Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1397.163

- +5.835+0.42%

Trading Dec 12 15:50 ET

1399.703High1388.899Low

1392.447Open1391.328Pre Close50.26MVolume5Rise32.40P/E (Static)9.37BTurnover--Flatline0.20%Turnover Ratio5.33TMarket Cap10Fall5.30TFloat Cap

Constituent Stocks: 15Top Rising: MRK+1.63%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

MRKMerck & Co

101.3801.630+1.63%6.83M688.88M101.62099.750102.940100.120256.45B256.14B2.53B2.53B-2.10%-1.69%+2.92%-14.55%-23.24%-2.42%-5.23%3.04%0.27%21.21724.142.83%Drug Manufacturers - General

AAPLApple

248.1051.615+0.66%21.47M5.32B246.880246.490248.740245.6803.75T3.74T15.12B15.09B+2.08%+5.61%+10.21%+12.55%+19.47%+25.85%+29.50%0.39%0.14%40.8140.811.24%Consumer Electronics

SRESempra Energy

87.8600.450+0.51%2.14M188.16M88.00087.41088.50087.39555.65B55.57B633.40M632.48M-3.39%-6.17%-4.05%+7.46%+17.54%+18.53%+21.30%2.79%0.34%19.3518.341.26%Utilities - Diversified

TXNTexas Instruments

192.2400.540+0.28%1.97M375.54M191.000191.700192.260189.600175.36B174.94B912.22M910.03M-0.39%-3.49%-6.55%-3.59%+0.44%+17.15%+15.99%2.70%0.22%35.7327.191.39%Semiconductors

VRSKVerisk Analytics

285.4200.400+0.14%217.38K62.13M285.020285.020287.580283.89040.30B40.21B141.21M140.89M-1.20%-3.10%-1.59%+7.80%+5.18%+21.79%+20.04%0.53%0.15%44.5368.451.30%Consulting Services

LNGCheniere Energy

214.958-0.243-0.11%750.17K161.13M214.550215.200216.420213.65548.23B47.89B224.37M222.80M-4.85%-3.07%+2.36%+19.65%+30.16%+26.62%+27.23%0.81%0.34%13.675.281.29%Oil & Gas Midstream

JBHTJB Hunt Transport Services

181.760-0.250-0.14%484.26K88.27M182.290182.010183.800180.61018.33B14.57B100.83M80.16M-0.05%-4.49%-3.93%+7.57%+15.62%-9.05%-8.14%0.94%0.60%33.0526.081.75%Integrated Freight & Logistics

MAMasterCard

532.710-1.740-0.33%1.20M641.93M535.560534.450536.750531.985488.94B487.68B917.83M915.46M+1.51%+0.06%+2.08%+7.81%+16.91%+28.01%+25.62%0.48%0.13%40.2745.030.89%Credit Services

HSTHost Hotels & Resorts

18.835-0.095-0.50%2.27M42.95M18.91018.93019.03018.81513.17B12.10B699.03M642.45M+0.19%+2.20%+4.64%+6.52%+6.35%+2.24%-0.10%4.25%0.35%18.2918.111.14%REIT - Hotel & Motel

CVXChevron

154.900-1.310-0.84%6.04M937.00M155.810156.210156.525154.265278.37B264.52B1.80B1.71B-2.78%-4.45%-1.41%+8.70%-0.68%+7.77%+8.32%4.13%0.35%17.0213.641.45%Oil & Gas Integrated

COPConocoPhillips

101.030-1.160-1.14%4.08M414.07M102.320102.190102.520100.970130.69B130.47B1.29B1.29B-3.27%-5.92%-9.65%-6.34%-11.02%-9.65%-10.52%2.89%0.32%11.9811.151.52%Oil & Gas E&P

SCLStepan

74.550-0.950-1.26%25.48K1.91M74.90075.50075.51074.2551.68B1.58B22.49M21.20M+0.36%-1.53%-1.93%-2.09%-10.21%-18.63%-19.68%2.01%0.12%37.2842.601.66%Specialty Chemicals

FSLRFirst Solar

196.915-4.085-2.03%1.13M224.66M201.680201.000201.680196.06021.08B19.93B107.06M101.20M-0.51%+2.26%+8.12%-18.57%-24.63%+24.43%+14.30%--1.12%16.9625.442.80%Solar

MPCMarathon Petroleum

146.900-5.070-3.34%1.54M227.88M151.530151.970151.890146.72047.21B47.07B321.39M320.44M-2.13%-5.45%-7.14%-10.28%-14.67%-0.66%+1.04%2.25%0.48%11.406.223.40%Oil & Gas Refining & Marketing

WORWorthington Enterprises

39.390-1.470-3.60%133.98K5.28M40.50040.86040.50038.9801.98B1.23B50.26M31.26M-3.67%-3.05%-3.62%-13.18%-22.87%-29.50%-30.90%2.44%0.43%52.5217.903.72%Metal Fabrication

News

In the Last 12 Days of Trade, GS Can See $9T in Cash, 2 Dovish Cuts, and Rally in the S&P

Unpacking the Latest Options Trading Trends in Apple

Analyst Expectations For Verisk Analytics's Future

Apple's Homegrown Wireless Chip To Come To iPhone Later In 2025

10 Information Technology Stocks Whale Activity In Today's Session

Most and Least Shorted S&P 500 Financial Stocks in November

Comments

$ConocoPhillips (COP.US)$ feeling it gona trade through 100 level....very unfortunately

$Apple (AAPL.US)$ see ya at 240$

4

2

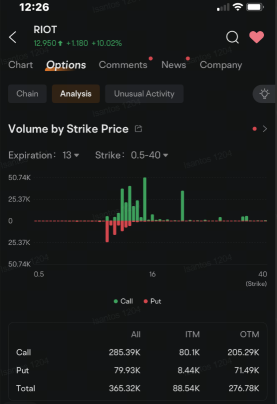

$Riot Platforms (RIOT.US)$ options volume jumped as the stock rallied more than 10% after the Wall Street Journal reported that activist investor Starboard Value has built a significant position in the company and is pushing for changes in the bitcoin mining operator.

Shares jumped as much as 12.8% to $13.28 Thursday morning, likely helping fuel demand for call options. The most active of them are call options th...

Shares jumped as much as 12.8% to $13.28 Thursday morning, likely helping fuel demand for call options. The most active of them are call options th...

12

3

7

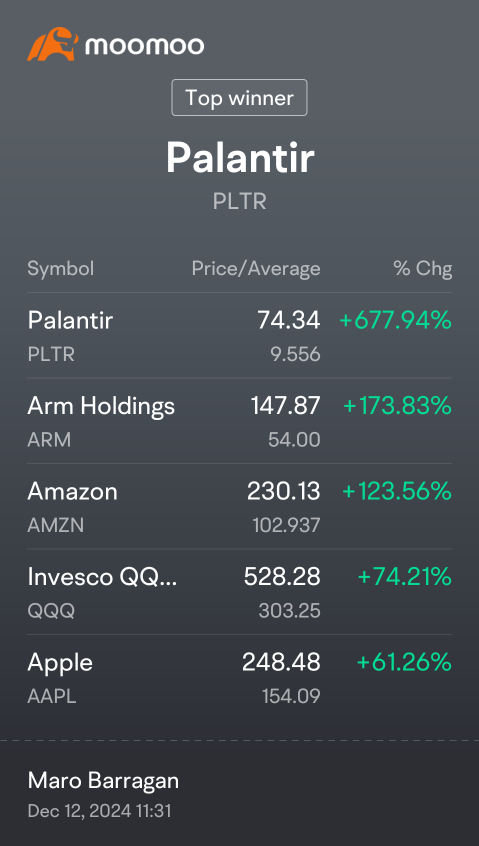

no matter what they say. long term always wins!

40

5

Read more