.48%+5.81%0.80%1.08%15.9715.971.42%Oil & Gas Midstream

SCLStepan

57.910-0.970-1.65%390.37K22.59M58.21058.88058.24056.6801.30B1.23B22.50M21.21M+0.38%-1.55%-7.13%-13.18%-24.70%-34.43%-9.93%2.61%1.84%26.3226.322.65%Specialty Chemicals

MRKMerck & Co

93.110-1.620-1.71%68.44M6.38B94.58094.73094.68093.070235.20B234.83B2.53B2.52B-0.69%-0.78%+4.93%-4.22%-16.29%-22.45%-5.59%3.35%2.71%13.8113.811.70%Drug Manufacturers - General

HSTHost Hotels & Resorts

14.690-0.270-1.80%19.64M287.57M14.80014.96014.80014.25010.27B9.44B699.11M642.79M-1.48%-10.04%-10.10%-17.90%-17.16%-27.04%-16.15%5.45%3.06%14.8414.843.68%REIT - Hotel & Motel

WORWorthington Enterprises

39.780-1.510-3.66%2.79M110.85M40.85041.29041.33039.0501.99B1.23B50.04M31.04M-2.50%-5.29%-5.82%-2.04%+0.13%-39.68%-0.40%1.23%8.98%47.3618.085.52%Metal Fabrication

News

Chevron Paid Hundreds of Millions to Venezuela in Secret Deal With Biden - Bloomberg

Notable Analyst Calls This Week: Tesla, Netflix and Starbucks Stocks Among Top Picks

$1000 Invested In This Stock 10 Years Ago Would Be Worth This Much Today

Balanced Risk-reward, Improved Cost Structure Earns Norwegian Cruise Lines an Upgrade

Chevron Snaps Six Straight Sessions of Gains

10 Information Technology Stocks With Whale Alerts In Today's Session

Comments

As a value investor, my focus is on strong fundamentals, reliable dividends, and long-term growth. Following Warren Buffett's principles, I carefully selected high-quality stocks in essential sectors.

✅ Chevron (CVX): A classic energy giant, providing consistent returns.

✅ Sirius XM (SIRI): Capitalizing on the subscription-based media industry.

✅ Capital One Financial (COF): Banking on financial resilience.

Every trade is a learning opportunity. My goal? To create a res...

✅ Chevron (CVX): A classic energy giant, providing consistent returns.

✅ Sirius XM (SIRI): Capitalizing on the subscription-based media industry.

✅ Capital One Financial (COF): Banking on financial resilience.

Every trade is a learning opportunity. My goal? To create a res...

4

1

2

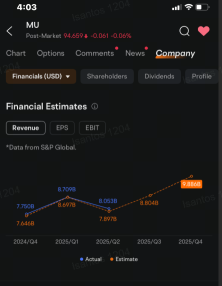

$Micron Technology (MU.US)$’s options volume doubled, boosted by a surge in put options trading after the chipmaker painted a less rosy outlook than analysts had expected, sending shares lower.

Shares slumped 8% to close at $94.72 Friday after the company said late Thursday that its adjusted gross margin for fiscal third quarter ending in May will be between 35.5% to 37.5%. The midpoint of that forecast missed analys...

Shares slumped 8% to close at $94.72 Friday after the company said late Thursday that its adjusted gross margin for fiscal third quarter ending in May will be between 35.5% to 37.5%. The midpoint of that forecast missed analys...

23

4

10

$Apple (AAPL.US)$ not bad to enter maybe next week 225

3

$Apple (AAPL.US)$ took profit early had a retest buy but it never came back🚀 great move up. I'll grab the next 🚀

1

$Apple (AAPL.US)$ those 2 cent eod calls lol 😆

1

Read more

FIRE Keith : BRK stock holding.